Rich Mom, Poor Dad: Tribute to My Mom Who Saved Us All

My mom came from a rich family in the northern Philippine town of Batac, Ilocos Norte. The same town where the late dictator Ferdinand Marcos, known for looting the country of billions of dollars, grew up. In fact, they were contemporaries. When I was young, she told me stories about …

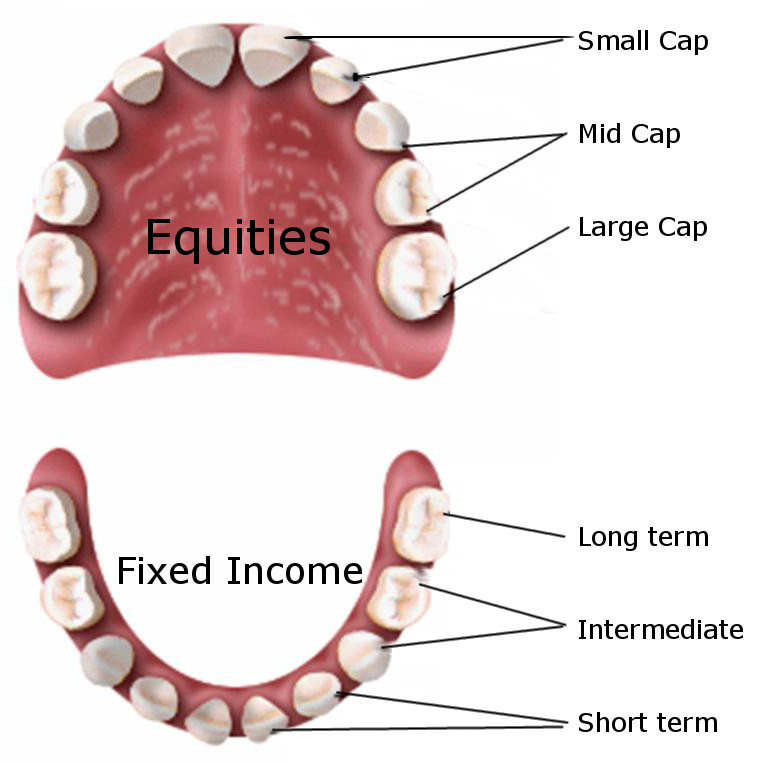

Rebalancing Your Portfolio is Like Going to the Dentist

There’s probably nothing more uncomfortable than your visits to the dentist. I don’t know about yours, but my dentist doesn’t have the gentlest hands I can brag about. Once you’re seated on that dreaded chair, you’ll be as helpless as a toddler as she works on scraping the tartar buildup …

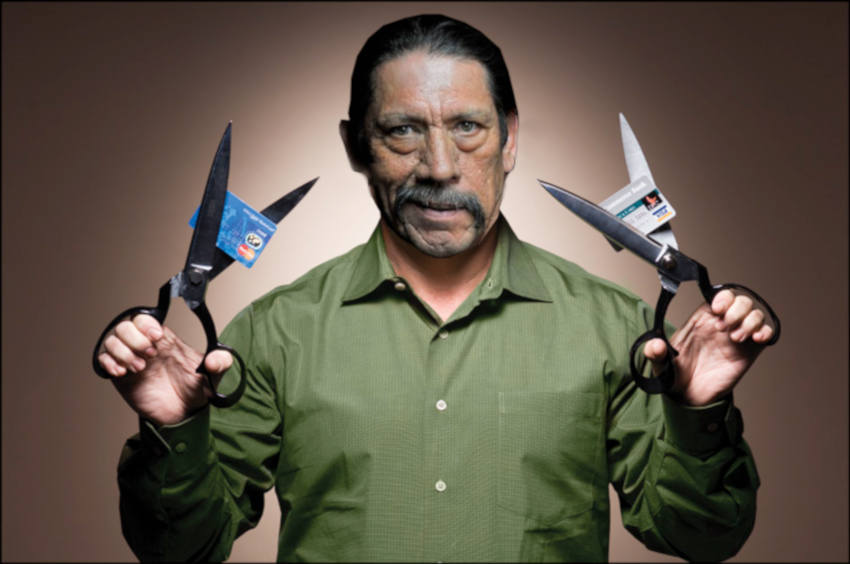

Forget Debt Snowball, Pay Off the Ugliest Debt First

Don’t blindly follow the experts. Follow what’s best for you. But you can’t go wrong with paying the ugliest debt first with a vengeance!

Here are America’s Richest Immigrants in 2019

Forbes recently published its annual list of billionaires for 2019. Not to be overshadowed, I too decided I’m making my richest immigrant list an annual thing; hoping this post can inspire and motivate fellow immigrants out there who are tired of hearing about the border wall.

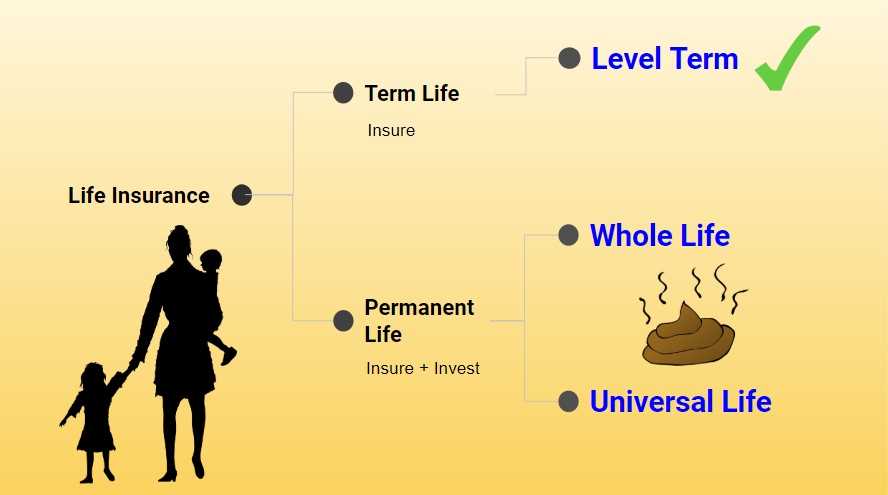

Why You Should Never Invest in a Life Insurance Policy

Besides the complexity and permanence, one thing permanent life policies have in common is they all stink and hence should be avoided as much as possible. Here’s why.

What If You Didn’t Have to Pay Taxes?

Do you find yourself constantly daydreaming about not paying taxes? Be careful what you wish for when you rub that magic lamp. Or you might end up like the 60-year-old husband who instantly turned 90 after wishing for a much younger wife!

How to Ruin Your Investment Portfolio (Part III: Short Selling)

In Wall Street and beyond, there is no shortage of greedy people. Many will resort to strategies that are borderline immoral like short-selling stocks of company XYZ and wishing that the company loses half of its value so long as they profit from the trade— even if it meant that the company goes bankrupt and the majority of its employees are laid off.

How to Ruin Your Investment Portfolio (Part II: Technical Analysis)

Humans are by nature impatient. At the supermarket counter, we’d constantly look into our watches when several people are queued ahead of us. If we’re in a hurry, we’d drive to another store even if it takes much longer to get there. And if we actually do, we’d honk on a car in front of us, at some stoplight along the way if the driver hesitates to proceed for safety.

How to Ruin Your Investment Portfolio (Part I: Day Trading)

Almost everyone has heard of Aesop’s parable of “The Tortoise and the Hare”. In a nutshell, the story goes like this… There once was a hare who bragged about how fast he can run. Tired of the hare’s boastful behavior, the tortoise, challenges him to a race. The hare soon …

The No. 1 Destroyer of Wealth is Divorce

Out of the most feared and dreaded D’s in life, there’s probably no subject more shunned upon by money bloggers than the topic of divorce. It’s not a particularly difficult topic to write about, and yet many avoid the subject altogether. This is surprising because divorce is no longer a taboo considering its prevalence in modern society.

Recent Posts

Recent Comments

- on The VIX Index: How to Get a Little Richer by “Timing the Market”

- on From Diapers to Diplomas: Tips on How to Fully Fund College Using 529s

- on From Diapers to Diplomas: Tips on How to Fully Fund College Using 529s

- on Why I’m Saving More in a Taxable Brokerage Account, Maybe You Should Too

- on Why I’m Saving More in a Taxable Brokerage Account, Maybe You Should Too

Categories

- About me3

- American dream10

- Asset allocation1

- Blogging4

- Books8

- Budgeting2

- Career6

- Credit4

- Financial Planning25

- Fitness1

- Fraud2

- Giving1

- Guest Post2

- Happiness3

- Health2

- Income2

- Insurance4

- Investing32

- Lifestyle21

- Motivation7

- Relationships20

- Retirement16

- Romance2

- Saving for college5

- Saving ideas11

- Side Hustle3

- Speculation4

- Spending11

- Taxes3

- Vacation3