Good advice. I have term life at work and also a separate term policy personally in case I’m laid off. I had a whole life policy which also I cashed out a couple of years ago. The premiums were colossal (main reason for canceling) and so was the surrender charge. To be fair it was my best performing investment during the Great Recession, but in normal market conditions not so much.

Why You Should Never Invest in a Life Insurance Policy

- By : Menard

- Category : Insurance

- Tags: Term Life, Universal Life, Whole Life

It has been said that the simple things in life are often the best. The simpler the design, the easier to use and understand. The more complicated ones can make your pimple protrude, hairs fall out, or blood pressure rise.

This is especially true in my line of work. As a software engineer, I learned through experience to keep things as simple and idiot-proof as possible— especially when designing user interfaces— buttons should be big enough so users can click them with their foreheads, for example.

The type of life insurance you choose to protect your dependents when you die is no exception. Sadly, insurance salespeople tend to pitch you the opposite. Be forewarned— the more complicated the terms of the policy, the faster you should run away from them.

Here’s some background information.

Types of Life Insurance

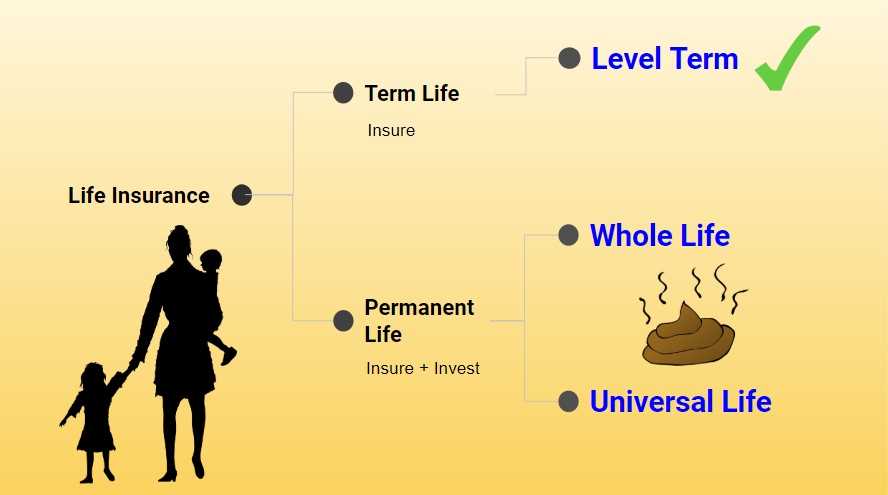

There are two main types of life insurance: term life and permanent life. Term life insurance is meant to be temporary. It’s “pure” insurance without an investment component. If you die during the policy’s term, your beneficiaries get a death benefit as long as you are paying the premium. It’s simple and straightforward to understand.

When people talk about term life, they usually refer to level term— premiums are leveled out such that you pay a fixed monthly premium for the life of the term— usually, 10, 20, or 30 years. Presumably, the need eventually goes away like when you expect a dependent elderly parent to pass away.

Permanent life, otherwise known as cash-value insurance, is a broad umbrella of complicated insurance policies. Besides providing life insurance, it also has an investment component in the sense that there’s a cash value that grows over time. Unlike term life, permanent life policies don’t expire. They continue until you die or stop making payments to the premiums.

The specifics of how much your beneficiary receives, how the cash value grows, and other questions depend on the type of policy you purchase. Whole life, universal life, and variations of these (like variable universal life or VUL), all fall under the permanent life category.

Besides the complexity and permanence, one thing permanent life policies have in common is they all stink and hence should be avoided as much as possible.

Read further to learn why.

Whole Life Insurance

When you buy a whole life policy, you’re guaranteed that your premiums won’t increase. Every month, you pay the same exorbitant amount of premium to the insurance company. A portion of the amount goes into a cash-value account that acts like a forced savings account.

Except that it’s nothing like a real savings account— the insurance company will charge you ridiculous interest for borrowing your own money, for example.

Worse, the insurance company usually invests the cash portion in a conservative-yield investment— a really bad idea considering that you’re “investing” for the rest of your life— you generally pay the premiums until you die, remember?

Had you bought an affordable level term life insurance and INVESTED THE DIFFERENCE in a low-cost stock mutual fund in an equally tax-deferred vehicle (like your 401K or IRA), your investment would have fared astronomically much better. Remember, investing in the stock market is not that risky over the long haul, and term life is, by far, the least expensive.

I just ran the numbers. A very healthy 40-year-old non-smoker can get a 20-year $500,000 coverage for as little as $28.74 a month. In contrast, the premiums for the equivalent whole life policy is $416.22. That’s 14 times more than the term life premium!

There’s a reason insurance salesmen are paid higher commissions for selling whole life than term. The insurance company gets a much bigger chunk of profit in the form of high fees. Money that never gets invested in your cash-value account!

Universal Life Insurance

Like whole life, universal life insurance has a cash value. But unlike whole life policies, this type of policy offers the flexibility to adjust the premium and coverage— meaning you could access some of the cash value to adjust the payments and death benefit.

At first, this sounds attractive. You might be able to lower the premium payments— depending on how much your cash value “investment” has grown— especially when it comes to a variable universal life or VUL policy, which gives you control over how the cash is invested.

The flexibility, however, comes at a price in the form of the annual renewal term. Remember, your annual premium is a factor of your age and the cash value of your account.

And since you’re likely on a fixed income when you retire, you may not be increasing what you’re contributing— you could be decreasing because you’re using a flexible option. So you run the risk of depleting the cash value, which means your policy could lapse, and end up losing your coverage— even after paying tens of thousand worth of premiums!

There’s a reason this extremely complicated policy is cheaper than a whole life policy— the insurance company transfers the risk to you!

Final thoughts

With too many choices to choose from, the general public has long been duped by insurance companies into buying the complex and substantially more expensive types they know people are unlikely to keep.

Admittedly, I was one of them. I bought the stinkiest VUL policy when I was young and clueless. Like many people, I ended up canceling the “permanent” insurance policy and paid a very hefty surrender charge.

For the vast majority of people, term life insurance is the only way to go. Never mind getting permanent life insurance. If you live below your means, save aggressively, and invest wisely, by the end of the term, you’re likely to be self-insured.

If you have dependents, buy life insurance; not invest in one. There’s a big difference.