Introducing… MB50 Monte Carlo Retirement Calculator

Scared that you might not be able to retire? Fear not! This not-so-simple calculator performs 1,000 simulations to give you valuable insight into the longevity of your savings. Of course, it’s written by no other than yours truly. So, I know exactly how it works! This is very timely because …

Net Worth Update: Eight Years Later

I’m supposed to share our household net worth every Labor Day. It’s a tradition I’ve observed since I started this blog. Unfortunately, I got sick after my long flight from Manila. But it’s better late than never. This year, I’m going to do something different: I’m sharing actual investments! Ladies …

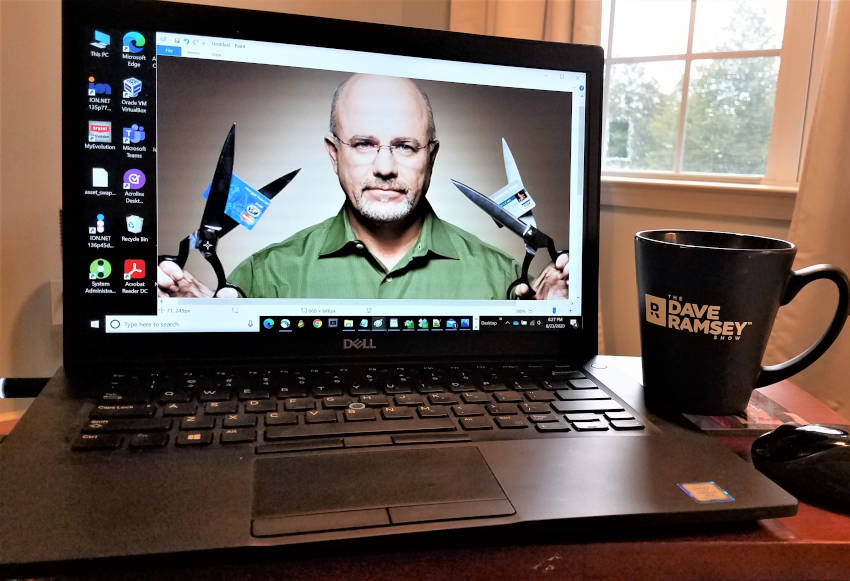

Dave Ramsey is Right. Pay Off that Stupid Debt Before Chasing that 401(k) Match

When it comes to paying off debt, there’s only one name that comes to mind: Dave Ramsey. For decades, he has taught millions of people through his podcast and radio show, a process for getting out of debt and building wealth, which he calls the “Baby Steps.” He has helped …

Introducing… MB50 Financial Independence Calculator

How can you tell if you’re Financially Independent? There are a lot of misconceptions about this subject. Your 21-year-old who left the house for good is nowhere near F.I.— He simply transferred his dependence from you to his employer. Being a multi-millionaire won’t necessarily make you financially independent either. Financially …

Net Worth Update: Seven Years Later

Seven years ago, in August, I launched this blog with a net worth shy of $1M. On Labor Day the following year, I posted our very first net worth update. I thought sharing our net worth was a motivational boost to myself and other financial voyeurs who are on a …

Net Worth Update: Six Years Later

Once again, it’s Labor Day– the day I “brag” about the fruits of my labor. Except there’s nothing to brag about this year. Our investments have been hammered like cryogenically frozen horse meat you badly want to barbecue. As a result, our household net worth is down for the first …

How to Survive and Thrive from a Bear Market Attack

Imagine you’re hiking in the Alaskan wilderness with a friend, and not far away, you spot two little cubs heading toward you both. Your heart starts pounding, wondering where momma bear is until you get startled by the sight of an angry grizzly ready to pounce the two of you …

How to Calculate Your Savings Rate the Right Way

I recently got interviewed by the FI community on Instagram, and one of the questions the content curator asked was, “How much is your savings rate?” to which I responded with 40%. But in all honesty, I grabbed the number out of thin air. I’ve been religiously tracking my annual …

Net Worth Update: Five Years Later

If you’re one of the smart ones who follow my blog, you’re probably aware I share our household net worth, for the past four or five years, on Labor Day. This tradition has symbolic importance. Never mind if you have a desk job sitting comfortably in front of a computer. …

How to Protect Yourself from Rising Inflation

Talks about inflation have been the rage across news outlets and social media lately. Biden’s $1.9 trillion coronavirus stimulus package is freaking out too many stock-market pundits faster than the vaccine rollout. Some are probably on drugs to even suggest it could reach hyperinflation levels. This fearmongering has led people …

Recent Posts

Recent Comments

- on From Diapers to Diplomas: Tips on How to Fully Fund College Using 529s

- on From Diapers to Diplomas: Tips on How to Fully Fund College Using 529s

- on Why I’m Saving More in a Taxable Brokerage Account, Maybe You Should Too

- on Why I’m Saving More in a Taxable Brokerage Account, Maybe You Should Too

- on Why I’m Saving More in a Taxable Brokerage Account, Maybe You Should Too

Categories

- About me3

- American dream10

- Asset allocation1

- Blogging4

- Books8

- Budgeting2

- Career6

- Credit4

- Financial Planning25

- Fitness1

- Fraud2

- Giving1

- Guest Post2

- Happiness3

- Health2

- Income2

- Insurance4

- Investing32

- Lifestyle21

- Motivation7

- Relationships20

- Retirement16

- Romance2

- Saving for college5

- Saving ideas11

- Side Hustle3

- Speculation4

- Spending11

- Taxes3

- Vacation3