Broke on the Fourth of July

While the Fourth of July commemorates America’s fight for liberty, it’s also a reminder to pursue personal freedom—especially financial independence. So as we celebrate breaking from British rule, let’s also break free from debt. That’s why I’m resharing this post. Coming from the eyes of someone who grew up in …

The VIX Index: How to Get a Little Richer by “Timing the Market”

I’m not going to lie to you. The past couple of months have been nerve-wracking for us mere mortals who depend on our 401Ks to break free from the nine-to-five grind. Multiply that anxiety tenfold for someone on the brink of retirement next year like I do. It quickly became …

Introducing… MB50 Monte Carlo Retirement Calculator

Scared that you might not be able to retire? Fear not! This not-so-simple calculator performs 1,000 simulations to give you valuable insight into the longevity of your savings. Of course, it’s written by no other than yours truly. So, I know exactly how it works! This is very timely because …

How to Make Your Grandkids Millionaires With as Little as $1,000

We all love our grandkids, sometimes even more than our own kids. Admittedly, there are moments when I wish my teens would leave the nest yesterday, especially when they test our patience. But new grandkids? They’re the cutest, most innocent little beings, untouched by the influences of social media and …

How to Become a Billionaire (according to Reddit)

I have this fantasy of becoming a billionaire. No, owning fancy cars and sprawling estates doesn’t captivate my imagination. What fascinates me is the journey, the process, and the impact—whether positive or negative—that a billionaire can have on society. Think about Elon Musk handing away a giant $1,000,000 check every …

Net Worth Update: Eight Years Later

I’m supposed to share our household net worth every Labor Day. It’s a tradition I’ve observed since I started this blog. Unfortunately, I got sick after my long flight from Manila. But it’s better late than never. This year, I’m going to do something different: I’m sharing actual investments! Ladies …

From Gold Medals to Millions: The Carlos Yulo Success Story vs. Raygun’s Breakdance Bust

Oh, the tale of two Olympic performances! On one hand, we have Carlos Yulo, the Filipino gymnast who soared to new heights at the Paris 2024 Olympics, clinching two gold medals with a flawless vault and artistic gymnastic routines that left the judges and audience in awe. His performance was a masterclass …

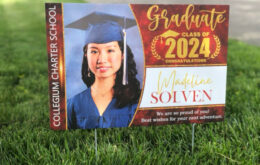

From Diapers to Diplomas: Tips on How to Fully Fund College Using 529s

As a parent of a recent high school graduate, discarding junk mail from overpriced colleges and universities across the country has become my new hobby. These institutions relentlessly compete for my hard-earned dollars—or rather, dollars they expect my daughter to borrow from opportunistic lenders who seek an unfair slice of …

Excessive Investment Fees: Is Your Portfolio Being Feasted Upon?

One of the most entertaining scenes in the movie ‘Wolf of Wall Street’ is when Mark Hanna (played by Matthew McConaughey) explains to new recruit Jordan Belford (Leonardo DiCaprio) how stockbroking business works over lunch of martini and cocaine. “F*** the clients. Your only responsibility is to put meat on …

This Is What It’s Like to Get Hitched On The Cheap

I was listening to a Dave Ramsey podcast episode on my way to work when a caller asked: what’s a reasonable wedding budget for a couple on Baby Step 2? That’s Ramsey-speak for someone still trying to pay off debt besides the mortgage. And, one of the co-hosts, George Kamel, …

Recent Posts

Recent Comments

- on The VIX Index: How to Get a Little Richer by “Timing the Market”

- on From Diapers to Diplomas: Tips on How to Fully Fund College Using 529s

- on From Diapers to Diplomas: Tips on How to Fully Fund College Using 529s

- on Why I’m Saving More in a Taxable Brokerage Account, Maybe You Should Too

- on Why I’m Saving More in a Taxable Brokerage Account, Maybe You Should Too

Categories

- About me3

- American dream10

- Asset allocation1

- Blogging4

- Books8

- Budgeting2

- Career6

- Credit4

- Financial Planning25

- Fitness1

- Fraud2

- Giving1

- Guest Post2

- Happiness3

- Health2

- Income2

- Insurance4

- Investing32

- Lifestyle21

- Motivation7

- Relationships20

- Retirement16

- Romance2

- Saving for college5

- Saving ideas11

- Side Hustle3

- Speculation4

- Spending11

- Taxes3

- Vacation3