What is the strategy you’re suggesting here if neither avalanche nor snowball? Wouldn’t paying off payday loan first count as the avalanche method? Lost me there. Can you illustrate, which ones to do after the payday loan? Thanks!

Forget Debt Snowball, Pay Off the Ugliest Debt First

- By : Menard

- Category : Budgeting, Credit

- Tags: Dave Ramsey, Debt Avalanch, Debt Snowball

I was listening to the Dave Ramsey podcast on my way to work when I heard the plight of one caller— a woman who is on the brink of filing Chapter 13 bankruptcy. She took out a $40,000 student loan debt in 1997. Twenty-two years later, she’s still in debt and the balance ballooned to $106,000!

Not to pick on this now divorced single mother of two teenagers, but the only way the loan could have ballooned to that amount is that she and her ex didn’t treat the loan as an emergency back when it was still manageable. And that probably also cost them their marriage— ’til debt do us part.

But aren’t student loans good debt? No. Having good debt is a factor of the following:

- Purpose of the debt

- Return of investment

- Borrower’s ability to repay

Not sure what college degree the woman has earned, but there’s obviously a negative return of investment here. The thing is, labeling a loan as “Good Debt”, bad home mortgages included, is why most people get into trouble.

Related: Stupid Money Mistakes My Smart Neighbors Make

Why treat debt as an emergency?

When you are in debt, other than maybe a low-interest mortgage on your primary home or lucrative investment, you should pay off the effing loan like your hair is on fire! Otherwise, you could get deeper and deeper in the hole— like a person jumping in quicksand— soon enough, you won’t be able to breathe!

You see, we live in a dynamic world where change is the only thing constant. Your employer could lay you off tomorrow rendering you jobless for the next 12 months. If you’re a business owner, at any given time, your customers could stop buying or using your services because of the competition.

If you can’t pay your monthly credit card balance in full (or any loan for that matter), the power of compounding interest is working against you!

Credit card companies are laughing their arse off, thinking of you as a very lucrative stock investment on steroids. Where else can you earn a steady 25% return in the stock market nowadays?

Here’s how you can free yourself from the chains of indebtedness using Dave Ramsey MB50 method.

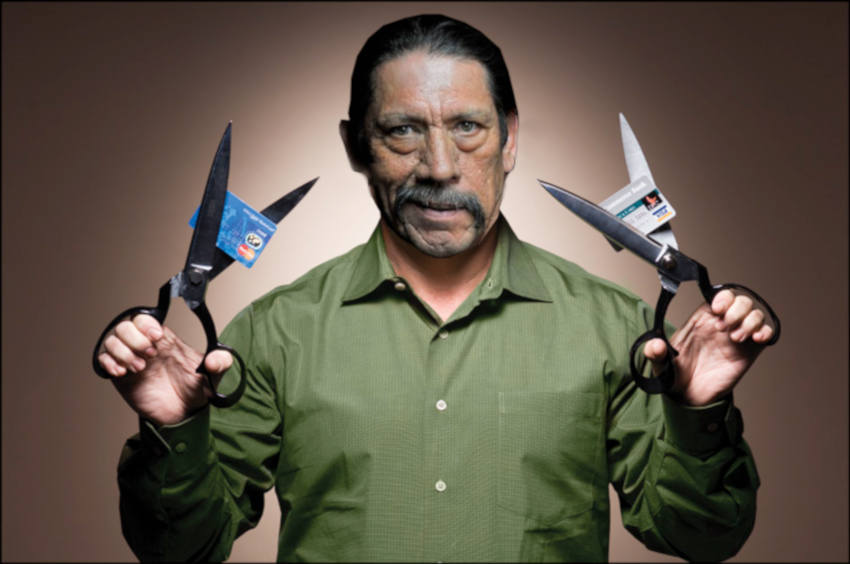

Step 1: Stop adding more debt

Cut off your credit cards, bury them in your backyard, or flush them into the toilet. I don’t really care. The point here is to stop the problem directly from its source.

Create a starter emergency fund you can use for small emergencies like when you blow a tire. This way, you don’t go further in debt when little things happen. Ramsey recommends $1,000. You obviously can’t save a real emergency fund if you’re drowning in debt.

Step 2: Minimize your expenses

Cable, Netflix or Amazon Prime subscriptions are the first to go. Minify your expenses back to the bare minimum: food, clothing, shelter— including water and utilities.

Conserve power, recycle resources, and minimize waste as much as possible. Telecommute to work, bring PB&J lunches, and take advantage of free food in the office. No eating out or vacations.

Create a budget for each spending category using the envelope or jar system and stick with it!

Step 3: Maximize your income

Work overtime. Ask your boss for a raise. Get a second or third source of income. Perhaps a side hustle. Walk your neighbor’s dog. Babysit or tutor their kids. Become the neighborhood handyman. Distribute flyers around your neighborhood to advertise your services.

Rent out that spare bedroom or get a roommate. Drive for Uber or Lyft. Deliver food for DoorDash or Grubhub. Do whatever you can to increase your income.

Step 4: Sell everything you can sell

Start a yard sale. Sell your stuff on Craig’s List or Facebook Marketplace. Both sites don’t charge commissions. My wife and I have been selling stuff we no longer use regularly. And we’re not even broke; far from it.

And please, sell that expensive pet (your kids should think they’re next).

Step 5: Pay the ugliest debt first

Most experts recommend either Debt Snowball (smallest balance first, Dave Ramsey method) or Debt Avalanche (highest interest first, Suze Orman method). The former uses psychology, while the latter is mathematically optimal.

Ignore them both. I will illustrate why either doesn’t always work in real life.

Regardless of the method you use, the idea is to list all your debts in a certain order and attack the one on top with a vengeance! You pay the minimum payments on the rest to avoid defaulting on any of them.

Say, you owe the following (which by the way, is very typical).

- $1,000 – Loan from grandpa, 0%

- $10,000 – Credit cards, 25% APR

- $20,000 – Car loan, 15% APR

- $80,000 – Student loans, 6% APR

Debt Avalanche: Paying the highest interest first can save you the most money if you stick with it. The problem is that most people won’t— the lack of discipline is why they got into trouble in the first place.

Depending on your level of intensity, it could take several months before your high-interest credit cards are paid off. This means that your grandpa who is on fixed income won’t be paid until everything else gets paid which could take years!!

Maybe it’s okay with grandpa. But you should be sick to your stomach.

Debt Snowball: It may seem that Debt Snowball may be better here because the ones with the lowest balance are often the ones that have the highest annual rate anyway. Not to mention the motivational value of getting the “small wins” much earlier.

But let’s say, for illustrative purposes, you actually took out a very ugly payday loan.

- $1,000 – Loan from grandpa, 0%

- $2,000 – Payday loan, 400% APR

- $10,000 – Credit cards, 25% APR

- $20,000 – Car loan, 15% APR

- $80,000 – Student loans, 6% APR

Yes, a typical two-week payday loan with a $15 per $100 fee equates to an annual percentage rate (APR) of almost 400 percent!!

It’s super dumb not to pay off this ugly debt first. Tell me honestly, isn’t paying off a REALLY UGLY debt more motivational than paying the relatively small loan from grandpa?

Besides Payday loans, really ugly debts include Cash Advance, Rent-to-Own, Title Pawning, and the Bombay 5-6 loans (very popular in the Philippines).

Final Thoughts

Being in debt to your ears is a really ugly predicament that should be treated as an emergency. Stopping the source while maximizing your income, minimizing your expenses, and methodically attacking your debt, one at a time, are all necessary to fix the problem.

Don’t blindly follow the experts. Do what’s best for you. But you can’t go wrong with paying off the ugliest debt first with a vengeance!

See also: Frugal Living Tips from Bella Wanana