End of the Year Question: What is Your Retirement Number?

If I were to pay you to quit your job, how much would it be? Is it $1 million, $3 million, or nowhere near these numbers? Many think you can no longer retire with $1 million because of inflation. This may or may not be true depending on your spending …

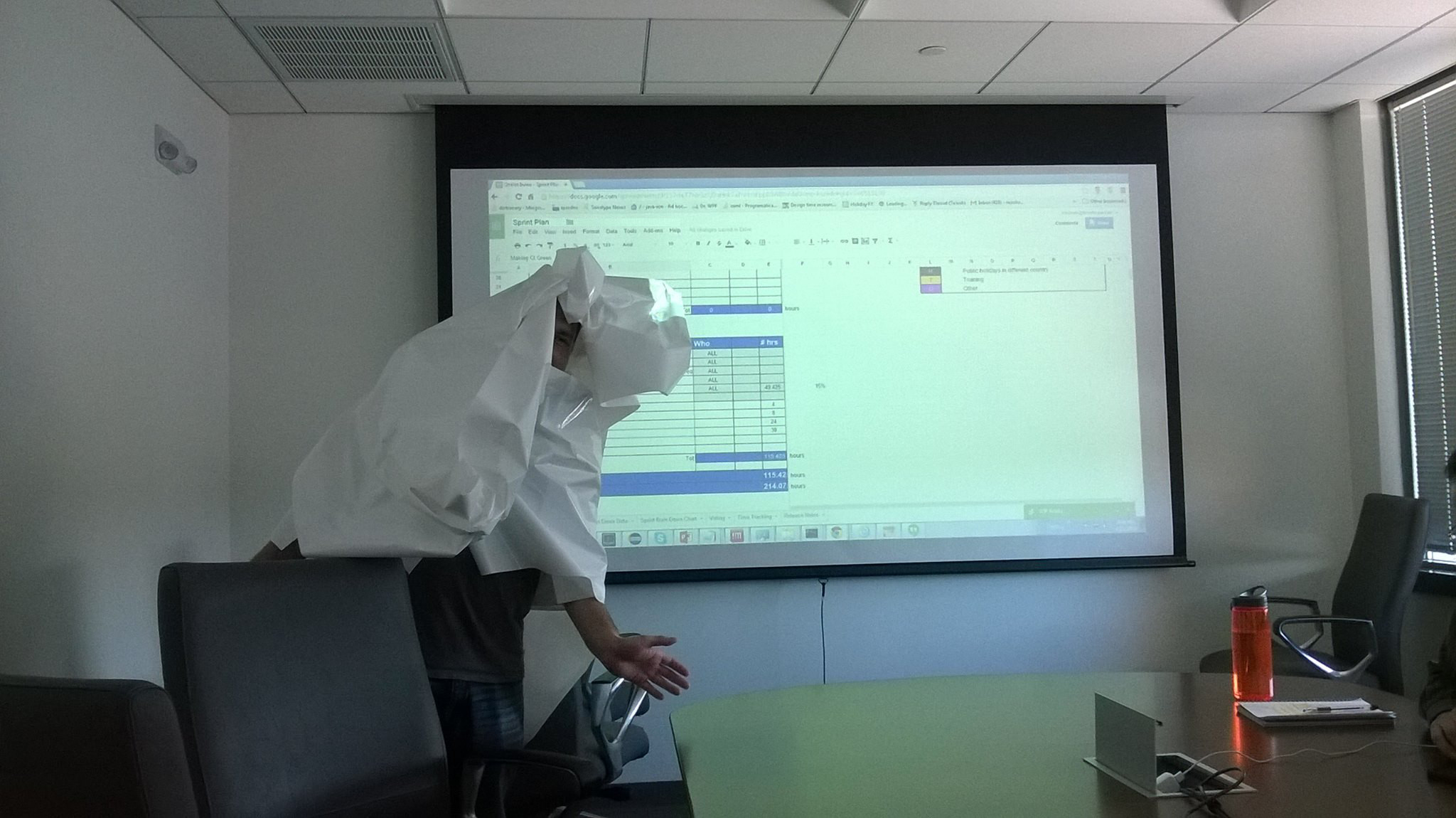

This Sheet Tells You When to Get Out of the Shithole

One of my favorite movies of all-time is American Beauty. The 1999 award-winning film stars Kevin Spacey who played Lester Burnham, a 40-something guy who hated his job and was on the brink of a mid-life crisis. The inflection point was when he saw his daughter’s gorgeous 16-year-old cheerleader friend, Angela Hayes (Mena Suvari), perform during a half-time dance routine at a high school basketball game.

Lester becomes so infatuated with Angela that he began having sexual fantasies with her. He becomes obsessed with youth that he started to live his life like he just graduated from high school. And when he was told that he was about to get laid off, he instead blackmailed his boss for $60,000. He then quits work anyway choosing to work as a crew in a fast-food chain instead– the position with, in his own words, the least amount of responsibility.

But what really caught my attention is the scene where Lester Burnham wonders in his cubicle while seeing a reflection of his image on the monitor, which resembles a guy trapped in a jail cell. With the numbers on the spreadsheet forming the jail bars in his mind, it’s pretty obvious that he felt imprisoned by his job and wanted an escape. A feeling that many people can sympathize.

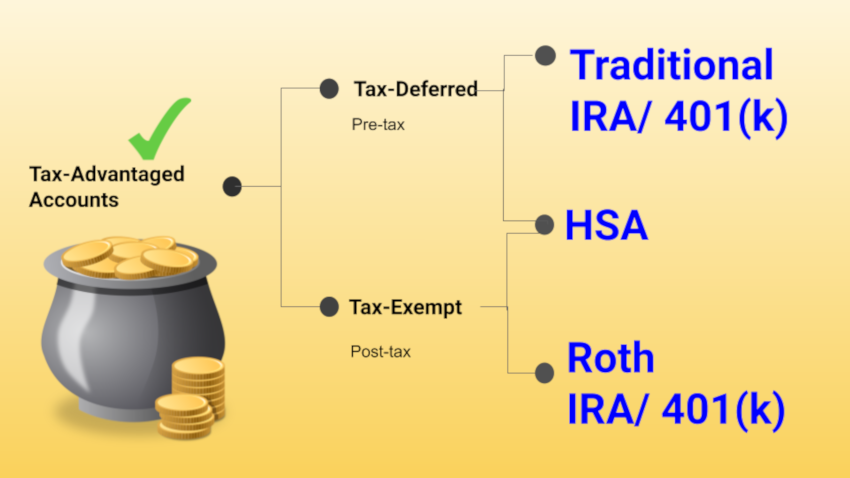

Tax-Advantaged Savings and Recommended Strategies

According to the National Study of Millionaires by Ramsey Solutions, 8 out of 10 millionaires invested in their company’s 401(k) plan, and that simple step was a key to their financial success. Not only that but 3 out of 4 of those surveyed also invested outside of company plans— mostly …

Why Work ‘Til You Drop When You Can Retire Early in the Philippines?

For many Americans, retiring early in the USA is a lost dream. Sure, staying within your comfort zone has certain advantages: established social connections, proximity to family and friends, and the local culture. But the cost of living— with rising housing, taxes, and healthcare costs— could potentially deplete your retirement …

Can You Retire from the U.S. Military as a Millionaire?

Retiring as a millionaire is probably the last thing you’d think about when joining the military. To serve the country is on top of the list. Besides, any financial gain you get from the government wouldn’t offset the sacrifices you have to endure: Rigorous training (10-13 week boot camps in …

The 4% Rule is Not for Everyone, Use this Calculator Instead

The first time I heard about “safe withdrawal,” I thought it was a family planning method. I was like, “I’m an expert!” Well, it turns out it’s for a different kind of planning— your retirement. Specifically, it answers the question, “How much can I safely withdraw from my retirement accounts?” …

What Turning 50 Means to Your Finances

If you’re wondering why you haven’t seen a new post in weeks, it’s because I was extremely busy. For starters, I’ve built a mini-basketball court in my backyard, moving 20 tons of gravel using a wheelbarrow in the process. My employer also demanded that we start working in the office, …

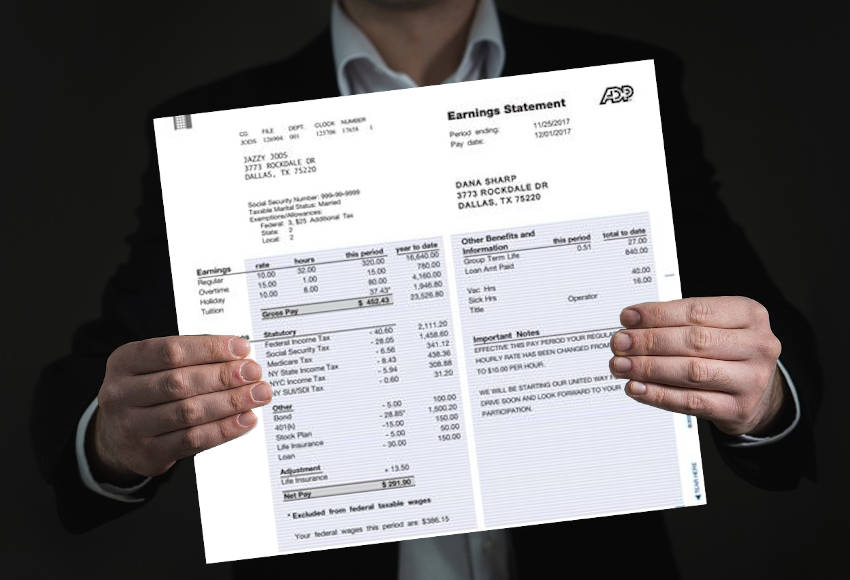

The Anatomy of an American Paycheck

If only more people paid attention to their paychecks than credit limits, we would have less poverty, homelessness, divorce, and more happy millionaires who don’t stress about money.

Life Without Retirement Savings Sucks (and what you can do about it)

Living longer is certainly a blessing. But being a 90-year-old with no money is not a particularly good problem to have. Your quality of life diminishes, and you become a huge burden to your kids, who already have responsibilities of their own.

Why I’m Paying Off My Mortgage Early, Maybe You Should Too

Paying down your mortgage when you have an ultra-low interest rate is unpopular among many investing geniuses because the stock market has historically returned around 12%. The typical advice goes like this: “Your 3% mortgage is cheap money. Put your money on investments that will make you more money!” In …

Recent Posts

Recent Comments

- on The VIX Index: How to Get a Little Richer by “Timing the Market”

- on From Diapers to Diplomas: Tips on How to Fully Fund College Using 529s

- on From Diapers to Diplomas: Tips on How to Fully Fund College Using 529s

- on Why I’m Saving More in a Taxable Brokerage Account, Maybe You Should Too

- on Why I’m Saving More in a Taxable Brokerage Account, Maybe You Should Too

Categories

- About me3

- American dream10

- Asset allocation1

- Blogging4

- Books8

- Budgeting2

- Career6

- Credit4

- Financial Planning25

- Fitness1

- Fraud2

- Giving1

- Guest Post2

- Happiness3

- Health2

- Income2

- Insurance4

- Investing32

- Lifestyle21

- Motivation7

- Relationships20

- Retirement16

- Romance2

- Saving for college5

- Saving ideas11

- Side Hustle3

- Speculation4

- Spending11

- Taxes3

- Vacation3