Why Building Your Muscles is One of the Best Investments You Can Make

Here are the top reasons why I think developing your muscles is one of the best investments that you can make.

Awesome Credit– You Must Have It!

If you have a low credit score, you might as well forget about buying anything on credit. Interest rates are so much higher now compared to when I first published this post. Instead, I’d focus on repairing my credit as I did, which is what this post is all about. …

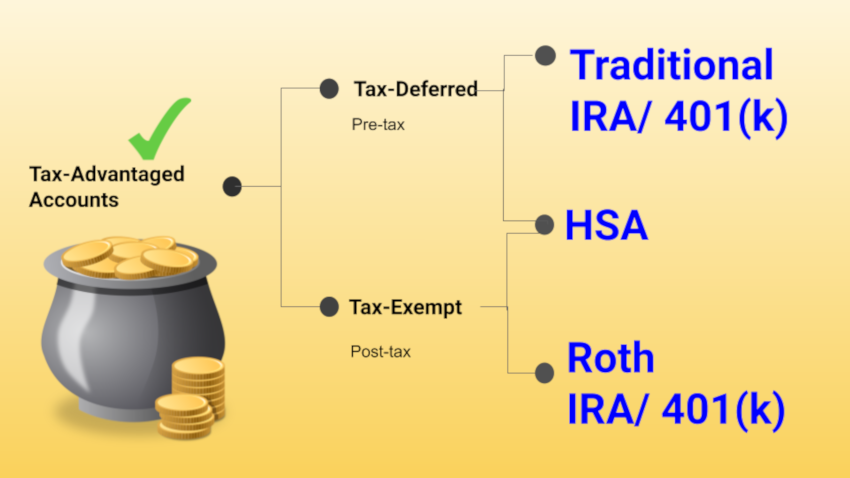

Tax-Advantaged Savings and Recommended Strategies

According to the National Study of Millionaires by Ramsey Solutions, 8 out of 10 millionaires invested in their company’s 401(k) plan, and that simple step was a key to their financial success. Not only that but 3 out of 4 of those surveyed also invested outside of company plans— mostly …

How One Guy Turned a Doctor’s Death Sentence Into a Multi-Million Dollar Business

My RN wife recently attended her college reunion in Dallas, Texas. As you probably know, Filipino nurses have been on America’s front lines during the pandemic. Now that the pandemic is behind us, they all need a well-deserved break— my wife and all her contemporaries included. So when she asked …

Crazy Cheap Asian: My Solo Trip to Singapore for Cheap

If you’re too gullible, it’s easy to be misled by the movie, “Crazy Rich Asians,” the first Hollywood movie with an all-Asian cast since Disney made “The Joy Luck Club” in 1993. Shot mostly in Singapore, a thriving city-state in Southeast Asia, it features jet-setting, Prada-wearing social butterflies flaunting their …

Cars that I’ve Driven and the Lessons that I Learned from Them

Image credit: Rugged Motorbike Jeans | Kevlar Pants Biker Jeans Rider Denim I’ve been seriously contemplating buying a new to us car this year. But then I learned about the new Prius 2023 and how handsome it looks. It is tempting to splurge on a brand-new one this year. Now …

Why You Probably Want to Track Your Spending

I came to America in 1997 with only $500 in my pocket. It was a grueling 20-hour flight from Manila to Philadelphia. Coming from a third-world country, I thought that was a lot of money. So, midway through the flight, I bought a $100 Swiss leather watch, which I justified …

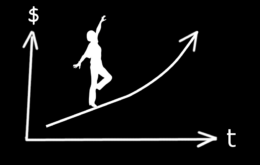

The Power of Compounding Continues to Amaze Me

Let’s say you’ve saved Warren Buffett’s cat from falling into a ditch. Extremely grateful, he offered a reward that lets you pick between two options: Which option would you pick? Option 1 or Option 2? If you picked the first option, congratulations, you’re $3,000,000 richer: But then, you just short-changed …

Why You Probably Don’t Want to Trade Options

When the market is moving haywire, many DIY investors are tempted to be more creative with their investments. So, they resort to strategies that will likely ruin their portfolios: day trading, buying on margin, short selling, etc., instead of sticking to the proven, slow-and-steady, or buy-and-hold approach to investing. One such strategy …

Why There’s No “Bad” Time to Invest

Many newbie investors have second thoughts about investing their hard-earned money in the stock market, which is completely understandable. But some ask silly questions like, “Should I invest now or wait for the bottom?” And I’m like, “Good luck finding the bottom!” The truth is, whether you invest at the …

Recent Posts

Recent Comments

- on The VIX Index: How to Get a Little Richer by “Timing the Market”

- on From Diapers to Diplomas: Tips on How to Fully Fund College Using 529s

- on From Diapers to Diplomas: Tips on How to Fully Fund College Using 529s

- on Why I’m Saving More in a Taxable Brokerage Account, Maybe You Should Too

- on Why I’m Saving More in a Taxable Brokerage Account, Maybe You Should Too

Categories

- About me3

- American dream10

- Asset allocation1

- Blogging4

- Books8

- Budgeting2

- Career6

- Credit4

- Financial Planning25

- Fitness1

- Fraud2

- Giving1

- Guest Post2

- Happiness3

- Health2

- Income2

- Insurance4

- Investing32

- Lifestyle21

- Motivation7

- Relationships20

- Retirement16

- Romance2

- Saving for college5

- Saving ideas11

- Side Hustle3

- Speculation4

- Spending11

- Taxes3

- Vacation3