I love the quote by Warren Buffett on diversification, it’s one I’ve been wrestling back and forth with for my own investing. Focus my money on the funds with the best returns or spread them out? I think it was Peter Lynch who asked why invest in something you know won’t do well in the name of diversification. But, as you pointed out – we’re not Buffett or Lynch so maybe diversification is protecting us from our stupidity? I don’t know, still working through this! Enjoyed the post!

Rebalancing Your Portfolio is Like Going to the Dentist

- By : Menard

- Category : Investing

- Tags: Portfolio rebalancing

There’s probably nothing more uncomfortable than your visits to the dentist. I don’t know about yours, but my dentist doesn’t have the gentlest hands I can brag about. Once you’re seated on that dreaded chair, you’ll be as helpless as a toddler as she works on scraping the tartar buildup from every corner of your teeth with her very rough hands. It’s never a pleasant experience.

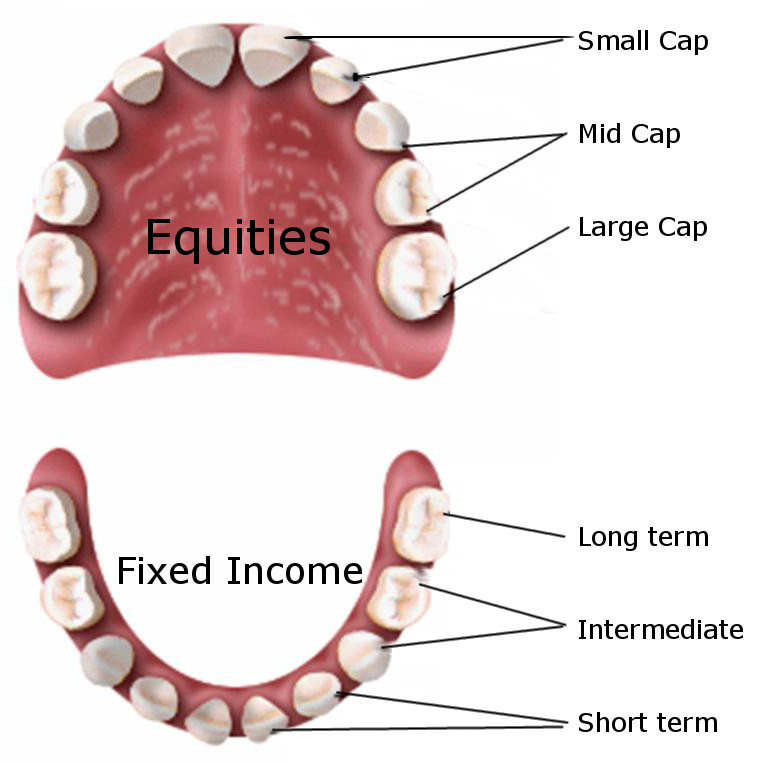

The same can be said when rebalancing your portfolio. Except that now, you’re in charge. You are the dentist and your patient’s set of teeth is your investment portfolio.

Your portfolio needs a regular checkup

Every six months you need to get your teeth checked or else you might get cavities no matter how skillful your brushing skills are. Same is true with your portfolio— it needs regular checkup no matter how good your mutual fund or stock picks are.

Just like your visits to the dentist, it’s never a pleasant experience. But you know it needs to be done regularly to maintain your financial health. Unlike your experience in the dental chair, however, the pain is purely psychological.

Rebalancing your portfolio involves selling your winners– the ones that went up substantially in value, and buying some ‘losers’ with the aim of adjusting the allocation to match your original goals.

The problem is that this process goes counter to natural human emotions. Because of greed, we tend to buy more of those that went up. Out of fear, we sell those that went down without regard to the long-term outlook. As a result, we end up buying high and selling low.

Perform an X-ray of your investments

The dental X-ray machine provides pictures of the teeth, bones, and soft tissues around them. Not only do these images help find issues with the teeth, but they can also provide some insights into possible problems with the mouth and jaw. A similar tool should be used for your portfolio, and it’s probably already being offered by your online brokerage. One of them is the Schwab Portfolio Checkup tool, which I’ve been using to x-ray my portfolio on a regular basis.

The following aspects of your portfolio should be thoroughly examined.

Asset allocation

You need to stick to your long-term plan. The great portion of your assets should be invested in stocks when you’re in for the long haul (10 years or longer). Historically, stock investments offer the best upward potential compared to other investments. In my opinion, someone with a high tolerance for risk and longer investing time horizon should allocate 90% of his portfolio to stock funds.

Stocks (otherwise referred to as Equities) are often categorized based on market capitalization: large, mid, and small caps. Large-caps are companies that have market capitalizations of $10 billion or more. As a consequence, they provide stability and liquidity to a portfolio. Small and mid-cap companies have more upside potential for growth given their smaller size.

As you approach retirement, it’s wise to gradually increase your allocation to fixed-income instruments such as bonds, which are less riskier. This is especially true when you find yourself unable to sleep at night, constantly worrying about an incoming market crash.

Not only will fixed-income instruments soften the effect of a market crash having no direct correlation with stock market price movements, but they also generate regular income flow that you can potentially reinvest.

Sector diversification

The equities portion of your portfolio may be diversified in other aspects, say, market capitalization. But if those companies all belong to a single sector then you may be in trouble.

For example, everyone knows what happened to the airline sector in 2011 as profits were trimmed substantially when the travel industry was hit hard by rising fuel prices.

The chart below displays the percentage of my equity holdings by sector compared to the overall market (S&P Global BMI). Any deviation of at least 20% is a red flag.

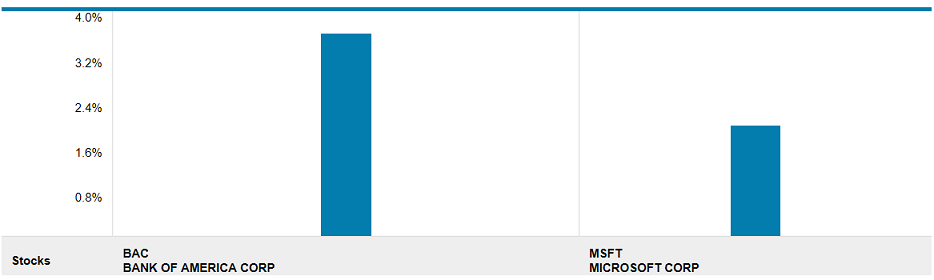

Equity concentration

Billionaire investor Warren Buffett famously stated that “diversification is protection against ignorance” and many investors took this to heart and lost a lot of money.

The problem is not because they got cocky or too confident about their picks. Rather, it’s because their entire portfolio balance is highly concentrated in a few stocks. Not to mention that they’re not Warren Buffett.

In my case, the two largest individual stocks in my portfolio are Microsoft (MSFT) and Bank of America (BAC), both of which I’ve owned for a very long time. But they represent less than 5% of my overall portfolio.

The thing is even if you run the company yourself or are involved in its day-to-day operations, there will always be some risks that need to be managed. The saying that you should never put all your eggs in one basket still holds true.

Fixed-income

Like equities, your typical fixed-income mutual fund may be comprised of different types. For example, US Treasuries provide stability while municipal bonds provide tax-exempt income. Treasury Inflation-Protected Securities (TIPS) provide protection when inflation is high.

You should examine the allocation of your fixed-income holdings to make sure they still reflect your original goals.

Bonds can be also classified based on the credit ratings of the companies or institutions that issued them. For example, US issued treasuries are rated AA+ by Moody’s. On the other end of the spectrum are junk bonds, which generally offer higher yields and therefore riskier.

Lastly, it is important to understand how your fixed-income investments react to higher interest rates. Until recently, the Federal Reserve kept rates very low to promote economic recovery. This is where the time-to-maturity matters. The longer the bond matures, the more sensitive its price reaction will be against rate hikes.

Quality

While there are many techniques that you can perform to check the quality of an investment, the simplest approach is to compare the rate of return against the set benchmark.

One red flag is the consistent underperformance. I’d personally invest only in funds that have a long positive track-record. Sadly, they seem to be harder and harder to find, in employer-sponsored retirement plans.

I’d pick a fund with higher Morningstar ratings (4 stars or more). The company provides data on thousands of investment offerings, including mutual funds. It has emerged as a trusted source of investment research.

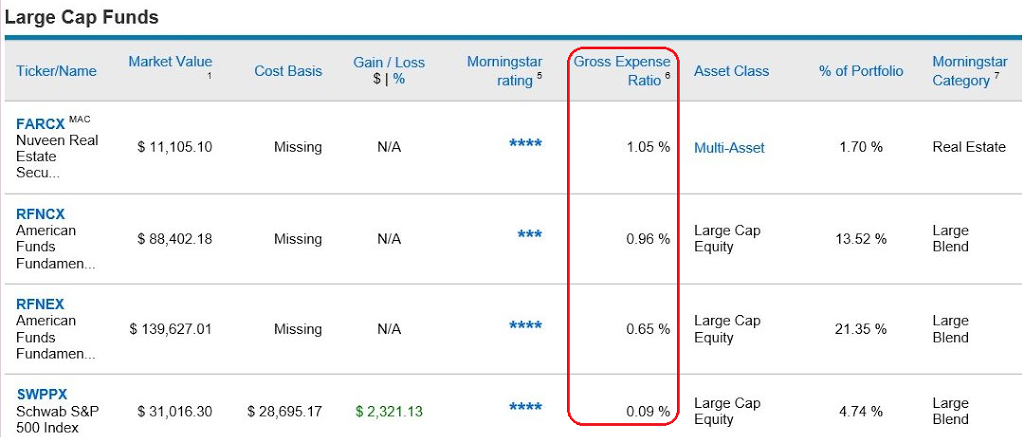

Expense ratios

You need to pay attention to your fund’s expense ratio as it can easily eat up your return. Actively managed funds have substantially higher expense ratios than index funds— they need to pay a fund manager and other expenses related to actively managing the fund.

If you can’t stick to index funds, I’d avoid any actively managed fund that charges more than 0.5%. Unless of course, the fund has a really exceptional track record. Note that international funds generally do have higher expense ratios.

What’s next

Your portfolio’s ‘X-ray’ report is an important tool. Using the numbers and information that you gathered, you can adjust your portfolio to better reflect your risk tolerance and time horizons for various goals.

Here’s how I’ve rebalanced my portfolio in 2018. With rising interest rates and record-high equity prices, I decided to increase my cash position while making sure that it is still completely aligned with my current goals.

Just as X-rays can be harmful when done too frequently, rebalancing your portfolio too often can do more harm than good.

You don’t need to follow the day-to-day changes in your portfolio either. For most of us, that would be stressful and could lead to reactive, bad investment decisions driven solely by emotions.

In my case, I rebalance my portfolio once every six months— the same frequency as my visits to the dentist.