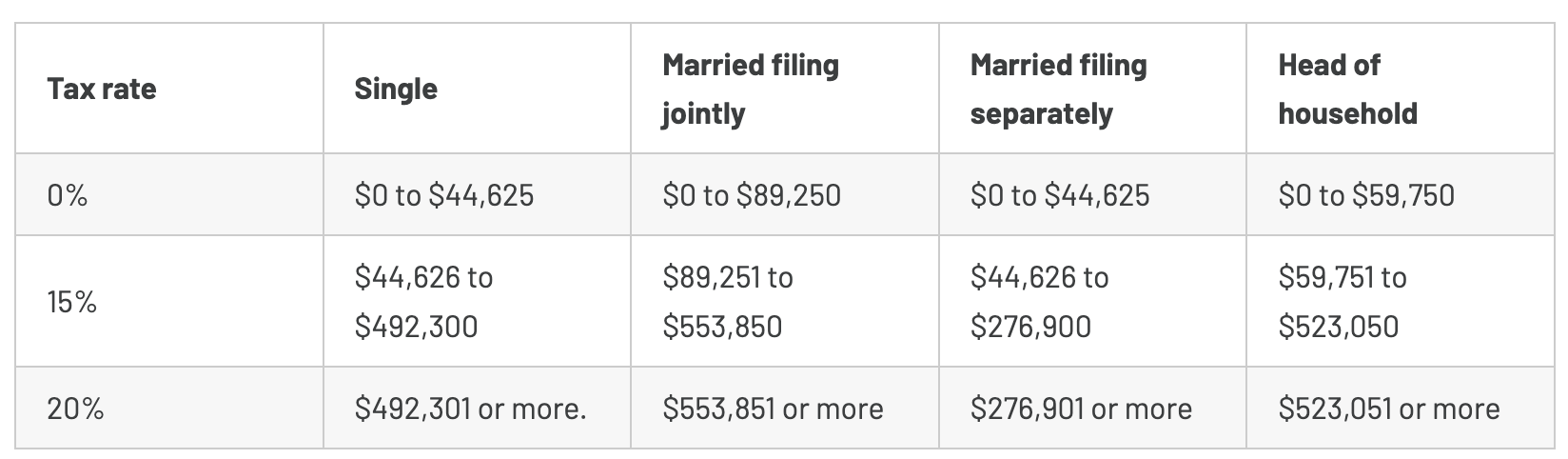

In your example you would not pay $6000 in taxes. You would only be taxed 15% on the amount over $89,250. $10,750 x 15%= 1,612.5

Why I’m Saving More in a Taxable Brokerage Account, Maybe You Should Too

- By : Menard

- Category : Investing

- Tags: Taxable account

Ever since I paid off our mortgage, I’ve been buying a mortgage worth of stocks in my taxable brokerage account. Now that I’m inclined to retire early, I plan to stash even more into this third bucket I proudly refer to as my “war chest.”

Sure, every budding early retiree should max out their tax-advantaged accounts, both Traditional and Roth, because your money grows faster in these buckets. But this year, I plan to contribute just enough to my 401K to get the full company match while still maxing out the Roth. The rest goes straight to a taxable account.

Let me tell you why.

Helps me bridge the gap to age 59 1/2.

If you’re dead set to retire early, you better make sure you have a hefty taxable account you can live on. Otherwise, you’ll be charged a 10% penalty for dipping into your 401K early. By saving in a taxable account, you have maximum liquidity. You don’t have to spend it on qualified health care or education expenses like an HSA or a 529 would require you to do.

Should you decide to blow it on a sports car, you can! This is the bucket I accessed to buy my wife a sexy 2024 Toyota Corolla with cash. Sure, I had to pay long-term capital gains taxes when I sold some of my investments. But having substantial cash handy for big expenses and expected house repairs felt good. Not to mention It can double as a sinking fund separate from your emergency fund.

To retire early, I’m counting on a little-known IRS provision, Rule of 55, which allows you to access 401K without penalties when you leave your job the year you turn 55 or later. Still, if I get fired before that age, I have this wonderful “war chest” available as an escape hatch.

I don’t have to pay long-term capital gains tax.

If you held an investment for less than a year, you’ll pay short-term capital gains— taxed at the same rate as you’d pay on your ordinary income. Hold it longer, and you’ll pay a much lower tax rate.

But guess what? If you have a low enough or no W2 income like when you’re living on this “war chest” the entire year, you could pay no capital gains taxes when you sell!

For example, say you bought NVIDIA stock in 2022 for $10,000 and sold everything for $50,000 one year and a day later. You now have a $40,000 capital gain ($50,000 – $10,000 = $40,000).

If your “married filing jointly” taxable income is $100,000 (including the $40,000 gain) for 2023, you would be in the 15% capital gains tax bracket. In this example, you pay $6,000 in capital gains tax ($40,000 x 15% = $6,000). That amount is in addition to the tax on your ordinary income.

Had you kept your taxable income below the $89,250 threshold (see 3rd column above) by drawing $10,750 ($100,000 – $89,250) from your after-tax “war chest,” you’ll pay no taxes for this transaction. Heck, you’ll pay ZERO income taxes for the entire year if you draw everything from this account!

A plethora of investment choices with no contribution limits

Rather than letting your money yawn in a savings account, you can invest in pretty much anything under the sun: index funds, ETFs, individual stocks, REITs, and even cryptos like Bitcoin. You can also do risky stuff like using a margin account to short a stock or trade options. And there are no income and contribution limits– you can invest your spare cash to your heart’s content!

Of course, you want your investments to be tax efficient as possible. ETFs are considered more efficient than competing mutual funds as they tend to have fewer capital gains distributions to shareholders. Most ETFs passively track broad market indices, resulting in less frequent buying and selling compared to actively managed funds.

In my case, it’s invested mostly in Vanguard Total Stock Market ETF (symbol: VTI). Actively managed dividend funds and high-yielding bond funds are probably the worst types of investments to hold in these accounts due to the high turnover and potential taxable income they generate.

If you’re an income-focused investor, you can also buy tax-free municipal bonds or “Munis” issued by local governments. The interest isn’t taxed by the federal government or by the state they are issued in. This is certainly an advantage if you’re in a higher tax bracket even if they tend to pay lower yields.

I can harvest my losses as tax write-offs.

I’ll be the first to admit, I lost about $2,000 when I sold an experimental crypto investment. But guess what? I was able to deduct the loss from my taxes. Each year, you can write off up to $3,000 of your losses from your ordinary income depending on your filing status. And any losses beyond that can be carried over into the next year. Sure, it hurts to lose $2,000, but at least I got like $500 of my money back.

With tax-loss harvesting, you can even capture your losses without losing a great investment. You can exchange one investment in which you have a loss, for another which is similar, but not identical to avoid a wash sale.

For example, if you took a loss on Invesco QQQ ETF, you could immediately exchange the money into Vanguard’s VGT as these two ETFs essentially hold the same tech investments. But from the IRS’s point of view, they are substantially different. You don’t have to wait 30 days just to avoid a wash.

Keeps me in a lower tax bracket in retirement.

One of the best things about retirement is the potential to control your tax bracket. Keeping your “income” low is essential to minimize healthcare and income tax expenses.

If you’re like me, who has a big chunk of his nest egg in a tax-deferred 401K, one way to potentially lower your taxes during the lifetime of your retirement is to do Roth conversions, which involves pre-paying the taxes. However, you wouldn’t want to use the same assets you want to convert to pay the taxes as you’ll miss out on tax-free growth on that amount. This is one instance when the taxable account comes in handy.

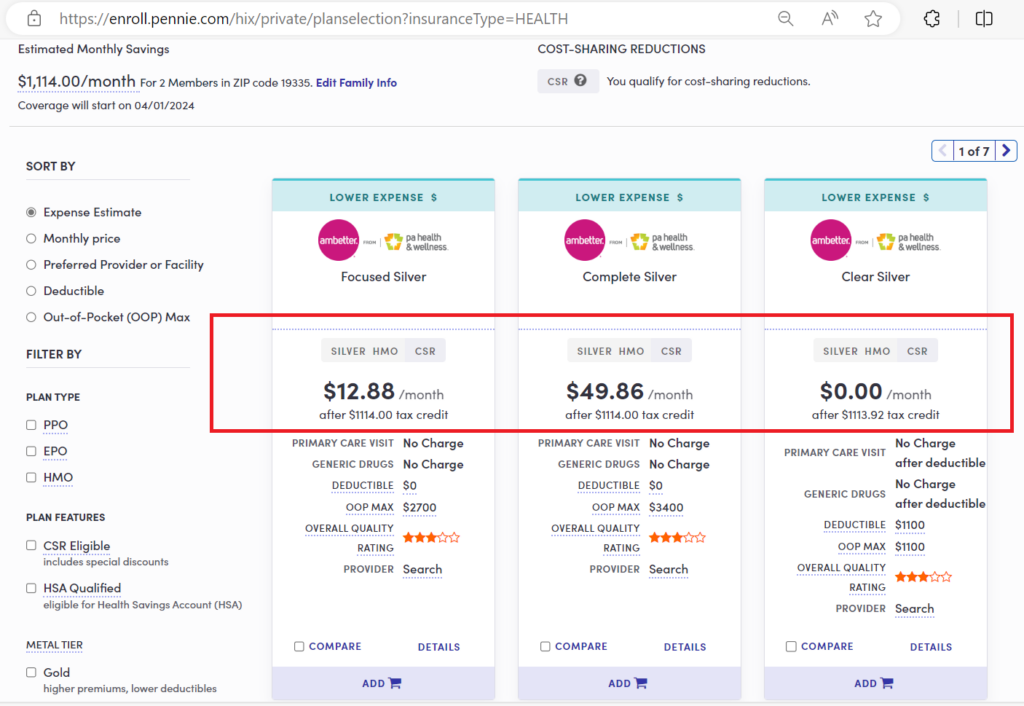

With a taxable brokerage account, you can keep your reported income as low as possible to qualify for government-subsidized healthcare premiums. It doesn’t matter that you’re a millionaire, from the eyes of the IRS, the money you spent coming from this account doesn’t constitute income because it has already been taxed.

Had your taxable income exceeded $100,000 because you don’t have this awesome “war chest,” you would have easily paid over $700 in monthly premiums for two people. Not to mention pay taxes on those Traditional 401K or IRA distributions.

Final thoughts

While saving in a taxable account gives you maximum flexibility, do not overdo it— it’s a leaky bucket. If you’re in the growth phase, you’re better off maxing out your tax-deferred and tax-free buckets that grow faster without the tax drag.

But everyone should grow this third bucket. It’s the secret weapon everyone ought to have to fight the taxman in our journey to financial independence and beyond.