What 20 Years in America has Taught Me About Money

Today is my 20th anniversary living in America— the land of milk and honey. The place where pretty much anything that I’m accustomed to seeing is bigger. Bigger houses, bigger cars, bigger TVs., bigger you name it. I can vividly remember what my reaction was

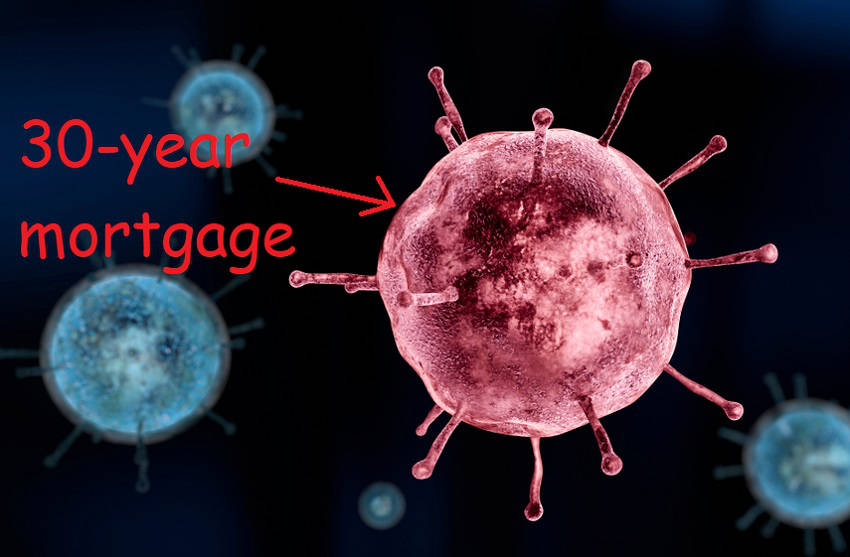

Why You Should Avoid a 30-Year Mortgage Like the Plague (and how the coronavirus paid off our mortgage)

For many people, owning their own home, as opposed to renting and paying someone else’s bond, is a dream come true. And the dream usually starts as soon as your broker hands you the keys— you suddenly have more room, greater privacy, and in our case, a spacious backyard where …

The Road to Riches Starts Here: Track Your Net Worth

It may not be a surprise to my readers, but I have a confession to make. I’m obsessed with tracking our net worth. Every month, I update a spreadsheet to keep track of our numbers, in addition to logging into various sites that aggregate our financial data over the web. I’ve …

Book Review: Beating the Street by Peter Lynch (How He Conquered the Stock Market)

This post is about Peter Lynch’s successful exploits to conquer the stock market. I’ve happened to get hold of a copy of his book, Beating the Street, which I enjoyed thoroughly.

Open Enrollment: Why I Switched to an HSA

Do you know what’s the biggest expense that you will incur in your lifetime? Nope. It’s not your home. I remember my hand was shaking when I handed my agent a $43,000 cashier’s check as a down payment for our house, 15 years ago. But like I said, it’s not …

Art Ability: Overcoming Disability Through Art

As someone married to a rehab nurse, dinners often consist of sad stories of people in dire circumstances— from someone who was debilitated by a mild stroke, to someone who needs multiple surgeries because of a traumatic brain injury, or a concussion. If you’re contemplating losing weight, it’s a great way …

Book Review: Everyday Millionaires By Chris Hogan

If you search for images of millionaires over the web, what do you see? People in nice black suits, tall hats, and fancy cars. Maybe pictures of your favorite celebrities or athletes? A millionaire is someone with net assets of at least seven digits— that’s assets minus liabilities. In contrast, …

How Bitcoin Mining Helped This Woman “Mine” a BMW

Not every day do you see someone being gifted with a brand new car. You only see it in commercials— the husband brings his blindfolded wife to the garage, and carefully removes her blindfold to the sight of a shiny new vehicle. She then jumps up and down hysterically in joy before kissing him until he can’t breathe.

Are You Getting Vishing Calls? Here’s How to Fight Back

Yesterday, I received a vishing (i.e., voice phishing) call supposedly from one of my banks in which I have an account with: This is a call from Chase National Bank. We’re seeing unusual activity in your account. We need to talk to you as soon as possible. Again, it’s imperative …

FinCon 2019: An Experiment on How to Overcome Introversion and Shyness

What’s the best way to know if you’re an introvert? Attend a conference where you absolutely don’t know anyone. If you find yourself wishing you’ve gone fishing instead as soon as you hop out of your hotel room, you are one! Fortunately, I know myself enough to overcome that feeling. …

Recent Posts

Recent Comments

- on From Diapers to Diplomas: Tips on How to Fully Fund College Using 529s

- on From Diapers to Diplomas: Tips on How to Fully Fund College Using 529s

- on Why I’m Saving More in a Taxable Brokerage Account, Maybe You Should Too

- on Why I’m Saving More in a Taxable Brokerage Account, Maybe You Should Too

- on Why I’m Saving More in a Taxable Brokerage Account, Maybe You Should Too

Categories

- About me3

- American dream10

- Asset allocation1

- Blogging4

- Books8

- Budgeting2

- Career6

- Credit4

- Financial Planning25

- Fitness1

- Fraud2

- Giving1

- Guest Post2

- Happiness3

- Health2

- Income2

- Insurance4

- Investing32

- Lifestyle21

- Motivation7

- Relationships20

- Retirement16

- Romance2

- Saving for college5

- Saving ideas11

- Side Hustle3

- Speculation4

- Spending11

- Taxes3

- Vacation3