Let’s say you’ve saved Warren Buffett’s cat from falling into a ditch. Extremely grateful, he offered a reward that lets you pick between two options:

- Receive $100,000 every day for 30 days; or

- A penny— only $.01— but he’ll double it every day for the next 30 days

Which option would you pick? Option 1 or Option 2?

If you picked the first option, congratulations, you’re $3,000,000 richer:

But then, you just short-changed yourself by over $7.7 million! Don’t you believe me? Click the second option above to update the chart.

(Go ahead, and click it)

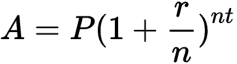

Had you picked Option 2, you would have pocketed $10,737,418.24!!! Thanks to the following formula:

Unlike simple interest, the interest earned is reinvested at the same r rate as the original P investment. Repeat this process n times within a set number of t periods, and over the long term, the growth is exponential— you’re in nerd paradise!

See also: Calculating Warren Buffett’s Rate of Return (and what you can learn from it)

Tale of two savers

Here’s a classic example. Jane invests $500 monthly for ten years early in her career but stops contributing after she gets pregnant. On the other hand, Joe procrastinates but manages to save the same amount for 30 years, later in life.

Who do you think has more wealth after 40 years?

Have you seen how much Joe saved? Click the second option above to update the chart.

(Don’t be shy, click it)

Despite contributing three times as much and three times longer than Jane, Joe ended up with $684,730.60, or almost $190,000 less than Jane!

When it comes to compounding interest, time is of the essence— the earlier you start, the more time your savings can compound.

And both of them would have been millionaires had they been investing the entire 40 years of their careers.

How compounding can work against you

Albert Einstein is often quoted as saying, “Compound interest is the eighth wonder of the world. He who understands it earns it; he who doesn’t pay it!”

It will take you almost 21 years to pay off a $4,000 credit card at 18% APR if you only pay the minimum. By then, you would have paid over $11,000 in interest alone!

True story: a woman once took a $40,000 “low-interest” student loan in 1997 and never bothered to pay the monthly bills…

Twenty-two years later, the loan ballooned to over $105,000!! This happens when you don’t treat debt like your hair is on fire.

(Try playing with the values above and see the chart update in real-time.)

Besides money, how can I leverage the power of compounding?

In the book “The Compound Effect,” author Darren Hardy emphasizes the principle of reaping huge rewards from a series of small, smart choices. Here’s the formula:

Small, Smart Choices + Consistency + Time = RADICAL DIFFERENCE

Hence, small, seemingly insignificant steps, like swapping that muffin for an apple, or reading a good book instead of watching reality TV, completed consistently over time will make you healthier and smarter in the coming years.

My dear readers, I’d like to wish you a very Merry Christmas and a Prosperous New Year!!!

No Comments