Why You Probably Don’t Want to Trade Options

- By : Menard

- Category : Investing

- Tags: How-Not-To

When the market is moving haywire, many DIY investors are tempted to be more creative with their investments. So, they resort to strategies that will likely ruin their portfolios: day trading, buying on margin, short selling, etc., instead of sticking to the proven, slow-and-steady, or buy-and-hold approach to investing.

One such strategy to add to the list is “trading options.” Having recently sold one, I have to admit, I’m a hypocrite in this regard, lmao.

Read further to learn more about it. Hopefully, you don’t make the same mistake as I did.

What is an Option?

An option is a contract that gives you the right to buy or sell an underlying investment (usually a company stock) at a specific price by a certain date. Like you would buy stocks on the stock market, there’s an options market where you can buy and sell options.

- Call option: gives you the opportunity to buy at a set price within a certain time frame, which means they become more valuable if the stock’s value rises.

- Put option: allows you to sell at a set price within a certain time frame, which means the option becomes more valuable if the stock price falls.

You probably heard of lucky new hires at Apple or Google being granted employee stock options (or ESO) as a part of the compensation package. It’s essentially a call option: they can buy a set number of company stock at a set price by a specific date. Except it’s not traded on the exchange.

Important point: an option only gives you the right to buy or sell, not the obligation to exercise that right.

How Do Options Work?

I know this is a lot of jargon and lingo but bear with me. I’ll break it down into bite-sized pieces for you :

- The underlying investment. Usually, 100 shares of stocks the owner of the option can buy or sell while the option is still active.

- The type of option: call or put— the right to buy or sell, respectively.

- The “strike price.” The price at which the underlying investment is bought or sold in case the holder chooses to exercise the option. A call option is “in the money” if the market price is higher than the strike price, for example. Otherwise, it’s “out of the money“— the option can’t be exercised.

- The expiration date. Every option comes with an expiration date— anywhere between a few days to a few years from the time you buy or sell the option.

- The premium. This is how much you need to pay for the option. Or how much you are paid if you’re the one writing the option.

Buying vs Selling an Option

As a trader, you could either buy or sell the option. Traders who are bullish can buy a call or sell a put, whereas if they’re bearish, they can buy a put or sell a call.

Buying an option is a way to capitalize on changes in the market price. If you buy a call, you are betting that the price of the underlying investment is going up. Conversely, if you buy a put, you think prices are going down. Whether you bought a call or a put, your potential loss is limited to the premium— the dollar amount you paid for it.

Selling an option simply means you’re the one writing the option contract in exchange for receiving the premium. Buyers have no obligation, sellers do. If the other party chose to exercise, you’re obligated to buy or sell the underlying stock even if the price is not in your favor.

How buying an option can go wrong

Let’s say Joe is really bullish about Facebook stock (ticker: META). He wants to buy a call option for Meta, currently worth $100 per share. He’s heard of Zuckerberg’s big push for the “metaverse” and is pretty confident the stock will skyrocket over the next few months.

Joe bought a call option for Meta with a strike price of $90 and an expiration date of three months from now. The price of the option is listed at $10— that’s a $1,000 premium (x 100 shares) to buy the option.

One month later, Meta rises to $110 per share. Here’s an important point to remember: the value of an option, at the very least, is worth the profit you could make if you were to exercise it. Since the option’s strike price is $90, that means the call option has to be worth at least $20 per share or $2,000.

So, if Joe decides to sell his option now, he would make a $1,000 profit. Not too shabby!

Instead, he becomes a little greedy and decides to hold on to his option. Besides, there are still a couple of months left before the expiration. Joe still thinks Meta stock might skyrocket to give him a much much bigger profit.

But Joe is wrong– the metaverse flops big time— Meta stock price drops like a rock!

One day after Meta hit that $110-per-share high, the price plummets and continues to drop for the next two months. The day before Joe’s option expires, Meta’s stock price is now worth a mere $50 per share—that’s $40 below the strike price!

With no time left and the stock price well below the strike price, Joe’s option is worth nothing. No one is going to buy his option since it’s cheaper to buy the Meta stock on the open market, and it makes no sense for him to exercise his own option. Joe’s option expires worthlessly and he kisses his $1,000 initial investment goodbye.

Writing a “covered” call

A couple of weeks ago, I logged into my Schwab Roth account and saw my beloved Microsoft shares falling to $220 per share. As recent as three months ago, they were close to $300.

I told myself, “Not going to sell these shares anytime soon. But I might as well sell a call option against them for passive income!”

In a flat or falling market, the receipt of the premium can reduce the effect of the loss or even make it positive.

Besides, I’ve owned many of these shares when they were trading for $25. I’d still make a killing if I’m forced to sell them at $235.

Out of the many popular options strategies, a “covered” call is one of the least risky because you already own 100 shares of stocks that might get exercised.

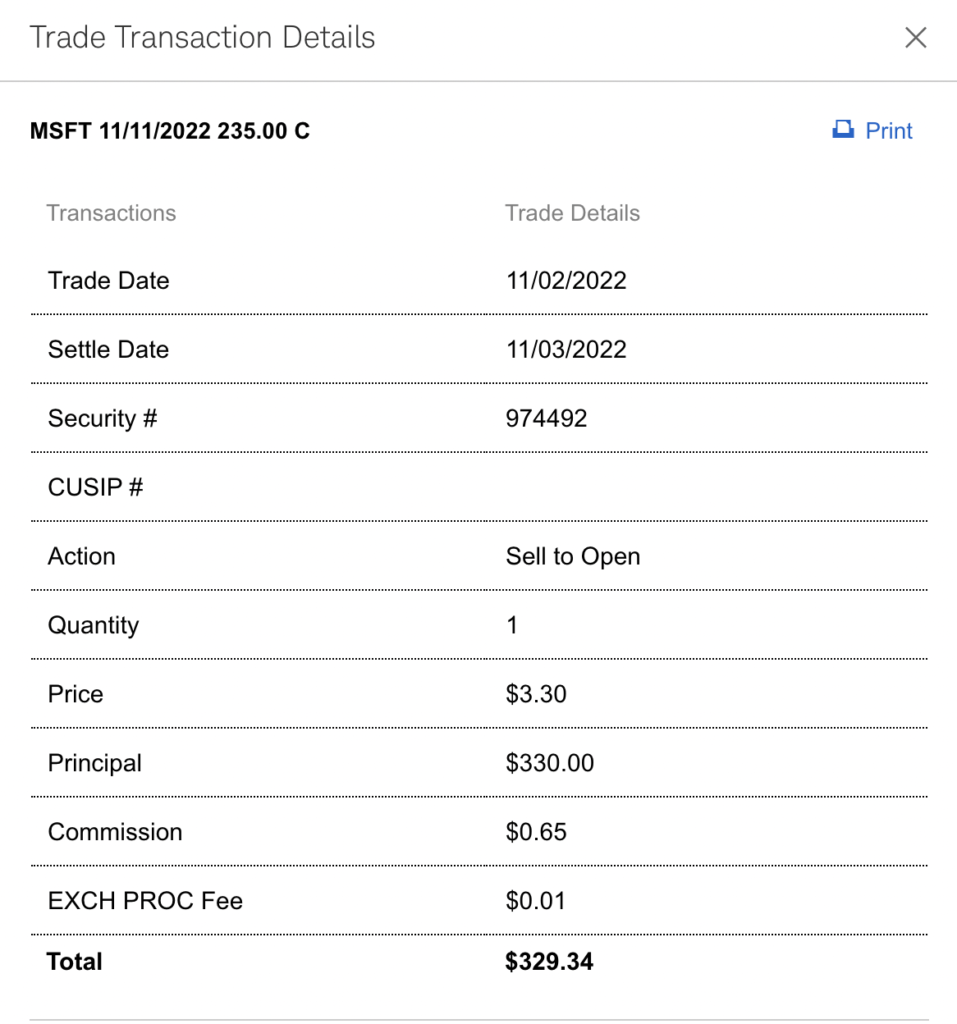

So I went ahead and sold (wrote) the call below.

The trade details: “MSFT 11/11/2022 235.00 C”

- Underlying investment: 100 shares of MSFT

- Strike price: $235

- Premium: $330

- Expiration: 9 days (11/11/2022)

($3.30 x 100 shares of Microsoft) minus commission

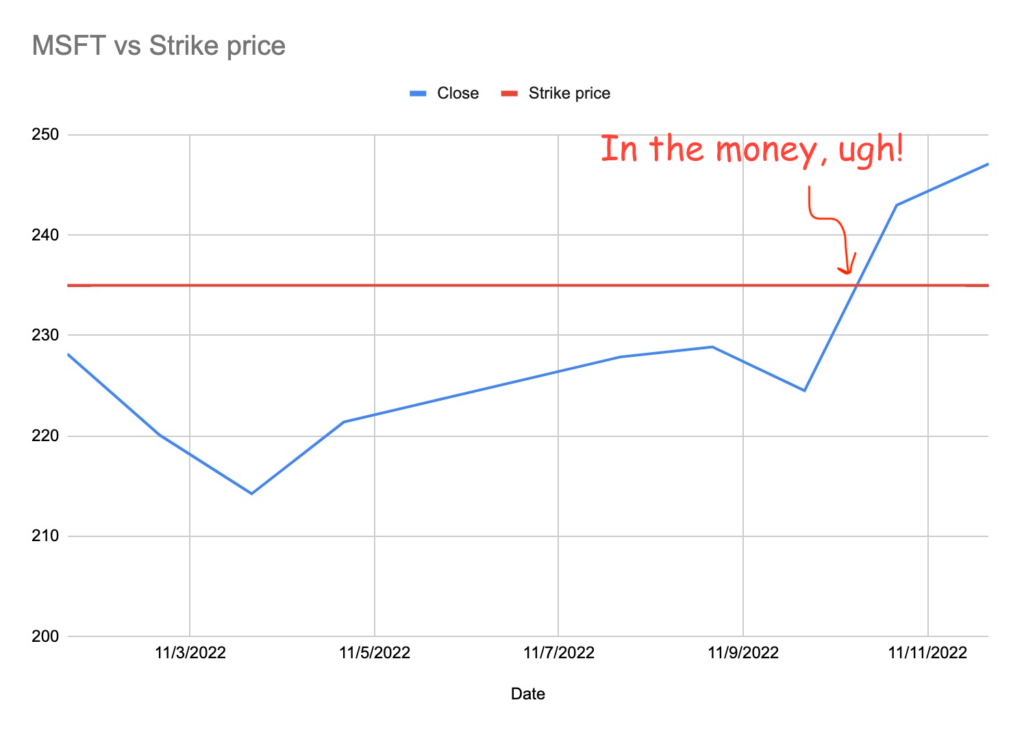

Since MSFT stock recently plummeted to $220, my bet was that the stock value won’t hit $235 in 9 days.

And boy, I was wrong. My timing couldn’t have been worse. On November 10th, the S&P 500 jumps 5% in the biggest rally in two years after the light inflation report. Of course, MSFT stock is a big chunk of the index.

Not to mention, the ex-dividend date is on November 16th. Stock value tends to rise closer to this date as more investors buy the stock to qualify for the distribution.

Now imagine if I wrote a “naked” option instead— I didn’t own the shares and the stock rises to the roof— my losses could be unlimited!

Fortunately, I’m covered. Still, a hundred of my MSFT shares have been assigned at $235 when I could have sold them at $245 or more. I basically traded a potential $1,000+ gain ($245 – $235 per share) for a mere $330 premium.

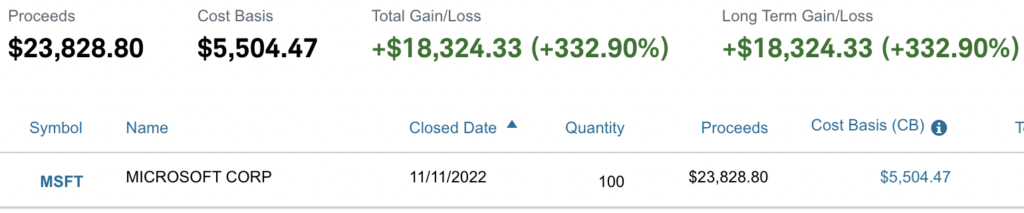

Of course, this is not really a loss as I bought the shares at a much lower price:

It’s just that buying the underlying investment many years ago is what made it profitable…. not trading the stupid option!

No Comments