Great post, this is so true, timing the market is a fools game. The best you can do is stay the course, invest consistently by dollar cost averaging, and over time you will have done very very well. Great post, love the historical references!

Why There’s No “Bad” Time to Invest

- By : Menard

- Category : Investing

- Tags: Bear markets, S&P 500

Many newbie investors have second thoughts about investing their hard-earned money in the stock market, which is completely understandable. But some ask silly questions like, “Should I invest now or wait for the bottom?” And I’m like, “Good luck finding the bottom!”

The truth is, whether you invest at the top or the bottom, in the long run, getting into the market, even if you have bad timing, has historically beaten sitting on the sidelines. So why wait?

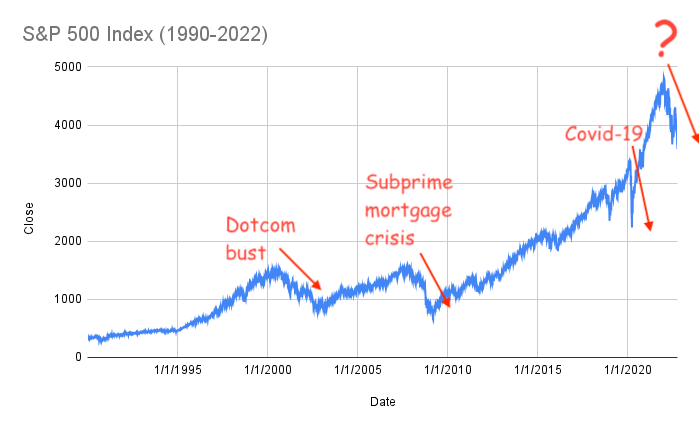

Here’s how $10,000 invested in the S&P 500 index (see chart below) at the last three market peaks and bottoms (i.e., “perfect timing”)— and held until last month’s market close— performed against the same amount held in a cash equivalent account.

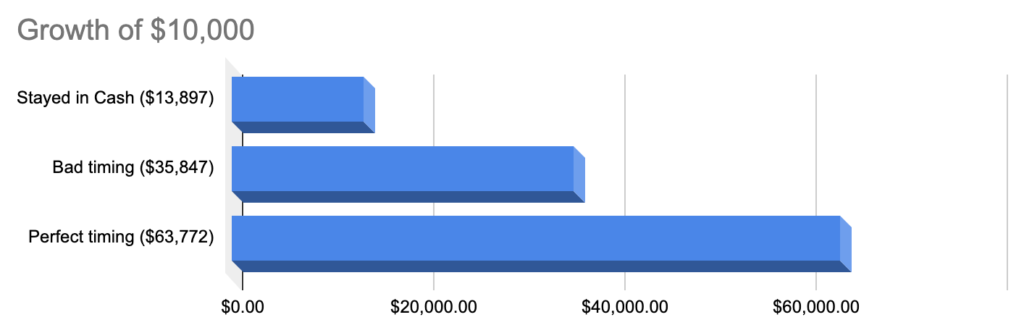

Dotcom bust (2000-2002)

I didn’t have chips on the table at the peak of the market in 2000. But times were pretty darn rosy. There was “irrational exuberance” as massive euphoria was everywhere. Investors were buying internet companies left and right that had ridiculous valuations.

By the end of March that year, it came to a crashing halt. The bubble, which had been building up since I moved to the states, slowly started to pop. People lost faith. And many tech workers, including yours truly, got laid off.

- Peak, 3/24/2000

- Bottom, 10/9/2002

- Decline, -49.1%

Had you invested at the peak of the Dotcom bubble, after 22 years, your investment still would have ended up 258% ahead of when you stayed in cash!

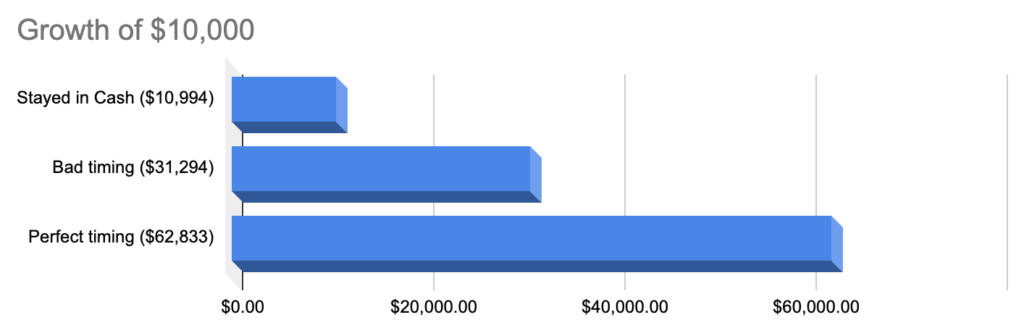

Subprime mortgage crisis (2008-2009)

The first bear market in which I had substantial money invested. The 2008 financial crisis was mainly due to lax lending standards that fueled a housing bubble. With cheap credit, even the “bum” next door earning minimum wage and no savings could buy a house.

Mortgages were granted to nearly anyone because investors were generating huge returns as housing prices continued to climb. This is followed by the dramatic collapse of the real estate and stock markets, and one of the biggest corporate bailouts in US history.

- Peak, 10/9/2007

- Bottom, 3/9/2009

- Decline, -56.8%

Had you invested at the peak preceding the Great Recession, after 13 years, you would have ended up 285% ahead of when you stayed on the sidelines!

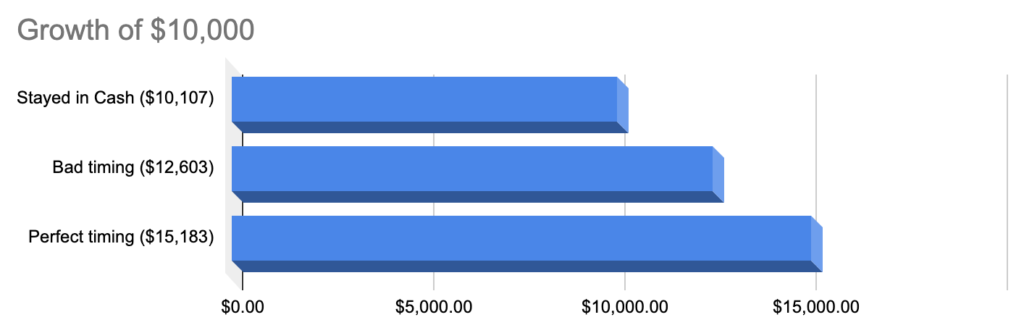

Covid-19 pandemic (2020)

When Kobe Bryant died in a helicopter crash; I knew right away that 2020 was a bad year. Sure enough, the novel coronavirus wreaked havoc across the globe. For the first time, I wasn’t afraid of losing money in a bear market— I was scared of dying from the virus!

The global lockdowns, of course, caused the U.S. stock market to plunge 66% in only a few weeks!

- Peak, 2/19/2020

- Bottom, 3/23/2020

- Decline, -66%

Even over a short term– less than three years— $10,000 invested at the market’s peak would have bested cash by 25%.

Final thoughts

The hypothetical examples above are for investing a lump sum of money. But what if you have a series of cashflows to invest monthly like your 401K contributions?

Even if you have a crystal ball, and bought only the dips, you are likely to miss out on gains for two reasons:

- Over the long term, the direction of the market is very predictable— it always goes up.

- The future “dip” you’ll buy is likely higher than what it was had you simply bought as soon as the money is available.

Therefore, the best strategy is to invest immediately.