The Road to Being Rich: 7 Tips for Earning Extra Money While Working Full Time

In this age where real wages aren’t rising due to inflation, it’s becoming increasingly important to supplement your income with side hustles. And those who are willing to do what average people won’t do are the ones that are rewarded with above average results.

Book Review: Your Money or Your Life by Vicki Robin

Imagine yourself walking into a dark alley, in the middle of some ghetto neighborhood, and halfway through, a masked thug suddenly appears, pulls out a sharp knife and exclaims, “Your Money or Your Life!” Unless your first name is Chuck and your last name is Norris, chances are, you would surrender …

Net Worth Update: Two Years Later

One reason why I share my net worth over Labor Day Weekend is that of something with symbolic importance. The holiday is meant to celebrate the achievements of American workers. To quote the U.S. Department of Labor, “a tribute to the contributions of workers have made to the strength, prosperity, and well-being …

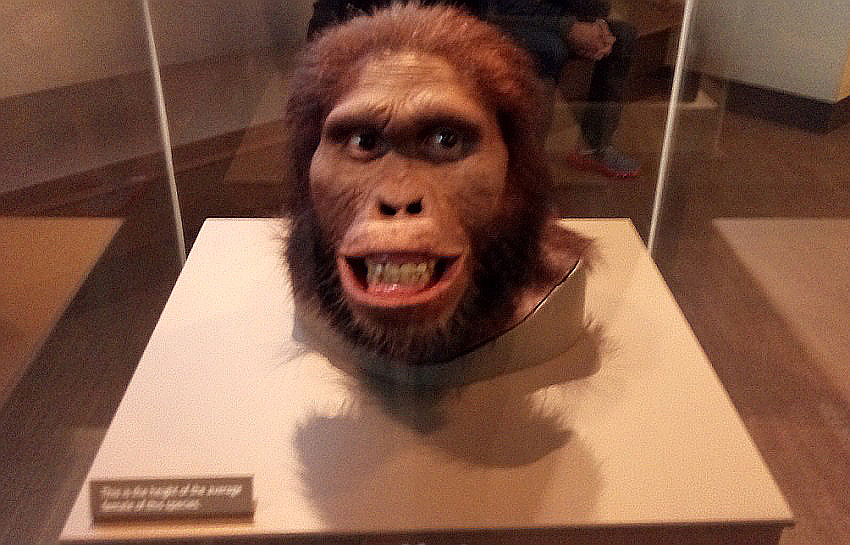

How He Achieved Financial Freedom by Smart Investing

The term Financial Freedom is often used interchangeably with Financial Independence. But to me, there’s a subtle difference– Financial Freedom is a step higher than being financially independent. That’s when you can splurge on first-class airline tickets as opposed to traveling in coach, where strangers might end-up snoring on your …

Stupid Money Mistakes my Smart Neighbors Make (Part II: Car Payments)

In Part I of this blog series, I talked about the expensive mistakes my neighbors are making by sending their children to private schools. At the risk of being forever castigated by my neighbors if they ever discover my posts, I’ll continue with Part II to talk about one of …

Stupid Money Mistakes my Smart Neighbors Make (Part I: Private Schools)

One of my goals in writing this blog is to help you become smarter with money. You’d think it’s just common sense. But as it turns out, common sense is not so common. Otherwise, people wouldn’t buy things they can’t afford. They wouldn’t smoke cigarettes or eat junk food either. …

Three Days, Five People in Quebec City on a Budget

What do you do when you’re dying to visit Europe, but don’t have a large budget to spend on five people? Would you take out your credit card and charge the expense? Or do you try and expand the budget? The answer is neither, you should think of a viable …

How She Finally Managed to Save for Her Family Vacation

The following is brought to you by Emma Lewis– a loving mother, a devoted wife and a part of the team supporting Spacer – the AirBnb of storage space. Emma is also a staunch supporter of the sharing economy and often mentions its benefits. She lives and works in the …

Why Would Successful People Commit Suicide?

You’ve seen it in the news, especially during an economic depression. A man loses his job, gets into a big pile of debt, runs out of options, and then kills himself. In more tragic cases, he takes his whole family with him. If you think having a job is stressful, …

What Frugal People Think About Organic Food

The labeling term “Organic” refers to accredited methods agricultural products are grown and processed. Regulations vary from country to country, but in general, organic crops must be grown without the use of synthetic pesticides, bioengineered genes (GMOs), petroleum-based fertilizers, or fertilizers from municipal sewage… Eew! Organic food is not defined …

Recent Posts

Recent Comments

- on From Diapers to Diplomas: Tips on How to Fully Fund College Using 529s

- on From Diapers to Diplomas: Tips on How to Fully Fund College Using 529s

- on Why I’m Saving More in a Taxable Brokerage Account, Maybe You Should Too

- on Why I’m Saving More in a Taxable Brokerage Account, Maybe You Should Too

- on Why I’m Saving More in a Taxable Brokerage Account, Maybe You Should Too

Categories

- About me3

- American dream10

- Asset allocation1

- Blogging4

- Books8

- Budgeting2

- Career6

- Credit4

- Financial Planning25

- Fitness1

- Fraud2

- Giving1

- Guest Post2

- Happiness3

- Health2

- Income2

- Insurance4

- Investing32

- Lifestyle21

- Motivation7

- Relationships20

- Retirement16

- Romance2

- Saving for college5

- Saving ideas11

- Side Hustle3

- Speculation4

- Spending11

- Taxes3

- Vacation3