12 Jaw-Dropping Stats About Retirement

Below is a guest post from Archana Singh, a finance blogger from the Mystic Land of India. Archana works for one of the leading insurance and web aggregator in the country. Even if you don’t live there, you’ll quickly learn that retirement challenges are fundamentally the same; circumstances could devour …

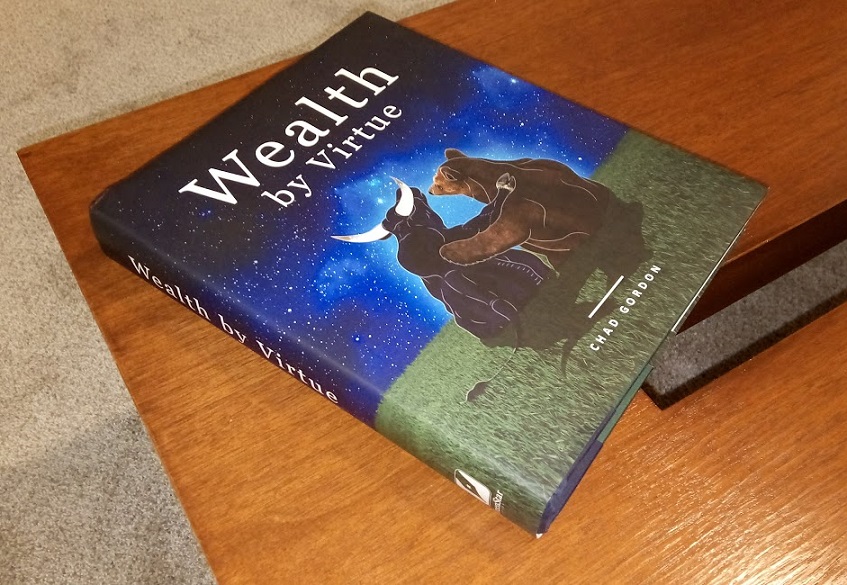

Wealth by Virtue: a Book by Chad Gordon

Not long ago, I accepted an offer from a publisher to receive an advanced copy of Wealth by Virtue. Being a money nerd, I said yes, given that it came with a “no expectations and pester-free guarantee.” Even if the book turns out to be a dud, it could still …

How She Finally Became Financially Independent

Financial independence feels like a dream everyone strives to achieve. I got sick of longing for it and decided to commit myself to doing something about it. The first few years were really hard, but I knew what I was working towards. By toughing it out then, I knew it wouldn’t be so tough now. I would be able to put it behind me.

Here are America’s Richest Immigrants in 2018

Forbes recently released its Richest People On The Planet list for 2018. I figured it would be interesting to determine who, among the 575 American billionaires, are immigrants like me. I’ve patiently and painstakingly gone through the list to figure out which ones emigrated from other countries based on the …

Vintage Computing: Turning Trash into Treasure

Ever since I was able to resell a “vintage” typewriter for a profit, my wife and I have been propelled to look for other potentially valuable items. We went as far as driving around garage sales of wealthy neighborhoods hoping to find a “hidden gem”: a 19th-century necklace, an oil …

Saving for Retirement or Paying Off Debts: The Dilemma

Whether to prioritize a retirement saving or pay off debt is a vital question to assess for people who are in debt. Some people think that paying off debt first makes sense. But what about the retirement? If you don’t save for your retirement, you may have to work for a longer time than an average retirement age.The dilemma is genuine.

On the other hand, the conventional wisdom says that people should start saving money for their retirement before paying off debts. Because, the sooner you start saving, the more time your money will get to grow.

If you have multiple debts with a higher interest rate, then the debts are costing you more money every day. Because it is a matter of assessing the interest rate that you are accumulating. You are actually losing money by paying the interest rate on the debts. You have to take initiative to pay them off to save money on the painful interest rate.

LinkedIn to Millionairedom

When you hear someone asking “Why are so many college dropouts successful in their life?” Bill Gates, Steve Jobs, and Mark Zuckerberg probably all come into your mind. The problem is that the question makes an erroneous assumption that there are “many” of them. The not-so-obvious truth for many is that these extremely successful dropouts are just drops in the ocean. No pun intended.

The majority of people who didn’t bother to acquire any marketable skill, let alone a college degree ended up in lower paying, dead-end jobs. Not to belittle people who actually work their butts off in low skilled jobs, but that’s the sad reality.

Of course, anything is possible in America. It’s just that being complacent with your education may ruin your chances of getting ahead. In this game we call life, investing in yourself is enormously important to improve your odds of winning.

The traditional advice that your grandma gave you: earn good grades, finish college, get a high paying job, and save for the rainy day, is still the best strategy for most people in any economy. Your heeding to the advice could spell the difference between earning a great income or settling for a minimum-wage. When you hear someone asking “Why are so many college dropouts successful in their life?” Bill Gates, Steve Jobs, and Mark Zuckerberg probably all come into your mind. The problem is that the question makes an erroneous assumption that there are “many” of them. The not-so-obvious truth for many is that these extremely successful dropouts are just drops in the ocean. No pun intended.

The majority of people who didn’t bother to acquire any marketable skill, let alone a college degree ended up in lower paying, dead-end jobs. Not to belittle people who actually work their butts off in low skilled jobs, but that’s the sad reality.

Of course, anything is possible in America. It’s just that being complacent with your education may ruin your chances of getting ahead. In this game we call life, investing in yourself is enormously important to improve your odds of winning.

My Worst Black Friday Experience

One source of amusement that my wife and I both enjoy is watching early shoppers wait in line outside the Best Buy store near our house on Black Friday eve. The store used to open around midnight to enable eager consumers to get their hands on the latest high-tech gadgets at substantially marked down prices.

Back then she worked night shifts, so right after picking her up, we would spend the time to drive around the store’s parking lot to check out the shoppers camping outside, sometimes for days at a time. We can’t help but be amazed by what people will attempt to do just to save a couple of hundred bucks.

Now that my wife is doing day shifts, I found myself on the other side of the coin. On my way back after driving her to work, it suddenly crossed my mind to stop by the store. Best Buy now conveniently reopens at 8 am. I figured I wanted to experience the euphoria over the shopping deals myself so I can write about it on this blog.

This post highlights my suffering spending at my favorite brick and mortar store. Yes, I still buy stuff from the store that issued me the card that ruined my credit in the late 90s.

9 Signs You Probably Won’t Need a Retirement Nest Egg

It’s a fact, people in developed countries are living longer. For instance, life expectancy for women is predicted to surpass 90 years in South Korea by 2030, according to the study published in The Lancet, one of the world’s oldest and most respected medical journals. Of course, the study assumes …

What Rihanna Can Teach You About Liability Insurance

There’s no denying that Rihanna is one of the hottest artists today. No offense to JayZ, but when it comes to overall talent, I honestly think Rihanna will give Beyonce a run for her money. Not only can she sing better, her moves are smoother, more spicy and hypnotic, enough …

Recent Posts

Recent Comments

- on From Diapers to Diplomas: Tips on How to Fully Fund College Using 529s

- on From Diapers to Diplomas: Tips on How to Fully Fund College Using 529s

- on Why I’m Saving More in a Taxable Brokerage Account, Maybe You Should Too

- on Why I’m Saving More in a Taxable Brokerage Account, Maybe You Should Too

- on Why I’m Saving More in a Taxable Brokerage Account, Maybe You Should Too

Categories

- About me3

- American dream10

- Asset allocation1

- Blogging4

- Books8

- Budgeting2

- Career6

- Credit4

- Financial Planning25

- Fitness1

- Fraud2

- Giving1

- Guest Post2

- Happiness3

- Health2

- Income2

- Insurance4

- Investing32

- Lifestyle21

- Motivation7

- Relationships20

- Retirement16

- Romance2

- Saving for college5

- Saving ideas11

- Side Hustle3

- Speculation4

- Spending11

- Taxes3

- Vacation3