The No. 1 Destroyer of Wealth is Divorce

Out of the most feared and dreaded D’s in life, there’s probably no subject more shunned upon by money bloggers than the topic of divorce. It’s not a particularly difficult topic to write about, and yet many avoid the subject altogether. This is surprising because divorce is no longer a taboo considering its prevalence in modern society.

Lessons from the Most Popular Posts of 2018

As we welcome the new year, let’s take a look at the most popular articles that were published here on Millionaire Before 50. But more importantly, let’s highlight the lessons that we can learn from them.

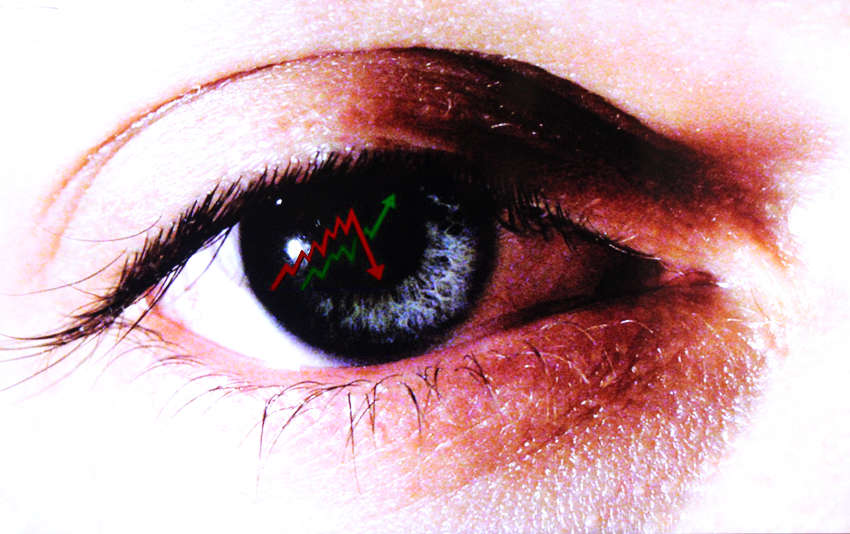

Stock Market is like Climate Change: Keep your Eye on the Man, not the Dog

In episode 12 of the fascinating science mini-series, Cosmos, Neil deGrasse Tyson explains why meteorologists suck at predicting the weather. He goes on to explain the difference between weather and climate. “Weather is what the atmosphere does in the short term, hour to hour, day to day. Weather is chaotic, …

Traditional vs Roth 401K: Understanding How They are Different

One thing that can significantly affect your long-term and retirement savings is the type of employer-sponsored retirement plan you choose. While traditional 401(k) plans and Roth 401(k) sound similar, there are some major differences between the two accounts.

Distinguishing between “Wants” vs “Needs” is so easy, even a 9-year-old can do it

“Hey pa, I got a perfect score!” my son proudly exclaims while greeting me as I come in the kitchen door next to my garage. I just got home from my long commute from work. “Great job! I’m so proud of you.” I replied, barely looking into the piece of …

Is it Time to Buy Bitcoin or just Laugh at the Suckers who are Holding onto It?

The following post is brought to you by Tom Dunleavy. Tom works in the Investment Consulting industry advising pension and 401-K plans, worth over a collective $5 billion dollars in assets. He writes about investing, personal finance and building your retirement portfolio over at investmentbasecamp.com. Admittedly, I’m actually one of the …

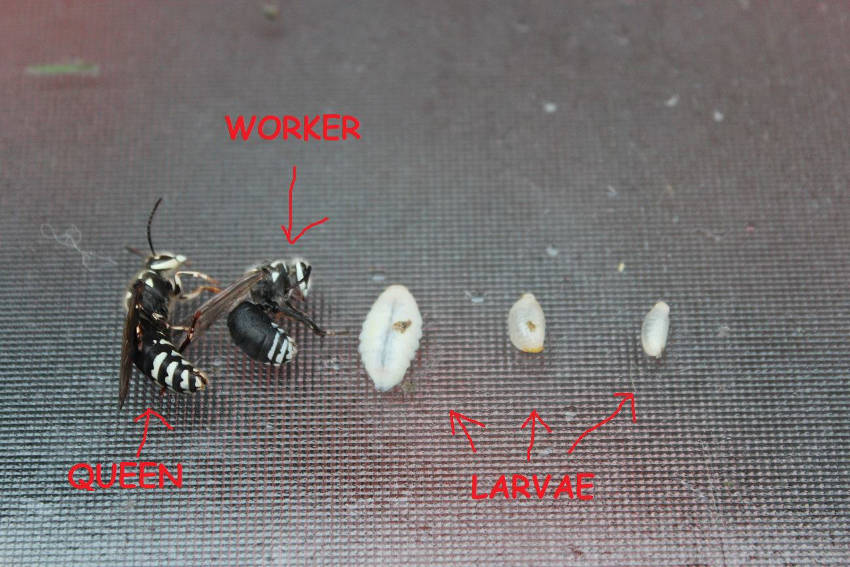

How the Massacre of “Killer Bees” Saved Me $300

If you ever own a home, you know that the monthly mortgage, property taxes, and insurance are not the only payments that you’ll ever have. A significant portion of your housing expense involves its maintenance from both inside and outside the house: plumbing work, appliance repairs, repainting, yard work, etc. …

What is a Life Well-Lived? (Hint: It’s not about having lots of money)

Money affects every aspect of our lives. From what we eat, where we live, and how we dress, to what we do with our spare time. Having enough money is essential to achieving sustainable happiness. However, having an abundance of money “per se” is not really a true measure of …

Visualizing the Best and Worst Days of the Dow

“Dow falls 832 points in the third-worst day by points ever” was the headline last Thursday on CNN Business. The media loves to sensationalize declines in the stock market, like any other news topic. The increase in readership almost always results in increases in advertising revenue. But the truth is the …

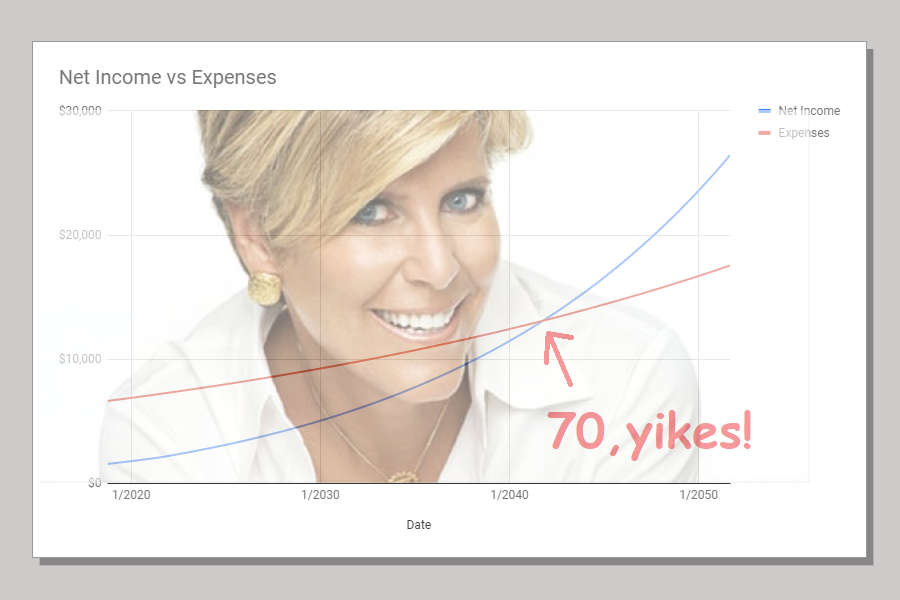

Suze Orman Could be Right, This Calculator Can Tell You Why

If you’ve been following my posts, you probably know by now that this is not a FIRE (Financially Independent, Retire Early) blog. For one thing, I’m already in my forties when I wrote my first post. There’s no way I could retire in my 30’s without sneaking into my sister’s time …

Recent Posts

Recent Comments

- on The VIX Index: How to Get a Little Richer by “Timing the Market”

- on From Diapers to Diplomas: Tips on How to Fully Fund College Using 529s

- on From Diapers to Diplomas: Tips on How to Fully Fund College Using 529s

- on Why I’m Saving More in a Taxable Brokerage Account, Maybe You Should Too

- on Why I’m Saving More in a Taxable Brokerage Account, Maybe You Should Too

Categories

- About me3

- American dream10

- Asset allocation1

- Blogging4

- Books8

- Budgeting2

- Career6

- Credit4

- Financial Planning25

- Fitness1

- Fraud2

- Giving1

- Guest Post2

- Happiness3

- Health2

- Income2

- Insurance4

- Investing32

- Lifestyle21

- Motivation7

- Relationships20

- Retirement16

- Romance2

- Saving for college5

- Saving ideas11

- Side Hustle3

- Speculation4

- Spending11

- Taxes3

- Vacation3