Wealth by Virtue: a Book by Chad Gordon

- By : Menard

- Category : Books, Financial Planning

- Tags: Chad Gordon, GreenStar Advisors, Wealth By Virtue

Not long ago, I accepted an offer from a publisher to receive an advanced copy of Wealth by Virtue. Being a money nerd, I said yes, given that it came with a “no expectations and pester-free guarantee.” Even if the book turns out to be a dud, it could still be thrown into the fireplace to help me stay warm this past winter.

But, alas, the book turned out to be a masterpiece– not only was I obliged by my conscience to write a positive book review; I also couldn’t use it as a firewood alternative.

Kidding aside, I’m very happy that I received a copy. I’d love to use it as a reference for future topics that I want to cover in this blog.

Here’s why the book stands out.

One of the most comprehensive books that I’ve read in a long time.

While it certainly doesn’t cover every topic under the sun, as it wasn’t the author’s intention to make it encyclopedic, the book successfully covers six areas of personal finance: banking, investments, real estate, insurance, legal planning, and tax planning. The author states that everything in your personal finances fits into these categories. And by recognizing the structure, you can learn to make them all work together, putting yourself on the path to wealth and making wealth-optimized decisions.

But what really stands out is the quality of information that you can find in the form of masterful explanations and illustrations that the author had meticulously organized and arranged in its 370+ pages.

It provides answers to life’s most difficult personal finance questions.

Should you pay down your debt or add to your investments? Should you rent or buy a house? How much insurance do I need? Is it better to get a trust or a will?

The above are common questions that a lot of other personal finance books or articles try to address. But not many can provide easy to understand explanations that are supported by color-coded tables, graphs, and real-life case studies to help prove their point.

The author’s goal is to, in his own words, “empower you as someone who makes investments rather than a mere buyer of financial products.” And I believe he has successfully done so with his intelligent writing.

It does an outstanding job in prepping you to become wealthy.

It has been said that building wealth is 80% behavior and 20% knowledge. The book emphasizes that wealth is largely the result of positive attitude or behavior towards money and that investing success is a question of how stocks behave versus how the investor behaves. To quote the NRA, “Stocks don’t kill portfolios, people kill their own portfolios.”

The book advises you to embrace what you can’t control such as inflation and short-term movements of the market. You should focus your energy on things that you have control over. Your investing behavior and investment choices are examples of these.

Perhaps that’s the reason why the author named the book “Wealth by Virtue”.

The book was written by a professional financial advisor.

Chad Gordon is the founder and CEO of GreenStar Advisors, a registered investment advisor.

Unlike some self-proclaimed money experts out there, he advises individuals, couples, and families toward wealth-optimized decisions using a holistic approach and does this in real life.

He believes that the best tool to help clients have financial confidence (and rational behavior) during scary times is a well-thought out financial plan.

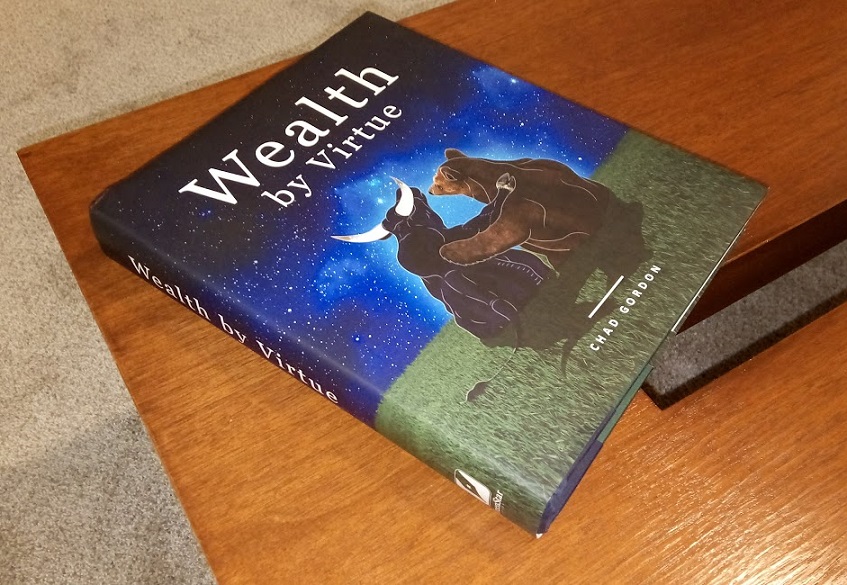

All about the book cover

The thing that triggered my curiosity most is the cover. I’ve never seen the bull and bear, both ferocious animals, portrayed as lovers enjoying the moonlight before. Why are they suddenly intimate friends?

Here’s the explanation that I got from the book’s official website:

The bull and bear are the classic icons of Wall Street. Generally, a bull market is when it is going up and a bear is when it is going down. Often you will see these two facing off against each other and portrayed as enemies. Here, they are friends because I believe that people should not see them as opposing forces. I see bear markets as your “price of admission” for the long-term superior returns of the stock market. You have to embrace the bear, to get all the benefits of the bull.

Wow. You couldn’t get a better explanation than that.

But I still prefer to see them fighting…

No Comments