Nice posting ! Thanks for sharing this information

tips for senior citizens

12 Jaw-Dropping Stats About Retirement

- By : ASingh

- Category : Retirement

- Tags: Guest Post, India, retirement

Below is a guest post from Archana Singh, a finance blogger from the Mystic Land of India. Archana works for one of the leading insurance and web aggregator in the country. Even if you don’t live there, you’ll quickly learn that retirement challenges are fundamentally the same; circumstances could devour you if you’re not ready.

For most people, retirement is an opportunity to get out of the rat race. But are you are prepared to face what’s there in store for you? Are you sure whether your effective preparations and planning will help you live a comfortable life post retirement? Are you aware and have invested in good pension plans that will help you secure your financial future? Here are 12 rather surprising and jaw-dropping statistics about retirement that every person must be knowledgeable about:

You may end up living much longer than you’ve anticipated

As long as you have made enough money and have saved sufficiently for your twilight years, you don’t really have a reason to worry. A long and a healthy life is a blessing.

Just about 20 years ago, life expectancy at birth in India was just 53 years. Today it stands at 71. And with expected advances in medical technology over the next 20-30 years, this is expected to go up even further. If not a 100, most of us will live till 90 at least.

The question is: Can you afford your retirement? Have you anticipated you will die at 75? What if you live 10 years longer? Do you have enough funds that will take care of all your needs?

Health insurance may not be adequate

Medical expenses are rising day by day. Your health insurance must be able to cover these expenses. It is important to take health insurance in your early years because aging makes it tougher for you to obtain a health insurance.

You must also opt for a critical health insurance plan and if your children are employed, ask them to include your name under a good group insurance scheme that is offered by their employers. Some amount must be kept aside to build an emergency medical coffer.

47% of Indians aren’t saving for retirement

According to a report by HSBC, a large number, precisely 47%, of working people in India haven’t started saving for retirement, or have discontinued or faced challenges while saving for their future.

This is higher than the global average of 46%.

Only 15% of India’s GDP is dedicated towards retirement planning

According to a retirement survey conducted by a leading fund house, Reliance Capital Asset Management, India’s per capita retirement assets as a percentage of GDP (Gross Domestic Product) is among the lowest when compared to other developed economies like USA, Brazil, and Germany.

While Brazil has 41% of retirement assets as a percentage of GDP, Germany has 21%, the USA has 78.9%; India has only about 15.1%.

Spending increases after retirement

While you may no longer spend too much on commuting, clothing, offspring’s’ education, you may end up spending more on traveling, pilgrimage trips, and/or may want to invest in fulfilling desires you earlier didn’t get a chance to fulfill. You cannot downgrade your lifestyle, especially if you are used to living a high-end lifestyle. The fact remains that spending remains more or less the same even after retirement.

Real-estate assets may not be enough to secure your future

In India, it is a well-known fact that most individuals invest heavily in real estate assuming that it will give good returns and act as a security in bad times and during retirement. However, it is important to note that real estate prices are stagnating, rental yields are low, and rentals are not growing beyond a point.

Generating a monthly rental income on a regular basis is harder than it sounds and rental income alone may not be adequate to manage all expenses and live through old age.

Jobs are not as secure as they once were

If you are an employee, it is important to know that over the last decade or so, things have drastically changed. More and more workplaces are letting go of older highly paid employees and replacing them with younger ones at a lower cost. Despite this environment, not many people have a plan in place to secure their financial future post-retirement. Investing in pension plans such as the National Pension Scheme (NPS) is a must right from the early stages of your career.

Inflation is eating up into your savings

Retirement can be a long phase in your life and may last several decades. Inflation is bound to ruthlessly cut down the value of your savings. Your savings must earn you enough; else you will run out of money in no time.

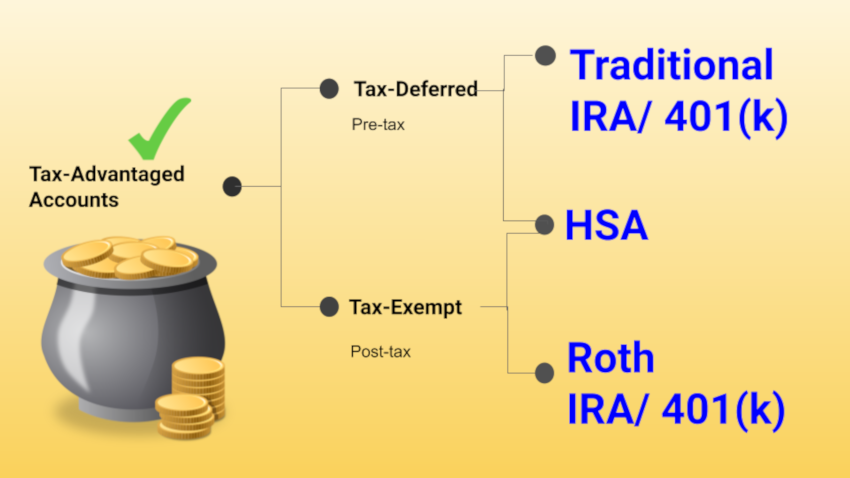

You will still be paying taxes

While your income tax liability will come down drastically after retirement, you will still be paying taxes on rental income and capital gains.

Healthcare expenses are skyrocketing

In between 2004 and 2014, average health care expenses increased by an astonishing 176%. It goes without saying you will be spending a sizeable amount of your savings to take care of your health during your retirement years.

Working years have reduced and retirement years have increased

Since more and more people are going for their higher education, they do not start earning before they are 25. Many of them also retire early as they are unable to cope up with intense work pressure. This leaves them with very few years to earn enough money that can help secure their financial future.

Absence of a social security structure

Developed economies have a social security structure. In India, individuals do not have the liberty to depend on anyone else but themselves to fund their retirement.

Consider investing in pension plans and other financial instruments that provide adequate financial security and stability during old age when you do not have a regular source of income to bank on.