It will be interesting to see what happens with Social Security. Far too many people rely on it for their only source of retirement savings, so I’m bullish on it never going away. Plan as if it won’t be there, and there should be a nice little chunk waiting for you at age 62 that is basically a bonus.

The Anatomy of an American Paycheck

- By : Menard

- Category : Income, Retirement, Taxes

My first-ever paycheck on American soil was for $6,000. Coming from a third-world country, I thought I was rich! My boss then had me working before I got my work permit, so it was for three-months worth of work.

Like many twenty-something male consumers, I went into an expensive tech gadget shopping spree. I later learned, to my dismay, that I have to pay the IRS a big chunk back— my employer didn’t withhold sufficient taxes!

That was 23 years ago when I was financially naive and stupid. I know much better now. Today I’m sharing information no other PF blogger will dare to share— my paycheck.

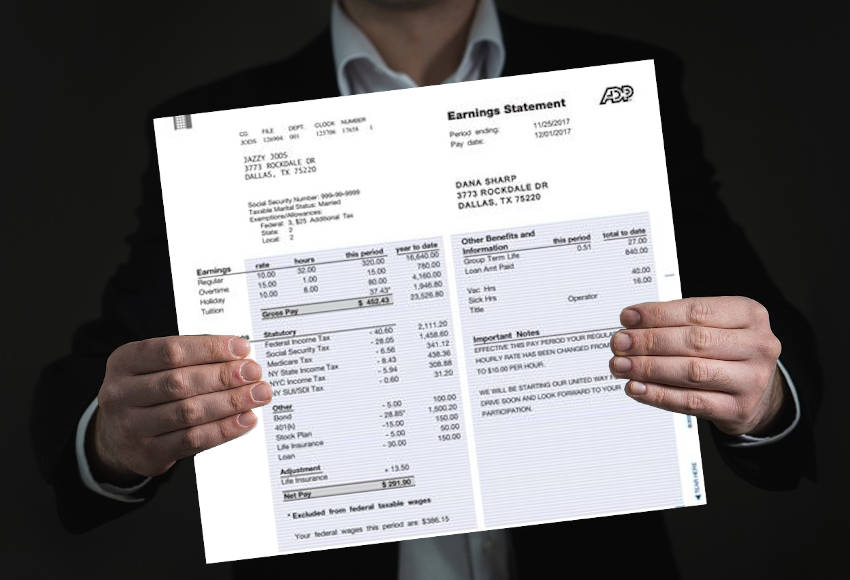

That’s gross! You only pocket the difference.

As a salaried employee (as opposed to hourly), I get paid a flat $120,000 per year or $10,000 per month before bonuses. Isn’t that a nice round monthly number to start with?

However, unless you’re from Canada, you might be shocked to see that what goes into my pocket is only $6,161.54— almost the same amount as my first paycheck, ugh!

Thanks to the deductions…

Deduction #1: Taxes (-$1,863.48)

Death and Taxes are life’s two certainties, but at least Death gets to you only once. With Taxes, you get hit several times at many different levels.

Federal Income Tax

The U.S. federal government applies a progressive system for all taxpayers, depending on your tax bracket. That means different portions of your income are taxed at different marginal rates.

A single lady earning $100,000 who doesn’t contribute to a 401(k) can easily fall into the 24% tax bracket. But that doesn’t mean she pays $24,000 in taxes.

| Tax Rate | Taxable Income (Single) | Taxable Income (Married filing jointly) |

|---|---|---|

| 10% | Up to $9,700 | Up to $19,400 |

| 12% | $9,701 to $39,475 | $19,401 to $78,950 |

| 22% | $39,476 to $84,200 | $78,951 to $168,400 |

| 24% | $84,201 to $160,725 | $168,401 to $321,450 |

| 32% | $160,726 to $204,100 | $321,451 to $408,200 |

| 35% | $204,101 to $510,300 | $408,201 to $612,350 |

| 37% | Over $510,300 | Over $612,350 |

From the first two columns, you can see how she pays 10% on the first $9,700 of her income ($970) and 12% on the next range of income (i.e. $39,475 – $9,701 = $29,774 x 12% = $3,573), and so on.

Below you’ll see I’m paying $725.09 per paycheck, which is probably less than what I owed— I won’t get a refund next year. That’s because I don’t want to loan the IRS free money.

You can adjust your employer’s withholding by filling in the number of allowances on a W-4 form. The smaller the number, the bigger the withholding, the more likely you will not owe taxes.

State Income Tax

State rules vary widely. Most states have progressive tax rates similar to the federal level. The amount deducted is based on how you filled your state’s W-4 withholding.

But if you’re lucky to live in Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming, you pay no state income tax at all.

My state, Pennsylvania, levies a flat tax rate of 3.07 percent regardless of income level. Ten other states offer a flat tax rate: Colorado, Illinois, Indiana, Kentucky, Massachusetts, Michigan, New Hampshire, North Carolina, Tennessee, and Utah.

Municipal Income Tax

Also, your municipality may impose a local Earned Income Tax (EIT) and Local Services Tax (LST). Like many people, I pay 1% of my earnings to my municipality.

Of course, the terms vary widely between cities, counties, and districts. And many will impose additional taxes depending on the services they provide.

FICA Taxes: Social Security and Medicare

Regularly employed people like me pay FICA taxes. It stands for Federal Insurance Contributions Act, deducted on every paycheck based on your gross wages:

According to the Social Security website, you can think about FICA like this…

“Today’s workers help pay for current retirees’ and other beneficiaries’ benefits. Any unused money goes to the Social Security trust funds to help secure today and tomorrow for you and your family.”

But it’s really the federal government’s way of saying…

“I need your money today. I don’t think you’ll save money to take care of your butt in old age anyway. Let’s hope the future generation could pay for yours.”

Some like to label Social Security as a giant Ponzi scheme. I view it as forced savings at a mediocre return on investment— I honestly think I can invest the money much better than the government can.

But no matter how you view it, Social Security is more than a retirement program. It doubles as life insurance. When you die, your widow, children, or dependent parents could receive benefits, for example.

Medicare, on the other hand, is health insurance for older people (65 years and above). There are exceptions. Like when you have disabilities or renal disease. But trust me, you don’t want to qualify for Medicare, prematurely.

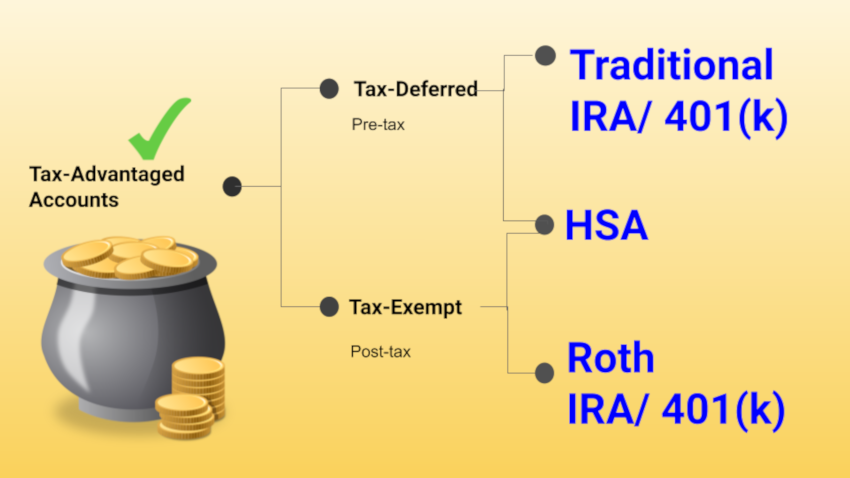

Deduction #2: Benefits (-$374.98)

In addition to a high deductible plan for medical, dental, and vision coverage; I’m making the most out of my benefits by voluntarily contributing to a Health Savings Account (HSA) to fund my present and future healthcare expenses.

HSAs are savings on steroids: it’s both tax-deferred and tax-exempt. Your money is not taxed on the way in, and on the way out— it’s tax-free as long as you use it for qualified medical expenses like health insurance premiums, prescription medications, and contact lenses.

A little-known feature is that you’re allowed to pull out and reimburse yourself for past eligible expenses AT ANY TIME— as long as you keep the receipts.

So, my strategy is to make that money compound as long as possible by investing in Vanguard stock funds!

Deduction #3: Retirement (-$1,600)

Being married and filing jointly, we fall under the 22% tax bracket even with my wife’s income. That’s mostly because we’re close to maxing out all our tax-deferred retirement plans.

I contribute $1,600 to my 401(k) per paycheck. This reduces my taxable income by $19,200 this year (the maximum contribution is $19,500 in 2020). The money will be taxed when I take distributions in retirement, hopefully, at a lower rate.

I may have listed this third, but any tax-deferred contribution means you’re paying yourself first ahead of the taxman!

Other important points

Deduction #1 (federal, state, municipal income taxes, and FICA) are all statutory deductions. Your employer is required by law to withhold the amounts. In contrast, Deductions #2 and #3 are completely voluntary. I’m making these deductions because of the awesome tax-advantaged savings that I get in the long run.

Paycheck deductions are a good thing, after all. I may have ended up with much lower net pay, but it’s comforting to know that most of the deductions will substantially benefit myself and my family in the future.

If only more people paid attention to their paychecks than credit limits, maybe people would spend less than they can afford, and use deductions to invest efficiently.

We would have less poverty, homelessness, divorce, and more happy millionaires who don’t stress about money.