Here I am in my early thirties just about to jump into our first mortgage! Hehe.. if you’re in a really good financial position as to be able to pay it off early, I don’t see why not. Other than the money considerations, I will personally choose prepayment for the emotional and mental freedom from thinking about having debts to pay. Such a load off my mind!

Why I’m Paying Off My Mortgage Early, Maybe You Should Too

- By : Menard

- Category : Retirement

Paying down your mortgage when you have an ultra-low interest rate is unpopular among many investing geniuses because the stock market has historically returned around 12%. The typical advice goes like this:

“Your 3% mortgage is cheap money. Put your money on investments that will make you more money!”

In general, that statement is true. For many years, I held off paying down our mortgage in favor of investing in the stock market for that same reason. The move has paid off due to the recent bull market.

Starting in 2018, however, I’ve switched to a different strategy— I’m now aggressively paying down our mortgage early. It will be completely paid off next year.

Maybe you should too. Read further to learn why.

I’m already heavily invested in the stock market

I don’t consider my house as an investment. For me, it’s just a place to live. But you can’t ignore the value a tangible real-estate property can have in your portfolio:

- Its value generally appreciates, sometimes dramatically.

- Its value is not tied in any way to the direction of the stock market.

- Locking your housing costs is a great hedge against inflation.

Nobody knows where the stock market is headed in the short term. But with the stock market close to an all-time high, it’s always smart not to put all your eggs in one basket.

By directing additional money towards the mortgage principal, you are essentially diversifying away from the everyday fluctuations of the market.

It will significantly increase our cash flow

Like many households, housing is our biggest monthly expense. Completely paying off our mortgage will significantly lower our total expenses.

To illustrate, consider my estimated household expenses below:

- Mortgage, $3,000

- Property Taxes, $700

- Groceries, $1,000

- Travel/ Entertainment, $500

- Transportation, $500

- Utilities, $350

- Communications, $200

- Insurance, $150

- Miscellaneous, $300

Isn’t paying a $3,000 monthly bill sounds painful to you?

Without the burden of a $3,000 monthly mortgage payments, our yearly expenses will go down from $84,000 to $48,000 a year.

That’s a 40% reduction in monthly expenses— $3,000 that I can redirect towards investing or maybe the kids’ college!

Note that my actual mortgage is around $1,500. But I’m adding $1,500 payment towards the principal.

No mortgage payments mean lower taxes in retirement

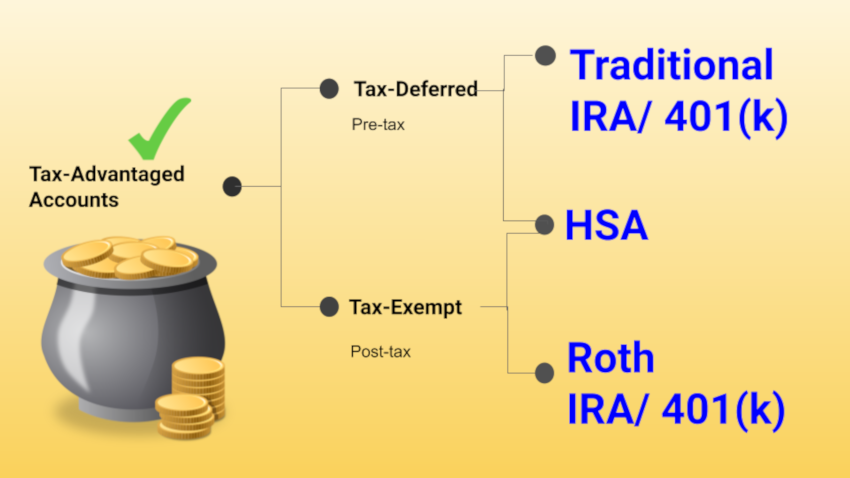

For individuals, most taxes fall under (1) Ordinary Income or (2) Capital Gains. If you earn an income, it will be taxed as ordinary income. If you have an investment that goes up in value and you sell it, the profit will be taxed as a capital gain.

1. Lower ordinary income taxes

Retirement distributions from a 401K, Social Security, and pensions are taxed as ordinary income.

Without a mortgage means, I don’t need to draw down as much from our savings— we can live below $50K a year. This results in lower income taxes in retirement because we’ll end up in the lower 12% tax bracket (see third column below), which is under $78,951 for married couples.

2019 Tax Brackets for Single/Married Filing Jointly

| Tax Rate | Taxable Income (Single) | Taxable Income (Married filing jointly) |

|---|---|---|

| 10% | Up to $9,700 | Up to $19,400 |

| 12% | $9,701 to $39,475 | $19,401 to $78,950 |

| 22% | $39,476 to $84,200 | $78,951 to $168,400 |

| 24% | $84,201 to $160,725 | $168,401 to $321,450 |

| 32% | $160,726 to $204,100 | $321,451 to $408,200 |

| 35% | $204,101 to $510,300 | $408,201 to $612,350 |

| 37% | Over $510,300 | Over $612,350 |

Lowering my income from $84,000 to $48,000 results to over 50% reduction in taxes!

2. No long-term capital gains tax when I sell my stocks

It gets even better if you own stocks that have appreciated as I do. Our long-term capital gains tax is likely 0%. You heard that right— zero!

Generally, if you hold the asset for more than one year before you sell, your capital gain or loss is long-term.

2019 Long-term Capital Gain Tax Rates for Single/Married Filing Jointly

| Tax Rate | Taxable Income (Single) | Taxable Income (Married filing jointly) |

|---|---|---|

| 0% | $0 to $39,375 | $0 to $78,750 |

| 15% | $39,376 to $434,550 | $78,751 to $488,850 |

| 20% | $434,551 or more | $488,851 or more |

Having a “low income” means that I can sell my stocks in retirement tax-free!

Since capital gains will not cause your ordinary income to be taxed at a higher rate, I’d still be in the same tax bracket the next year that I file!

Related: What If You Didn’t Have to Pay Taxes

The mortgage deduction is a myth

Don’t believe the lies that keeping the mortgage is worth it because of the itemized tax deduction either. With the 2017 Trump Tax-Cut Bill doubling the standard deduction— to $24,000 for a married couple filing jointly— it’s unlikely that you will itemize.

Even if you can itemize, keeping a mortgage for the sake of the tax deduction is stupid.

Consider the following example:

Let’s say you have a $200,000 mortgage and your interest rate is 5%. That means you can deduct the $10,000 in interest you send to the bank if you itemize. A $10,000 tax deduction on a $100,000 annual salary means you’re only going to be taxed for $90,000 portion of your income.

Assuming you’re single, you’ll be on the 24% tax bracket. If you paid off your mortgage, you no longer have that deduction— you have to pay the IRS twenty-four percent of that $10,000 or $2,400.

But guess what? You’re no longer sending $10,000 in interest payments to the bank! Don’t trade your dollars for pennies.

Related: Homeownership: Don’t Let Your American Dream Become a Nightmare

Final thoughts

I’ve outlined some quantifiable reasons why I’m now prepaying our mortgage— a paid-off house in retirement has many benefits that go beyond psychological. I’m sure it feels good to achieve that milestone. But don’t prepay only because “the grass will feel greener” when you step outside.

Don’t believe some investing geniuses who will try and convince you not to prepay your house either. Chances are, these people are the types who’d extend their mortgages to borrow for a swimming pool!

In the end, paying off your mortgage ahead of time is a personal financial decision. Do what makes sense for you.

Update 2/1/2020: I’ve paid off our mortgage, thanks to the coronavirus pandemic.