End of the Year Question: What is Your Retirement Number?

- By : Menard

- Category : Retirement

If I were to pay you to quit your job, how much would it be? Is it $1 million, $3 million, or nowhere near these numbers? Many think you can no longer retire with $1 million because of inflation. This may or may not be true depending on your spending goals, income, and longevity.

The problem is many aspiring retirees think of their number as a goalpost without sufficient planning. As a result, they either don’t achieve their goals or over-save — unnecessarily delaying retirement. When you don’t feel like you have enough, no amount of money will give you the peace of mind you are searching for.

The end-of-the-year bull market has me thinking, “Am I over-saving for retirement?” I’ve thought of it long and hard and came up with our “enough” number: $2,500,000.

Let me explain why.

What the averages tell you

According to the U.S. Bureau of Labor Statistics, the average retiree household spends around $50,000 a year in living expenses in 2021. And the average social security check is roughly $1,700 according to the Social Security Administration. That’s $3,400 for a couple or around $40,000 per year.

That means that on average, people would only need to draw down $10,000 from their retirement nest egg to bridge the gap. With the 4% rule, you can safely withdraw that amount yearly from a $250,000 portfolio invested in 50-50 stocks and bonds mix without running out of money in 30 years.

With social security, an average retiree will only need 1/4th of a million dollars to support their needs.

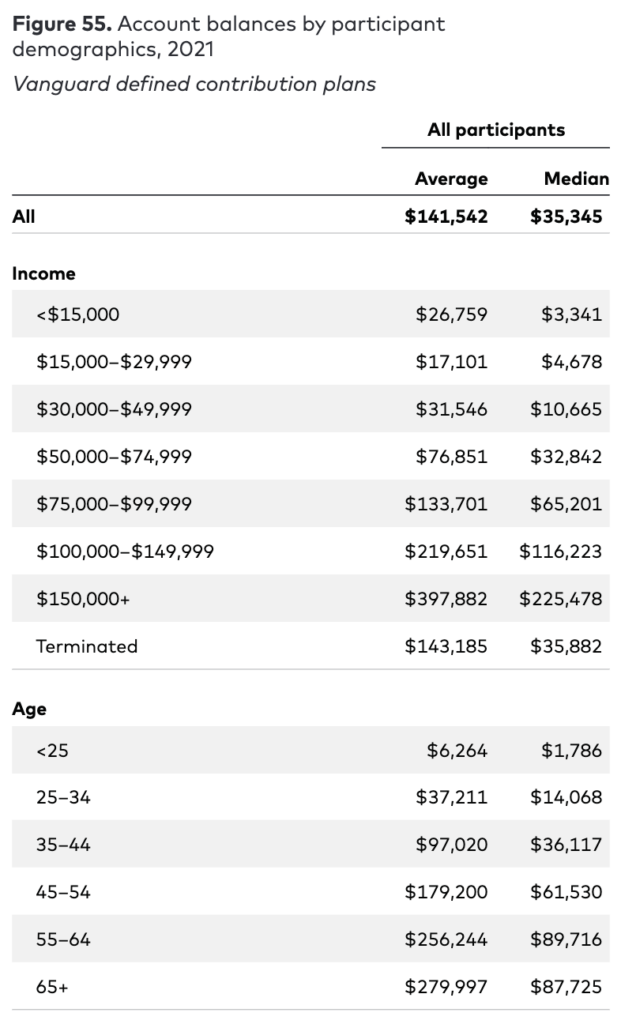

In fact, according to Vanguard, the average retirement balance for people in the 55-64 range is $256,244. However, this figure is a mathematical average number, it’s skewed upward by a few outliers. The median number is only $89,716.

The sad truth is most retirees won’t have enough money to last 30 years.

How I came up with the $2,500,000 number

As an aspiring early retiree, we expect to retire at age 55 with a portfolio 10x as much as the average number. But not to satisfy my ego, but to face reality— Social Security and Medicare are still several years away when we retire.

Having religiously tracked our household expenses for the past ten years, I can state with a high level of confidence that the following spending budget in retirement will work for us:

- $50,000 for essential expenses (food, clothing, utilities, insurance, etc.)

- $20,000 for discretionary expenses (travel, entertainment, gifts, etc.)

- $15,000 for health care (ACA premiums and deductibles, family of four)

- $15,000 for federal and state taxes

The above totals $100,000, which is a VERY NICE round number to spend during retirement; especially since the house is paid for, and the kids’ college is fully funded. Not to mention, you don’t need to save for retirement when you’re retired.

Again, using the 4% rule, divide $100,000 by .04 to arrive at $2,500,000 number.

But hey, “You’re retiring early. Isn’t the 4% rule meant for retirements with a 30-year duration?” you might ask.

That’s when social security and my wife’s pension will come into the picture. Besides, spending patterns in retirement are rarely constant. Retirees tend to spend more when they’re younger before gradually reducing spending as they age.

Back-testing our number using FIRECalc

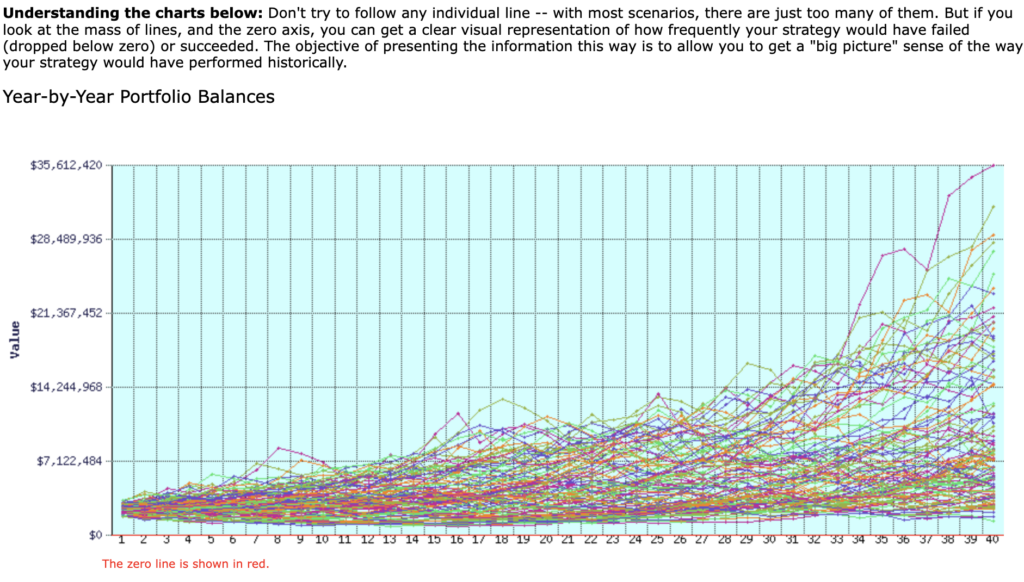

One popular tool to test your assumptions is FIRECalc, which can back-test your retirement plan against historical returns as far back as 1872!

In our case, the tool looked at the 113 possible 40-year periods in the available data, starting with a portfolio of $2,500,000 and spending $100,000 adjusted for inflation each year after that.

Here is how a portfolio of 75-25 mix of stocks and bonds would have fared in each of the 113 cycles. The lowest and highest portfolio balance at the end of your retirement was $1,267,522 to $35,447,197, with an average at the end of $9,837,606 (today’s dollars).

Failure means the portfolio was depleted before the end of the 40 years. FIRECalc found that 0 cycles failed, for a success rate of 100%.

Without our expected social security income data and my wife’s small pension, the success rate went down to 85.8%— not bad considering I’ve overstated our expenses.

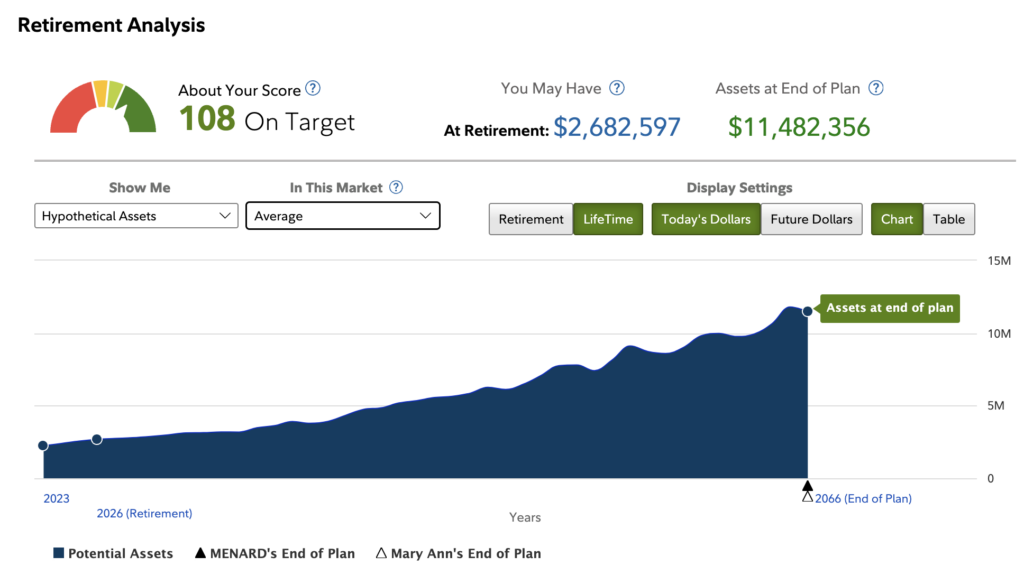

Perform a Monte Carlo simulation

Alternatively, you can use a tool that can perform Monte Carlo simulations to project a range of hypothetical market return scenarios. The simulations are based on a historical performance analysis of asset class returns instead of actual investments.

One such tool is Fidelity’s retirement planner. Being my retirement provider, it already knows our numbers:

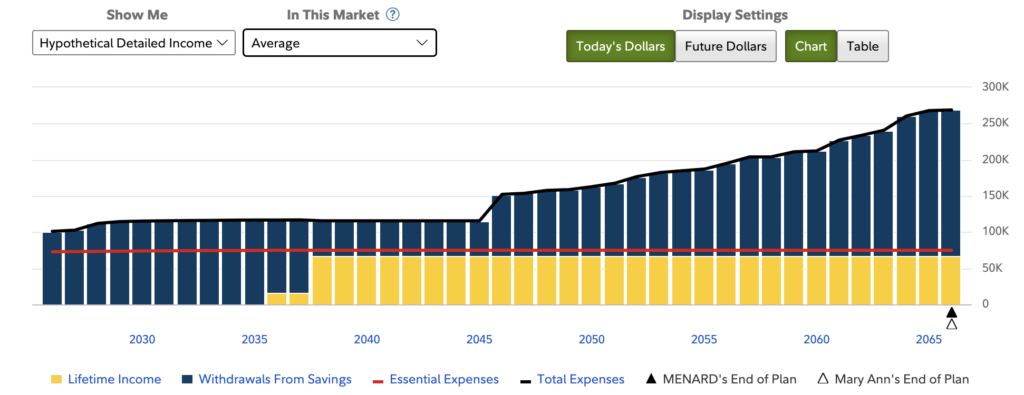

The same tool can also show your hypothetical income in detail (yellow represents social security and pension):

Final thoughts

When to retire is such a big decision you need to measure twice and cut once. There are many tools out there that can help you figure out your target number; I’ve only featured two. Play with the numbers (market returns, inflation, longevity, etc.) objectively to get realistic expectations.

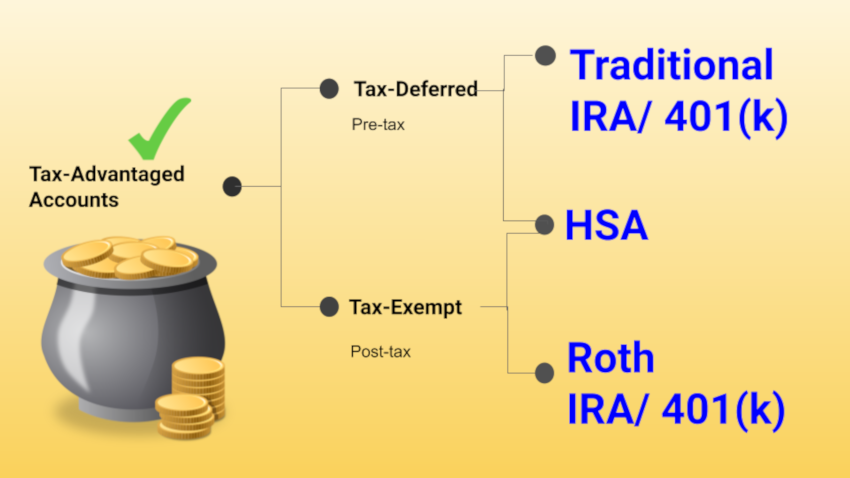

Retirement is not an age; it’s a financial number. You can draw down from your 401K or IRA at 59 1/2 without penalties, but if your nest egg has nothing to begin with— you simply can’t.

I wish you all a prosperous year ahead!

No Comments