What Turning 50 Means to Your Finances

- By : Menard

- Category : Retirement

If you’re wondering why you haven’t seen a new post in weeks, it’s because I was extremely busy. For starters, I’ve built a mini-basketball court in my backyard, moving 20 tons of gravel using a wheelbarrow in the process. My employer also demanded that we start working in the office, which took some of my free time.

I also turned 50 last month– the Big Five-O! It is flattering people continue to tell me I could pass as a 30-year-old. That’s one advantage of being Asian. The disadvantage is we’re always the butt of “small hand” jokes, which I can easily dispute, lmao.

To celebrate, we had a small party at my house, inviting our closest friends who are fully vaccinated. Still, a few unvaccinated friends-of-friends came and joined the fun. It is typical in Filipino parties not to RSVP. Fortunately, none of them got sick. In retrospect, I felt guilty hosting a party when the pandemic is still going on.

Financial perks of a teenager

You see, it has been decades since I had a birthday party. The last time was in 1987 when I turned 16. I asked my mom for money to buy two cases of beer— 48 bottles of San Miguel beer— to impress a bunch of new friends I barely knew in my freshmen year in college. Surprisingly, she gave me the money. No questions asked.

The party went on, without adult supervision, until the wee hours of the night. As you might expect, I threw up many times in the bathroom that night. I woke up that morning with a bad hangover, only to discover the place had been trashed, the smell of weed surrounded the place, and a few valuable items missing at my father’s law office— where I had my party. In short, I was in BIG trouble!

All trouble aside, that’s one of the financial perks of being a teenager. Your parents are still there to support you, no matter what. They loosen their grasp on your life and finally let you make the decision on your own. Sometimes, even if it’s not the right one. Hopefully, it could teach you a lesson.

I’ve learned mine— it was the last time I got drunk.

No such perk as an adult

Many grown-ups in their ’20s, ’30s, ’40s, and beyond will make the same mistake I did, albeit at a much bigger scale. And you don’t even need to get hooked on alcohol or other recreational drugs to get into trouble. Just open a line of credit and spend two, three, or four times more on everything (housing, cars, clothes, gears, and vacations) to impress people you barely know.

Then, all it takes is a zero support system, minuscule savings, and a job layoff. You’ll end up without a roof above your head, 100% guaranteed.

Many years ago, a high school mate of mine, who came from a well-to-do family, sent an email message to everyone in my class asking for financial assistance. He ended with something like the following:

“It saddens me that I can’t provide for my children the same level of support as my parents did for me and my siblings.”

That email broke my heart. Life is less forgiving when you are an adult.

How much should you have saved by 50?

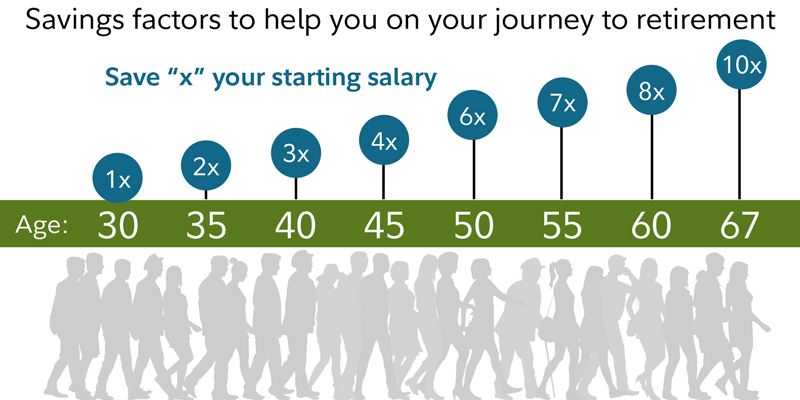

According to Fidelity, you should have saved at least six times your annual salary for retirement by the time you are 50.

Fidelity’s savings factor, however, are based on the assumption that a person saves 15% of their income annually beginning at age 25, invests more than 50% on average of their savings in stocks over their lifetime, retires at age 67.

So one must exceed Fidelity’s expectation if you want to retire early. Aim for 10 to 12 times annual salary by the time your reach 50. I’ve got nine times saved. I’d like you to aim higher.

What about household net worth?

According to the Fed’s latest Survey of Consumer Finances, the median net worth of a household, headed by someone between 45 to 54, is $168,600. If you have that net worth, yours is greater than 50% of households your age in America.

But what that means is you’re way below the average. The same survey states that the mean net worth (i.e., mathematical average) is $833,200. The way the stock market behaved recently, the number could have exceeded one million dollars now. Thanks to men like Jeff Bezos and Elon Musk, who keep on skewing the number every time AMZN or TSLA stock reaches new highs.

You are better off aiming for a highly skewed number than being content with that low median number. Complacency is the enemy of success. Depending on income, someone who reads this blog should aim at least six times the median or twice the mean number by the time they turn 50. That’s a modest and reasonable goal. After all, the name of the blog is Millionaire Before 50.

See also: The Road to Riches Starts Here, Track Your Net Worth

What if you’re behind?

If you’re still in your 20s or 30s, the simple answer is to save more and invest in a diversified mix of stocks for maximum growth. If you’re over 40, the answer may be a combination of reduced spending, increased savings, and working longer, if possible.

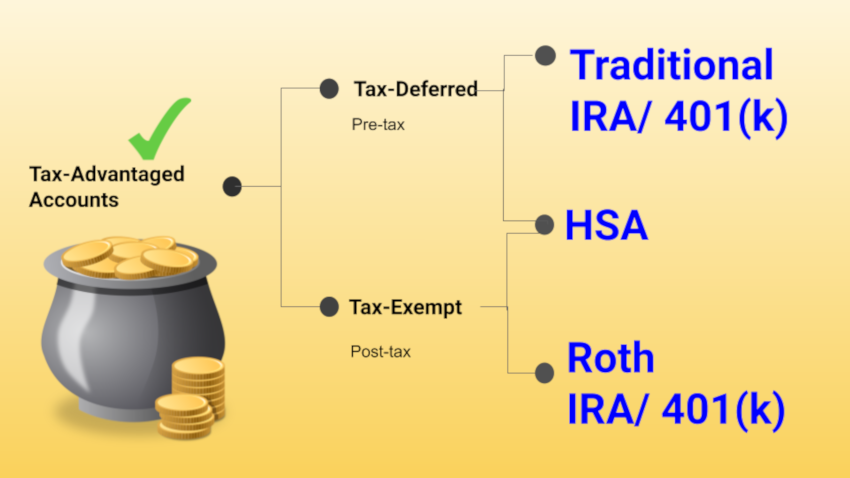

Don’t be discouraged if you’re not at your nearest milestone. There are ways to catch up. I’ve been maximizing my IRS catch-up contributions, for example, even if we’re way ahead of the game. Individuals who are 50 or over at the end of the calendar year can make annual catch-up contributions.

Remember, everyone’s situation in retirement is different. Having a paid-off house or a pension, for example, means your investments need not generate as much income.

The key is to take immediate action.

No Comments