Traditional vs Roth 401K: Understanding How They are Different

One thing that can significantly affect your long-term and retirement savings is the type of employer-sponsored retirement plan you choose. While traditional 401(k) plans and Roth 401(k) sound similar, there are some major differences between the two accounts.

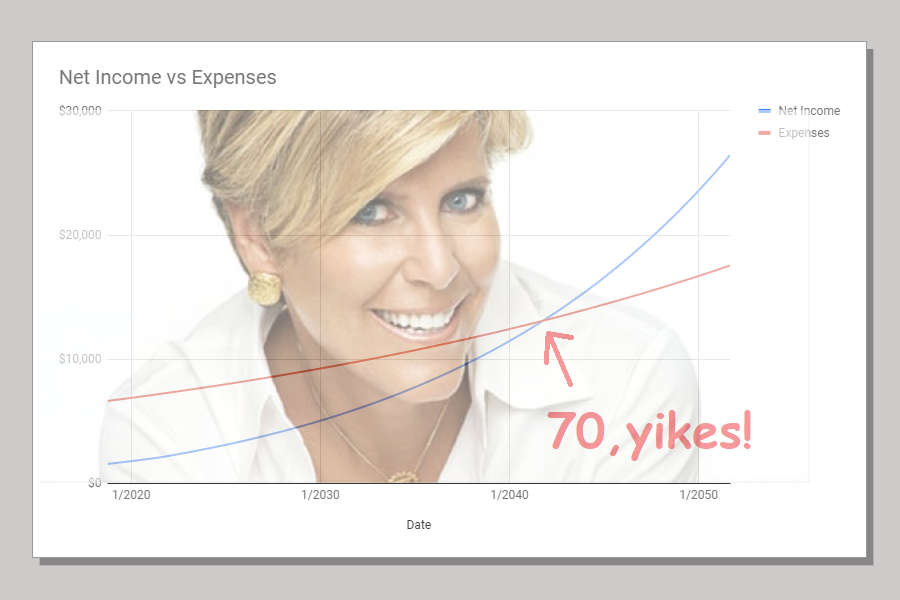

Suze Orman Could be Right, This Calculator Can Tell You Why

If you’ve been following my posts, you probably know by now that this is not a FIRE (Financially Independent, Retire Early) blog. For one thing, I’m already in my forties when I wrote my first post. There’s no way I could retire in my 30’s without sneaking into my sister’s time …

12 Jaw-Dropping Stats About Retirement

Below is a guest post from Archana Singh, a finance blogger from the Mystic Land of India. Archana works for one of the leading insurance and web aggregator in the country. Even if you don’t live there, you’ll quickly learn that retirement challenges are fundamentally the same; circumstances could devour …

9 Signs You Probably Won’t Need a Retirement Nest Egg

It’s a fact, people in developed countries are living longer. For instance, life expectancy for women is predicted to surpass 90 years in South Korea by 2030, according to the study published in The Lancet, one of the world’s oldest and most respected medical journals. Of course, the study assumes …

FIRE, FART, or Neither, the Choice is Yours

When it comes to your finances, there are two extremes to model yourself on, FIRE or FART (acronyms below) — that is if you want to be an extremist. The third option is neither, and that’s completely fine. The choice to quit the rat race at either 35 or 95 is completely your own …

400 Weeks

Coming up with a successful pre-retirement strategy involves detailed planning. For starters, you need to list down some goals. For us, the ultimate financial goal is to retire comfortably by age 60, which is 800 freaking weeks from now! This obviously is NOT a FIRE (Financially Independent, Retire in your …

Recent Posts

Recent Comments

- on The VIX Index: How to Get a Little Richer by “Timing the Market”

- on From Diapers to Diplomas: Tips on How to Fully Fund College Using 529s

- on From Diapers to Diplomas: Tips on How to Fully Fund College Using 529s

- on Why I’m Saving More in a Taxable Brokerage Account, Maybe You Should Too

- on Why I’m Saving More in a Taxable Brokerage Account, Maybe You Should Too

Categories

- About me3

- American dream10

- Asset allocation1

- Blogging4

- Books8

- Budgeting2

- Career6

- Credit4

- Financial Planning25

- Fitness1

- Fraud2

- Giving1

- Guest Post2

- Happiness3

- Health2

- Income2

- Insurance4

- Investing32

- Lifestyle21

- Motivation7

- Relationships20

- Retirement16

- Romance2

- Saving for college5

- Saving ideas11

- Side Hustle3

- Speculation4

- Spending11

- Taxes3

- Vacation3