Most people are good with 3% to 4% assuming they have a decent amount in their 401k plan.

The 4% Rule is Not for Everyone, Use this Calculator Instead

- By : Menard

- Category : Retirement

The first time I heard about “safe withdrawal,” I thought it was a family planning method. I was like, “I’m an expert!” Well, it turns out it’s for a different kind of planning— your retirement.

Specifically, it answers the question, “How much can I safely withdraw from my retirement accounts?” In turn, this helps you figure out how much you should save for retirement.

The rule states that you can only withdraw 4% or 1/25th of your retirement assets in the first year, and adjust for inflation thereafter. This implies you should continue to build your nest egg until it’s at least 25 times your annual expenses— if you want to become FI.

Given an average inflation rate of 2.5%, for a $1,000,000 portfolio, withdrawals should look like this:

Before the 4% rule, financial planners the client often get into trouble

Since stocks and intermediate-term Treasuries had returned, on average, roughly 10 and 5 percent, respectively. You could expect a nominal return of 7.5 for a portfolio consisting of 50-50 each. The expected “real” return is 5%.

Hence, a financial planner can recommend a 5% “safe” withdrawal rate for his client, right?

WRONG!

Using the averages is exactly how a financial planner can ruin a millionaire’s retirement.

If strictly followed, our hypothetical client would end up scraping rice and beans for dinner starting at year 19. Either that or dig a hole deep enough to reach China if he’s unlucky enough to outlive his money.

The origins of the 4% Rule

In 1994, Financial planner William Bengen wanted to establish a safe withdrawal rate or SWR that would give retirees confidence they wouldn’t outlive their savings.

Through his research, he found out that 4% is the maximum sustainable initial withdrawal rate in multiple 30-year retirement periods without running out of money. To get to the figure, he tested a variety of numbers against hypothetical retirements beginning in 51 different years, from 1926 to 1976. This period includes the Great Depression and the 1973 Oil Crisis. The latter, he considered more damaging because of high inflation.

That was a breakthrough finding. Finally, financial planners can recommend a figure based on what actually has happened, year-by-year, to investment returns and inflation in the past instead of relying on averages.

Four years later, three professors, as smart as Bengen, came up with the Trinity Study, which expanded on SWR. Instead of Bengen’s assumption of 50-50 stock and bond allocation, it explored different asset-allocation combinations:

If you look closely above, portfolio success rates for bond-dominated portfolios decline sharply for SWR of 8% or greater. Abandoning stocks in retirement is, therefore, a good way to outlive your money.

Furthermore, notice that 4% is sustainable regardless of the chosen asset allocation. This strongly reinforces Bengen’s original SWR figure.

Controversies surrounding the 4% rule

Bengen and the Trinity study have been criticized by pundits at Stanford for recommending an economically inefficient withdrawal strategy. They argue, “Retirees accumulate unspent surpluses when markets outperform and face spending shortfalls when markets underperform.”

On the contrary, spending patterns in retirement often follow a U-shape pattern: Retirees spend more when they’re younger before gradually reducing spending as they age; spending sharply increases as healthcare costs spike in old age.

Many dismiss the rule altogether as outdated. In an interview with Morning Star, retirement researcher Wade Pfau discussed in detail why the 4% rule is broken in today’s low-interest and high-valuation environment. Pfau suggested lowering the SWR to 3%.

In a 2017 Reddit post, Bengen himself stated it’s outdated— it’s too conservative! He wrote, “The 4% rule is actually the 4.5% rule– I modified it some years ago on the basis of new research.”

Bengen added, “I find that the state of the economy had little bearing on safe withdrawal rates. Two things count: if you encounter a major bear market early in retirement, and/or if you experience high inflation during retirement. Both factors drive the safe withdrawal rate down.”

So, what’s the tried and tested SWR? Is it 3, 4, or 4.5??

The truth of the matter is the 4% Rule is not for everyone— It’s only a rule of thumb!

Someone retiring early, I meant REALLY EARLY, like in their thirties, for example, would need a sub 3% SWR to ensure a nest egg that would last 50 or 60 years.

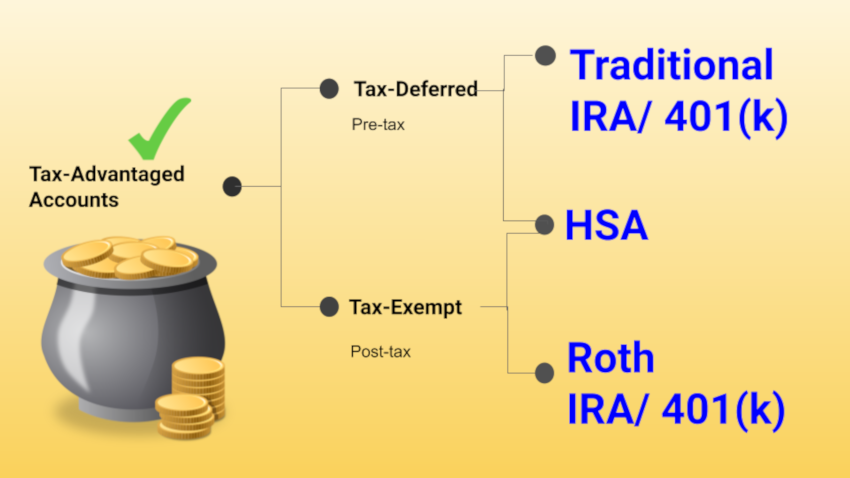

Besides age and longevity, portfolio asset-allocation also comes into play.

So, a risk-averse retiree whose 100% into risk-free Treasury bonds may need a 1% or lower SWR, considering today’s extremely low bond yields— the 10-year Treasury rate is only 1.59% as of this writing.

Lastly, like Bengen stated, the timing matters. The Shiller CAPE ratio tells you how undervalued/ overvalued the market is when you retire. And this helps you adjust your SWR.

Here’s an incredibly useful SWR calculator

Fortunately, I came across this incredibly useful SWR tool that lets you enter the right parameters to calculate the results that fit your requirements.

All you have to do is to enter your numbers. If desired, you can also specify taxes and fees to artificially lower the success rates.

Example #1: Successful 4% SWR for a 65 yo retiree with $1M nest egg.

Example #2: Same retiree paying a hefty 2% investment fees… Fail!

I hope this helps you successfully plan your retirement.