Looks very inviting. Definitely a proper place for retirement with a pension. U.S. dollars go far there. Dam.

Why Work ‘Til You Drop When You Can Retire Early in the Philippines?

- By : Menard

- Category : Retirement, Spending

For many Americans, retiring early in the USA is a lost dream. Sure, staying within your comfort zone has certain advantages: established social connections, proximity to family and friends, and the local culture. But the cost of living— with rising housing, taxes, and healthcare costs— could potentially deplete your retirement income.

The problem is Medicare, the federal health insurance, typically kicks in only after you turn 65. Until then, you’re on your own to get one from the private sector. The average cost of health insurance where I live is $498 and could be as high as $800 in states like New York or West Virginia. That’s $1,600 for a couple!

What if I tell you that you can live comfortably in my beloved Philippines, home to many spectacular beaches and rainforests in Southeast Asia, for the same amount or less? And that includes ALL your living expenses!

My plan B is to retire in the Philippines. Let me tell you why.

Three weeks, four tourists, and five hotels

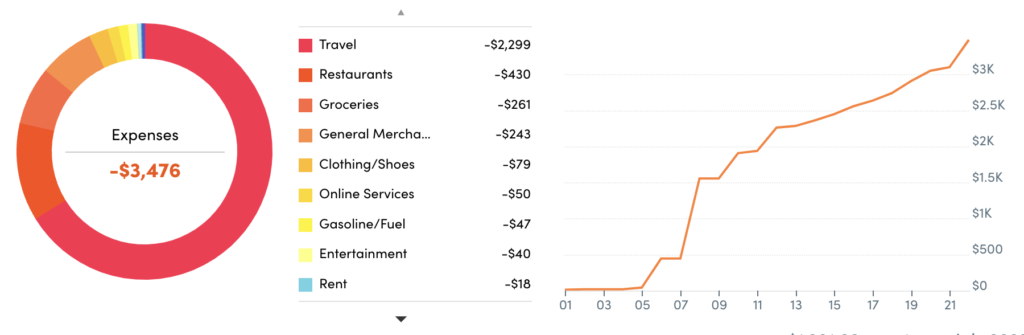

We recently came back from a three-week vacation in the Philippines. Besides visiting extended family, we went to see major tourist attractions, ate in fancy restaurants, and had our laundry done professionally.

The four of us stayed in five different hotels for the duration of the trip. And since my kids are older, we had to get a two-bedroom suite for a little privacy, which made our trip a bit more expensive.

Yet, not including airfare, we still managed to spend less than $3,500!

A similar trip to Europe would have easily set you back three times as much.

The monthly cost of living for an American expatriate

Of course, if you were to live in the Philippines permanently, your living expenses would be much cheaper. You won’t be spending like you’re on vacation.

Here are some numbers from Numbeo:

- Estimated monthly costs for a family of four, $1,589 (without rent)

- Estimated monthly costs for a single person, $460 (without rent)

- Rent for a one-bedroom apartment, $180 to $320

- Utilities (heating, electricity, gas …), $90

- Internet 60 Mbps, $36

Other typical expenses:

- Men’s haircut, $4

- Laundry services (including folding of clothes), $5

- Taxi ride (4 miles), $3

- Bottle of local beer, $1

The best way to stretch out your retirement savings is to embrace the local lifestyle. If you live like a Filipino, you’ll be surprised to find even cheaper options than I have presented here.

Healthcare in the Philippines

You wouldn’t want to retire in the Philippines if you have a chronic condition. But if you live in a major city like Manila, you should have easy access to healthcare that’s astronomically cheaper compared to the US.

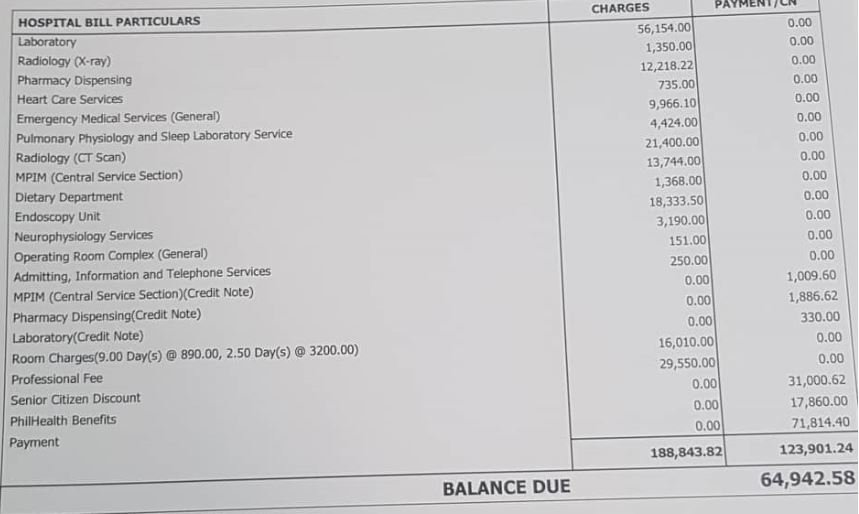

Case in point, here’s my 93yo father’s hospital bill (Philippine pesos) in 2019 after being confined for TWO WEEKS in a semi-private room:

It could be more expensive now, but even then, that’s only $2,400 in US dollars. It would have been $3,600 if he didn’t have insurance— still very cheap. Who says you can’t live a long life in the Philippines??

In contrast, the average insured OVERNIGHT hospital stay cost in America in 2022 is $11,700— that’s per day— ridiculously expensive!

Of course, this also depends on the hospital and the treatment being performed.

Besides the low cost, why should I pick the Philippines?

The Philippines is a tropical archipelago consisting of more than 7,000 islands. The sky is the limit if you’re the adventurer type. Forget Manila, you can find jaw-dropping scenery in Boracay, Palawan, Batangas, Pangasinan, Zambales, Siargao, Bohol, and more!

There are only two seasons: wet and dry. It’s not for everyone as it could be hot and humid in the summer. The bright side is you never have to wear a sweater or shovel snow. There are also no water shortages like what people in Southern California are experiencing now.

Being a former U.S. territory, English is widely spoken, and many have a neutral accent. If you ever called AT&T, Verizon, or Wells Fargo 1-800 numbers, chances are, you’ve interacted with a Filipino. If you’ve been to a non-English-speaking foreign country, you know how frustrating it is to ask for directions, let alone make friends. You won’t have this problem in the Philippines.

The government is making strides to make the country friendly to ex-pats. For starters, it won’t tax the income you receive from a pension, 401K, individual retirement account (IRA), or other types of retirement plan.

With a Special Resident Retiree’s Visa (SRRV), you can stay indefinitely in the country. You can also purchase a condo or townhouse. But you can’t buy land unless you’re married to a Filipino. You’d also be entitled to avail of PhilHealth insurance, which can provide substantial inpatient and outpatient benefits.

No wonder; the Philippines is home to 300,000 American ex-pats. With high inflation in the U.S., the number is expected to grow significantly.

But I don’t want to get kidnapped!

I’ll be honest. If you’ve never been to a third-world country before, it may be a bit of a culture shock to you— Metro Manila, in particular. Traffic could be terrifying. Lots of crazy drivers, security guards carrying guns, and beggars in the middle of the streets.

But you won’t run into any danger in Manila or Cebu that you won’t run into in New York or Philadelphia. There’s a lot of misinformation out there. You’re more likely to get shot in Philly, where a visiting Filipino lawyer recently got killed than to get kidnapped in the Philippines.

There are Muslim separatist groups, but they’re confined to the southernmost part of the country. But, even then, they have political agendas and have nothing to gain from kidnapping an American.

A more likely scenario is people trying to scam you because you’re a foreigner, the same way people in San Francisco attempted to scam me on my first day on American soil.

Just don’t make yourself a target and exercise common sense. You’ll be fine.