Dave Ramsey is Right. Pay Off that Stupid Debt Before Chasing that 401(k) Match

- By : Menard

- Category : Financial Planning

- Tags: 401K, Dave Ramsey

When it comes to paying off debt, there’s only one name that comes to mind: Dave Ramsey. For decades, he has taught millions of people through his podcast and radio show, a process for getting out of debt and building wealth, which he calls the “Baby Steps.” He has helped more people struggling with debt than anyone in America.

To many, that’s akin to Moses climbing atop Mount Sinai and proclaiming the Ten Commandments. “It’s God’s way of handling money,” according to Ramsey. Hence, many religiously follow his seven baby steps:

- Put $1,000 in a beginner emergency fund ($500 if your income is under $20,000 per year).

- Pay off all debt (except the mortgage) using the debt snowball.

- Put three to six months of expenses into savings as a full emergency fund.

- Invest 15 percent of your household income into Roth IRAs and pre-tax retirement plans.

- Begin college funding for your kids.

- Pay off your home early.

- Build wealth and give.

From the steps above, it is unequivocally clear: you’re not supposed to invest until you have paid off all your debt (except the house).

But what if your employer offers a generous company match? Many so-called “experts” will immediately make a blanket statement without making a thorough investigation.

How 401(k) matches work

When you contribute to a 401(k) or similar plan, very often, employers will match your contributions up to a certain percentage to encourage you to save.

For example, if your employer says they will match 50% of the first 6%— and your annual gross pay is $100K a year— you have to contribute at least $6,000 (6%) to get the full $3,000 (50%) match.

Whoa, sounds like a great deal— free money! No wonder, many experts cringe when you forego the match.

But let’s see how this generous match plays out using real-life numbers.

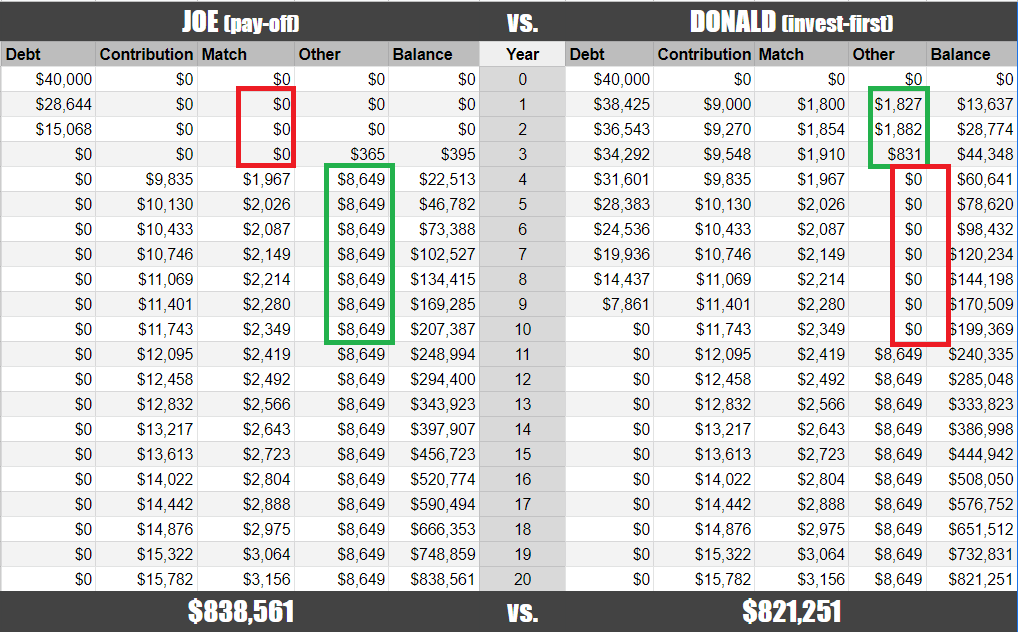

Tale of two broke friends

Joe and Donald are very close friends. Each has accumulated $40,000 in consumer debt at 18%— they have poor FICO scores. They start working for the same company at the same time with the same $60,000 starting salary and identical 401(k) benefits.

The good news is they both decide to change their old ways and start building wealth. They’re so close that whatever one does, the other follows suit.

But with one notable exception:

Joe wants to pay off his debt before investing 15% of his salary (baby steps 2 and 4) while Donald plans to contribute the same percentage of his salary to his 401(k) as soon as possible. $750 is the maximum they can both pay/ invest given their modest income and relatively high expenses (at least, until the debt is paid off).

Here are the details:

- Joe makes an additional $750 payment to the loan principal.

- Donald doesn’t but contributes the $750 (indexed to inflation) to his 401(k) instead to take advantage of the match.

- When the debt is paid off, either will channel the monthly payments to their respective investments.

- The company matches 50% of the first 6% of their salary— the most common company match.

The big assumptions:

- The stock market will return 8% compounded annually.

- Neither of them will lose their jobs in the next 20 years.

- Donald will invest the tax savings that he gets due to paying lower taxes (the contributions are tax-deductible) than Joe early on.

Fast forward 20 years, let’s see who came up ahead…

Why Joe came up ahead

There are three main reasons why Joe came up ahead despite Donald having a three-year head start contributing to his 401(k):

- Joe saved money in interest payments early on by pre-paying a stupid high-interest debt shortening the term to three years— seven years ahead of Donald.

- Having no monthly payments for seven years meant Joe could invest the same in the market when Donald couldn’t afford to save extra on top of his 401(k) contributions.

- Joe immediately took advantage of the match and tax savings as soon as the debt was paid off.

Scenarios when Donald wins

If you play with this awesome spreadsheet that I wrote, you’ll see that there are many scenarios when Donald could come up ahead of Joe:

- The interest rate is 15% or lower

- Term of the loan is seven years or shorter

- Stock market returned 11% or higher

- Contributions are higher than 15%

- The company match is 100% or higher (but who gives that?)

But then again, when Dave Ramsey tells you to pay off your debt, he doesn’t mean that you simply make additional principal payments. He expects you to work extra hours, eat rice and beans, and sell your car to get rid of the payments.

If Joe were really “gazelle intense,” he would have barely missed the company match!

Final thoughts

Taking advantage of the company match is wisdom that is overrated by many financial experts. People who struggle with high-interest debt are better off focusing their energy on paying it off than investing.

For these types of people, simplifying rather than optimizing is more effective. It’s the lack of discipline that placed them in that predicament in the first place.

Of course, I’m not in agreement with everything Dave Ramsey recommends. I did write about paying off your ugliest debt first instead of using Snowball. I also particularly dislike his investment recommendations.

But overall, his “Baby Steps” do make a lot of sense.

No Comments