The “cash” on which it is really based has value swings that a considerable measure of inside the subsidiaries and algorithmic exchanging spaces would salivate over.

Thoughts About Bitcoin

- By : Menard

- Category : Investing, Speculation

- Tags: Bitcoin

I’ve recently started a Facebook group for this blog where members are encouraged to ask any question about money. Out of the blue, one member asked about Bitcoin. In an effort not to monopolize the forum, I waited several hours. But nobody was keen on answering the question.

I eventually ended up writing a brief but very informative answer only to see the post mysteriously deleted, ugh! I’m writing this to preserve what I wrote and to expound on the topic a bit while the upfront research is still fresh in my mind.

I’m no cryptocurrency expert and never owned Bitcoins, but I’m probably more qualified to write about the technical aspects of Bitcoin than most bloggers out there given my experience…

- Spent almost 20 of my working years developing a Foreign Exchange trading system

- Led the development of an FX order management system used by broker-dealers

- Implemented a web-based payment system used by various regional banks

- Architected my company’s web security infrastructure

In other words, I used to eat currencies, payments and digital certificates for breakfast. However, I’m going to spare you from hearing about the technical intricacies, so you don’t fall asleep.

Without further ado…

What is Bitcoin?

Bitcoin is a type of digital currency with a built-in payment network. The exchange rate as of this writing is $2,236.02 per BTC or Bitcoin currency. As recent as one year ago, it was worth about $500 apiece. That’s more than 400% return!

Hold your horses, before you invest speculate. I wouldn’t recommend anyone to invest in Bitcoin because of the wild swings in prices. There are legal and regulatory issues that need to be addressed that affects its volatility.

For one thing, Bitcoin is not legal tender. It’s not recognized by law as a medium of payment that can meet a financial obligation. This means that you cannot require your landlord to accept your Bitcoins as late payment for your rent– he can still legally kick you out so you fall flat on your face.

Should you do decide to gamble, make sure it’s a small portion of your portfolio or be prepared to lose your shirt.

The idea behind Bitcoin is that there’s no central regulatory bank that can control the supply of money. Governments like that of China or the U.S., for example, can simply print money to devalue its currency to make exports more competitive– which often causes inflation. Not so with Bitcoin, there’s a special algorithm to prevent that from happening.

Just like gold, Bitcoins can be mined albeit electronically– anyone with specialized equipment, software and know-how can become a miner. The mining process involves the use of high-powered computers to solve mathematical puzzles as controlled by a special algorithm. Miners are issued a certain number of Bitcoins in exchange for the work done. It is this same process of solving mathematical problems that make the payment network more stable and secure.

The Napster of money

Do you remember Napster? It was the music service that first popularized peer-to-peer file sharing protocol. Between 1999 and 2001, pretty much anyone can download MP3 music files for free. And millions did so, including myself who acted like a kid in a 24-7 candy store. The fun didn’t last a long time as it was eventually shut down after the company was sued by Metallica and Dr. Dre.

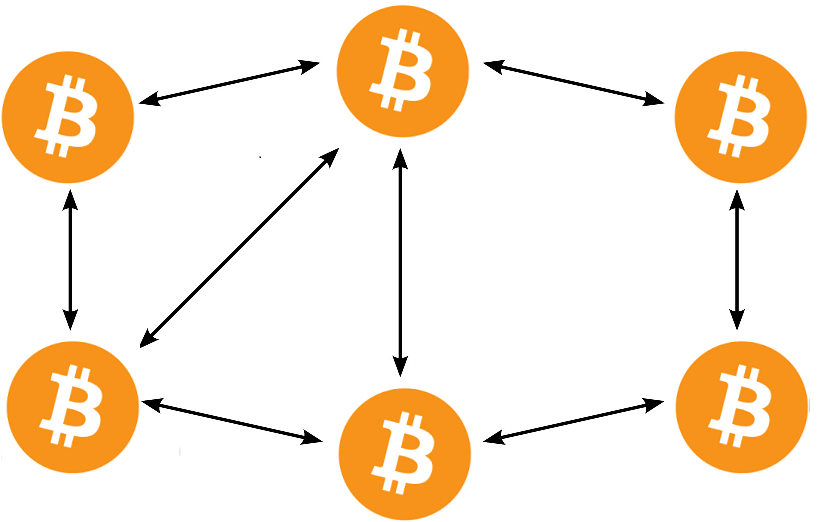

Unlike traditional client-server network architecture, peer-to-peer networks don’t use centralized servers to host the resources. Instead, pretty much any node in the network can allocate resources to other nodes. For Bitcoin, there are many advantages to this setup, among them:

- No central point of failure

- No third-party involvement

- Minimal transaction fees

It’s no surprise that this is the network architecture of choice for Bitcoin given its decentralized nature. This means that a merchant in the U.S. doesn’t have to deal with a shady bank in Somalia to accept payments from Somalis. No third-party involvement means that the transaction can occur instantaneously with minimal transaction fees.

Built-in payment network

What makes Bitcoin revolutionary is that it’s both a currency and a payment network. Never in the history of mankind had a currency been interwoven with a payment network. A dollar or a peso is a currency, but neither are payment networks. Paypal and Visa are both payment networks, but neither are currencies.

Software that runs Bitcoin protocol is called a wallet (you can download an app for your smartphone). It allows the holder to move Bitcoins from one wallet to another instantaneously without the involvement of a third party. This essentially makes users to effectively become their own bank.

Other interesting facts

Bitcoin was supposedly designed by a certain Satoshi Nakamoto– a man born on 5 April 1975 (which coincides with my wife’s birthday). Many believe this is just a pseudonym for a person or group of people who developed the protocol.

Bitcoin protocol is open source. Much like Wikipedia, anyone can view and modify the code. Subject to review by a panel of people, of course.

The first Bitcoin transaction was made in 2010. Somebody from the U.K. purchased 2 Papa John’s pizzas for 10,000 BTC. If that person kept the coins, it would have been worth around $22,000,000 today!

Want to learn more about Bitcoin? Here’s a very good book that I recommend.