Net Worth Update: Seven Years Later

- By : Menard

- Category : Financial Planning

- Tags: Net worth

Seven years ago, in August, I launched this blog with a net worth shy of $1M. On Labor Day the following year, I posted our very first net worth update. I thought sharing our net worth was a motivational boost to myself and other financial voyeurs who are on a similar path to financial independence.

Sure enough, our net worth grew to $2M in four short years. In contrast, reaching $1M took us fifteen years— the first million is indeed the hardest!

Now that we’re just a stone’s throw away from $3,000,000 (yes, I had to spell all those zeroes), I’m even more excited to share our latest numbers.

Without further ado:

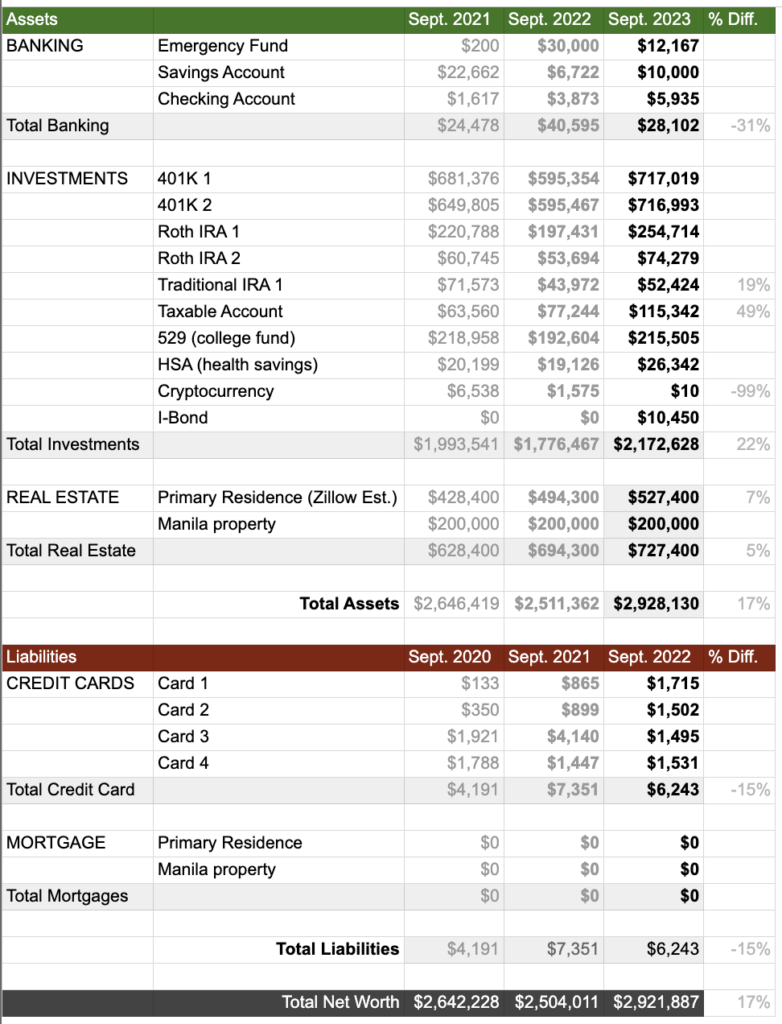

Assets are up by 17%

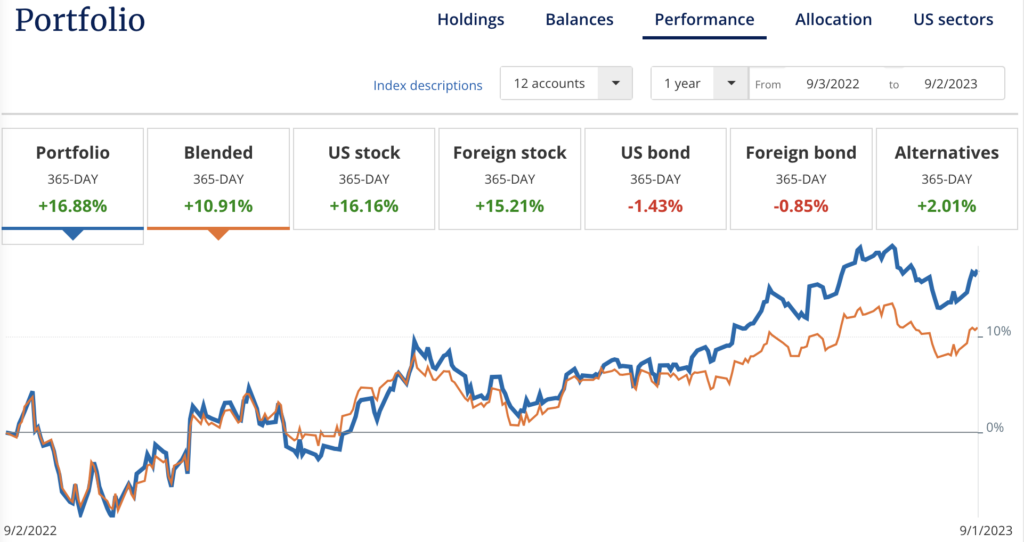

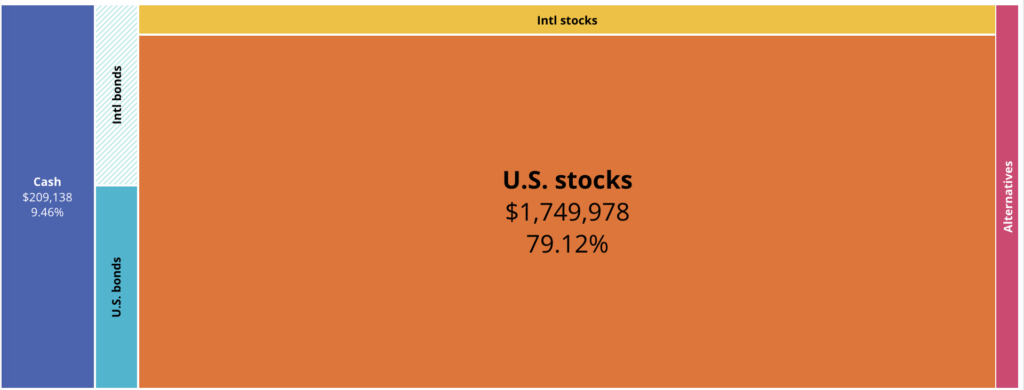

Our liquid investments are up 22% including contributions. Our aggressive portfolio mix of roughly 85/15 ratio of stock and bonds (blue line) substantially beat Empower’s (formerly Personal Capital) Blended portfolio (orange line):

Of course, the outperformance is not because I’m an investing genius. It so happens ours had more tech than any broad-based index except for the NASDAQ. Not to mention, I made a lucky move by rebalancing our portfolio from 80/20 to 100/0 when stocks hit rock bottom in late September last year. As a result, I maximized my returns before rebalancing to 85/15 recently.

Yet I feel like whenever I try to actively manage our portfolio, we often end up in a financial ditch. For example, I wrote a call option against the 100 shares of MSFT I owned for $235 last November. Surprisingly, the strike price was hit, and I was forced to kiss my beloved shares goodbye for a meager premium. I missed out on the upside now that MSFT is at $328, ugh!!

Fortunately, I didn’t stay in cash and immediately reinvested the proceeds into the following ticker symbols: AAPL, AMZN, GOOG, META, and TSLA. These are stocks of some of the most successful companies in recent history. The result is a more diversified albeit tech-focused Roth IRA (i.e., tax-free growth) portfolio.

Some might say our retirement portfolio is “too aggressive for our age,” but I disagree. The worn-out adage that you should subtract your age from 100 to determine the percentage of your stock allocation should be flushed in the toilet. So, I’m sticking to a much more aggressive allocation to fight inflation.

Our home value has increased 7% from last year. That’s according to the latest Zillow valuation. The housing market is slowing down because it continues to be harder for buyers and renters to afford housing with steep mortgage rates and ultra-high prices.

Liabilities are down 15%

With a debt-to-asset ratio of .002, we technically don’t have any debt. I continue to pay our credit cards in full automatically every month. I almost don’t even think about it.

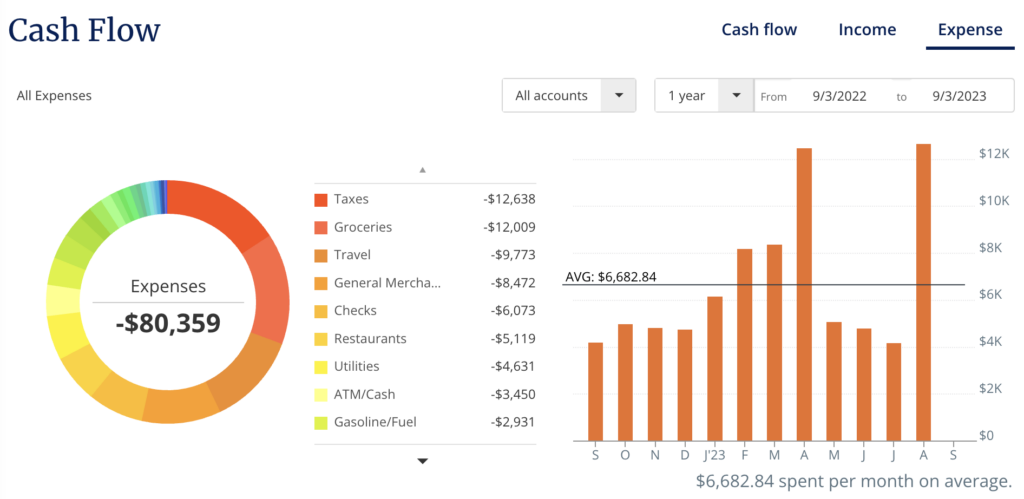

That said, our trailing 12-month spending has increased by $10K compared to last year due to expensive household repairs. We had to replace our furnace heat exchanger and water heater this year. This explains why our emergency fund is lower.

Net worth statement for 2023

(i.e., Total assets minus total liabilities)

Notice that I completely sold my experimental cryptocurrency investment in Cardano (worst investment ever, lol) and bought $10K of I-Bonds instead to save for a future expense.

Other assets not listed

Our net worth statement doesn’t include the following:

Automobiles and other personal property (< $20K): I drive an 11-year-old Toyota Prius C with 195,000 miles. My wife drives a 15-year-old Honda Pilot. So, they don’t amount to much.

My wife’s company pension (>$250K): She will receive $1,753 per month for life if she retires at 55. One of my readers, Bill, mentioned that her pension can be calculated using the following formula: (1,753 x 12 months) X 25 (4% rule). If this is correct, that amounts to an additional $525,900!!

All in all, net worth is up by 17%

I’m glad that our portfolio recovered after a bad 2022. It only goes to show that wealth building is not a quick or easy process. It requires patience, discipline, and consistency. It is the result of making smart financial decisions over a long period of time. It involves saving more than you spend, investing wisely, and avoiding unnecessary debt.

Tracking your net worth shows you how your wealth changes over time. It helps you improve your financial habits, reduce debt, and reach your goals. It is a simple and effective way to stay motivated and focused on your financial freedom. That way, you can triple your net worth in less than a decade like I did.

See also: The Road to Riches Starts Here: Track Your Net Worth

No Comments