As cliché as it sounds, the first million is the hardest. Having achieved recently my second in four short years instead of fifteen— saving for my first— is a testament to this.

But why exactly is that? The short answer is it takes money to beget money. The more money you have, the easier it will be to make more.

Mathematically, $1 needs to be invested at a ridiculous 100000000% return to grow to $1 million. To go from $1 million to $2 million, however, only requires a 100% return of your money. $3 million is 50% easier if you already have $2 million.

The harsh reality is many 20-something graduates in America will start their career with substantially less than $1 in their name. Thanks to a $50,000 student loan, $400 monthly car payment, and $3,000 consumer debt using a credit card they opened, like a bag of potato chips.

Here’s how you can make your journey to $1 million easier.

Stop the senseless spending

The biggest obstacle that will stop you from having $1 million in the bank is your monthly payments. The more money you give away to your creditors, the less money you can save and invest.

Avoid student loan debt. Apply for scholarships, spend the first two years in a community college, and work your way through college. Student loans can be a good investment if you need to boost your income. But you don’t need to finance a freaking $50,000 tuition to become a nurse or a computer programmer.

Lower your housing costs. Housing is one of the biggest expenses you will incur in your lifetime. No amount of day-to-day budgeting can compensate for your unaffordable housing costs.

If you’re a college student, live at home to save money if you can. It’s silly to pay $10,000 a year for room and board when all your classes are live streamed via Zoom.

Get rid of your car payments. Drive a cheap car with great mileage that you can pay with cash. Buy a reliable car you can drive from point A to point B, not drives itself to pick you up at point B so you can show off to your friends.

Now, imagine a life without these payments. No car payments. No student loan payments. No credit card payments. Perhaps not even a mortgage payment! Then you’ll have tons of cash in the bank, which brings me to the next step.

Invest, Invest, Invest!

Max your tax advantaged accounts (401k/403b, Roth, IRA, HSA). The money invested in these accounts compounds faster. I wrote about Tax-Advantaged Savings and Recommended Strategies, please read it.

A great way to get started is to open a brokerage account at Schwab or TD Ameritrade. And start with the Bogglehead’s three-fund portfolio:

- Vanguard Total Stock Market Index Fund (VTSAX)

- Vanguard Total International Stock Index Fund (VTIAX)

- Vanguard Total Bond Market Fund (VBTLX)

Pay attention to your asset allocation and fees. The farther you are to retirement, the higher allocation I would put into stocks— over 90% if you’re young. I’ve recommended Vanguard funds because the expense ratios are cheap.

The average expense ratio across the entire fund industry (excluding Vanguard) was 0.57% in 2019, which equates to $57 for every $10,000 invested. Compare that with Vanguard, where the average for all of our mutual funds and ETFs was 0.10%, or just $10— 83% lower!

That’s because the company is uniquely structured. It’s owned by the fund investors— people like you and me, and not filthy rich individuals.

Don’t forget to reinvest the dividends. One of my early investing mistakes was forgetting to enable automatic dividend reinvestment option on one great fund. Alas, for years, the dividends were automatically diverted to a bad fund in the same account with over 1% expense ratio.

You can read about my post about the compounding effect of dividend reinvestment here and it will blow your mind.

Stay the course, don’t miss out on market rebounds. Many investors sold at the bottom of the bear market in March of 2020, turning temporary paper losses into real, wealth-shattering losses! As for me, I bought more and thrived as a result. Panic is not a strategy.

See also: Build a Lazy Portfolio – Dividend Power

The Law of Attraction

This might sound crazy to you, but I believe in the law of attraction. Here’s what thelawattractionofattraction.com says about it:

“Simply put, the Law of Attraction is the ability to attract into our lives whatever we are focusing on. It is believed that regardless of age, nationality or religious belief, we are all susceptible to the laws which govern the Universe, including the Law of Attraction. It is the Law of Attraction which uses the power of the mind to translate whatever is in our thoughts and materialize them into reality. In basic terms, all thoughts turn into things eventually. If you focus on negative doom and gloom you will remain under that cloud. If you focus on positive thoughts and have goals that you aim to achieve you will find a way to achieve them with massive action.”

The concept is actually ingrained in the Bible: “Ask and you shall receive, seek and you shall find.” If you sincerely ask for the things that you want, the Universe will deliver.

Case in point: in 2016, I created a chart that visualized— focused my mind on— my net worth will reach $2M by the end of 2020.

As you can see from the chart above, I was spot on.

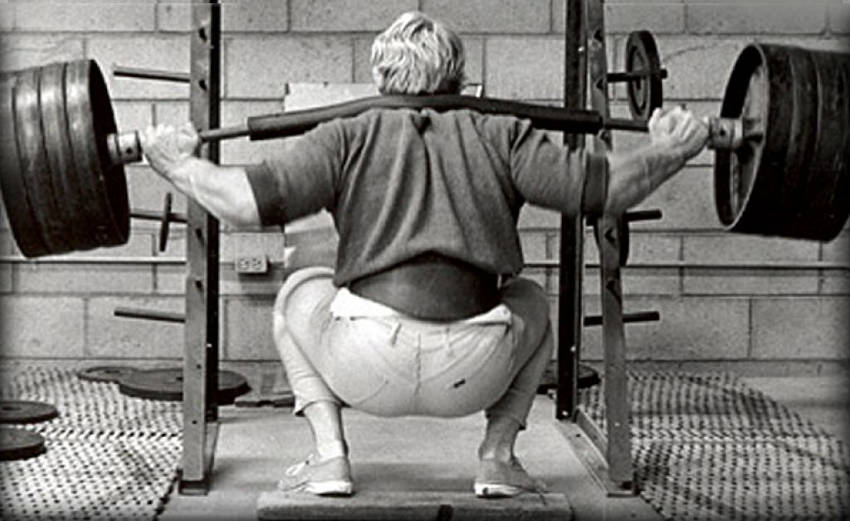

Visualizing is the great secret of success. In fact, Arnold Schwarzenegger once said he visualized his biceps becoming as big as mountains while he did curls. And there is growing scientific evidence to support the effectiveness of mental imagery and visualization in sports

Perhaps we can apply the same concept to our finances. We should use it to our advantage.

No Comments