Why You Probably Don’t Want to Trade Options

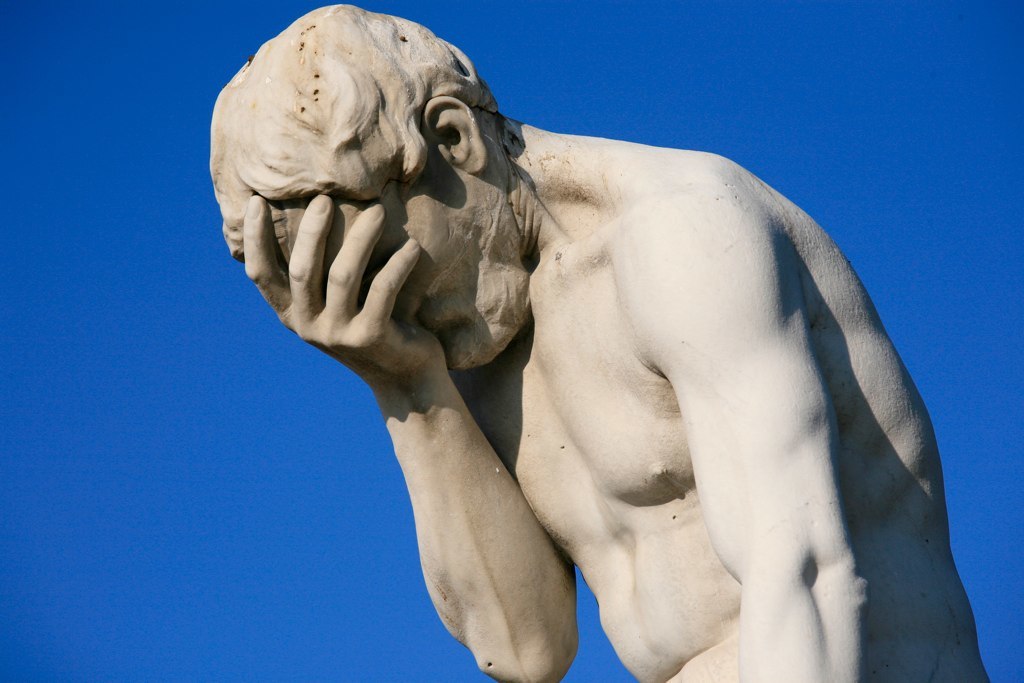

When the market is moving haywire, many DIY investors are tempted to be more creative with their investments. So, they resort to strategies that will likely ruin their portfolios: day trading, buying on margin, short selling, etc., instead of sticking to the proven, slow-and-steady, or buy-and-hold approach to investing. One such strategy …

How to Ruin Your Investment Portfolio (Part III: Short Selling)

In Wall Street and beyond, there is no shortage of greedy people. Many will resort to strategies that are borderline immoral like short-selling stocks of company XYZ and wishing that the company loses half of its value so long as they profit from the trade— even if it meant that the company goes bankrupt and the majority of its employees are laid off.

How to Ruin Your Investment Portfolio (Part II: Technical Analysis)

Humans are by nature impatient. At the supermarket counter, we’d constantly look into our watches when several people are queued ahead of us. If we’re in a hurry, we’d drive to another store even if it takes much longer to get there. And if we actually do, we’d honk on a car in front of us, at some stoplight along the way if the driver hesitates to proceed for safety.

How to Ruin Your Investment Portfolio (Part I: Day Trading)

Almost everyone has heard of Aesop’s parable of “The Tortoise and the Hare”. In a nutshell, the story goes like this… There once was a hare who bragged about how fast he can run. Tired of the hare’s boastful behavior, the tortoise, challenges him to a race. The hare soon …

Recent Posts

Recent Comments

- on The VIX Index: How to Get a Little Richer by “Timing the Market”

- on From Diapers to Diplomas: Tips on How to Fully Fund College Using 529s

- on From Diapers to Diplomas: Tips on How to Fully Fund College Using 529s

- on Why I’m Saving More in a Taxable Brokerage Account, Maybe You Should Too

- on Why I’m Saving More in a Taxable Brokerage Account, Maybe You Should Too

Categories

- About me3

- American dream10

- Asset allocation1

- Blogging4

- Books8

- Budgeting2

- Career6

- Credit4

- Financial Planning25

- Fitness1

- Fraud2

- Giving1

- Guest Post2

- Happiness3

- Health2

- Income2

- Insurance4

- Investing32

- Lifestyle21

- Motivation7

- Relationships20

- Retirement16

- Romance2

- Saving for college5

- Saving ideas11

- Side Hustle3

- Speculation4

- Spending11

- Taxes3

- Vacation3