I cant believe all the crazy fees those funds are. I’m sure she will be very happy with your suggestions for the future. Always go witj with Vanguard total stock fund my friend once told me. No better production for your money.

One reason why this blog will never achieve mainstream is I couldn’t share it with my family or friends. How could I when I’ve been blogging about the intimate details of my finances— and theirs too!

I first blogged about my sister’s finances in 2017 when she had a net worth of $1,266,000. The point was having a high income can sometimes save you from financial ruin when you’re indifferent to your finances. Heck, you could even become a multi-millionaire, thanks to inflation!

My sister recently paid me a visit. Being the “finance guy” in the family, she once again asked for financial advice as she wants to retire in a few years. Of course, I took notes, so I could once again profile her on this blog.

The accidental millionaire

My sister is a 65-year-old psychiatrist who has never married and has no children. She spent most of her lucrative career in a rural part of Texas, a no-income-tax state. Loneliness brought her to an HCOL (high cost of living) town in California, hoping to meet her prince charming.

Instead, she fell in love with the town and bought a modest house for $600K in 2015. That same house doubled in value and is now worth over $1.2M in which she owes $200K. She also owns a paid-off rental property in Florida that also doubled in value and is now worth $400K.

As a physician, she earns between $250K to $400K over the past 20 years– more than what my wife and I make combined!

Other facts about her:

- Buys on impulse (bought a $5,000 infrared sauna over lunchtime)

- Engages in irrational spending (spent $20,000 on an infinity pool she no longer uses)

- Doesn’t cook, relies on her microwave, and eats out often

- Recently totaled a brand new Tesla Model 3 after driving it for less than a month.

Her assets as of this writing:

- Real estate equity of $1,500,000 (including an inherited property in Manila)

- $500K in a Thrift Savings Plan

- $300K in a brokerage account

- Mercedes RV worth over $100K

- Toyota RAV 4 worth $30K

- $80K in cash, including $$$ she received from the insurance company for destroying the Tesla!

That’s over $2,500,000 in net worth— double what it was when I first sat with her five years ago!

Applying the Rule of 72, her net worth grew by over 14% annually. Impressive considering the stock market averaged around 12.5% in the same period.

At first glance, she looks like an investing genius. But if you compare her numbers from 2017, you’ll discover that her retirement investments are mostly flat. Her gains were all in real estate due to skyrocketing home prices. Even her RV, usually a depreciating asset, increased in value.

Pandemic-induced “work from home” hysteria coupled with supply chain issues has sent home (and used car prices) to the roof.

The devil is in the details

Her liquid investments in 2017 were over $700K. Six years later, they barely grew to $800K. What the heck happened?? Using an inflation calculator, the amount would have been worth $820K in 2022. Her money didn’t even keep up with inflation! With that rate of return, she’s better off stashing her cash in the mattress.

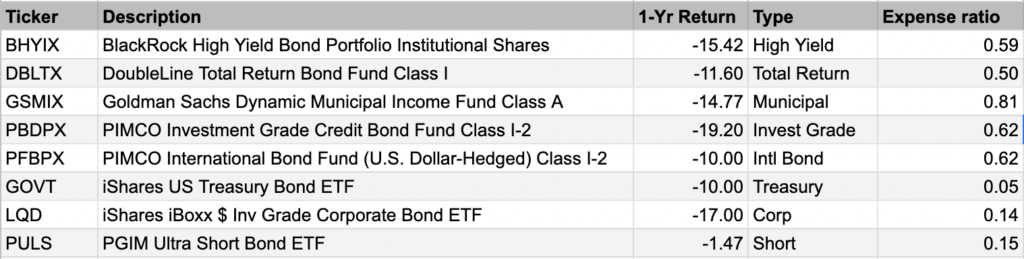

As someone she can trust, we logged into her retirement and brokerage accounts. I kind of knew why her portfolio returns sucked, and my suspicion was right on:

- Her investments are super conservative (70% bonds, 20% stocks, 10% cash)

- They are saddled with high fees!

Her brokerage portfolio is nothing but a hodgepodge of ticker symbols nobody can memorize:

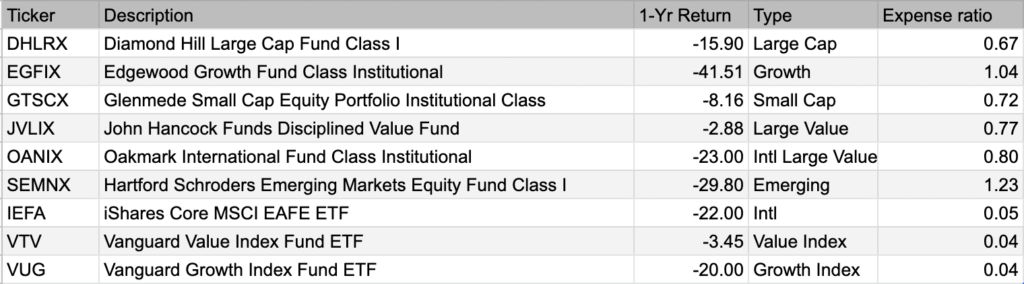

And her stock investments are equally complicated and expensive (with the exception of the last three funds):

The sheer number of funds alone makes me puke. Nobody needs this many funds in their portfolio.

My recommended plan of action

You see, I love my big sister. She took care of me when I was little. As the youngest of nine siblings, she was the one who brought me to public parks to play because our parents were too busy with their day jobs. I want to make sure that nobody is taking advantage of her. I have her best interest at heart.

The following are my recommendations:

1. Fire her investment advisors

Hiring financial advisors is probably why she ended up with a bunch of funds that serve no real purpose but to fatten their wallets. The extensive exposure to bonds is particularly disheartening.

I work with bonds all the time— that’s what my employer specializes in! I hardly write about them because they’re not great tools for building wealth. They can provide safety, but they hardly keep up with inflation.

Nobody needs to be invested in all types of bond funds (e.g., Municipal, Govt, Corp, etc.) for diversification, I don’t care if they’re close to retirement. The same is true with stock funds.

2. Invest more aggressively

Her stock-anemic portfolio runs a significant risk of being depleted too early. When she retires, she needs her assets to work for her for another 20 to 30 years. Otherwise, inflation will eat her retirement savings. Hence, I advised her to move the money in her TSP (401K for federal employees) to the C Plan– a fund that tracks the S&P 500.

Even at the age of 65, I’d have her invest 90% of her portfolio in stocks considering that:

- She has two gov’t. pensions that will provide her with at least $5,000 of income per month for life.

- She has rental income coming from her Florida property.

- An annuity that pays $1,000 a month for at least a decade.

- Social security also provides an additional safety net.

If she runs out of money, she can always sell her million-dollar California property and retire in a tax-friendly state. Not to mention it’s a good time to buy more stocks because of the recent downturn.

3. Simplify her accounts

Roll her aging Merrill Lynch IRA to Schwab where she already has an existing account. The older we get, the harder it is to get a bird’s-eye-view of your investments if they’re on separate accounts. It’s better to stick with one or two institutions.

I also asked her to close two Merrill Lynch accounts charging high fees:

- Merill Guided Non-Retirement, management fee: 1.5%

- Merrill Guided Investing with Advisor, management fee: .85%

This is along the lines of “firing her investment advisor.” Human or Robo, they both need to go.

4. Simplify her investments

Investing in 20+ different funds is a bad idea if you can’t tell what they are, let alone, what they add to your portfolio. When Warren Buffett says, “Diversification is protection against ignorance,” he was talking about a stock portfolio, not a mix of mutual funds. They could already be diversified individually.

That said, I’ve asked her to buy one fund, Vanguard Total Stock Market Index (VTSAX). Buying this fund allows her to own 4,100+ different holdings. It provides exposure to the entire U.S. stock market: large caps, small caps, growth, and value. And many of the companies in the fund: Apple, Microsoft, Google, Amazon, and Tesla, for example, are already invested internationally, so there’s global exposure as well.

The fund beats 95% of the funds she’s invested in— at a much lower cost— the Admiral Shares’ expense ratio is only .04 percent!

Final thoughts

Keep it simple: investing doesn’t need to be complicated. Owning a few high-quality funds lets you easily track your investments and how they perform. Not to mention how much they are costing you.

Everyone ought to be on top of their finances. Nobody cares more about your money than you do—unless you have a savvy younger brother you brought to public parks to play when he was little!