400 Weeks

- By : Menard

- Category : Retirement

Coming up with a successful pre-retirement strategy involves detailed planning. For starters, you need to list down some goals. For us, the ultimate financial goal is to retire comfortably by age 60, which is 800 freaking weeks from now!

This obviously is NOT a FIRE (Financially Independent, Retire in your Early thirties) blog.

Since that goal is too broad and so far away to be useful, breaking it down into a few very specific ones at the midpoint, i.e., 400 weeks, should make them more tangible.

In a healthy relationship, the wife should always be involved. So in my case, I had to sit and talk to my wife before coming up with the following:

- The option to quit our jobs and start our own business by age 52.

- At least two million dollars in investible assets.

- Mortgage paid off by the time our eldest daughter, Maddie, goes to college.

All three, I believe, can be accomplished in 400 weeks!

Paying off our mortgage is key. However, I don’t want to get too crazy paying it off because the interest is a minuscule 3%. In comparison, the stock market has returned more than 10%, on average, between 1970 to 2015 (here’s a calculator).

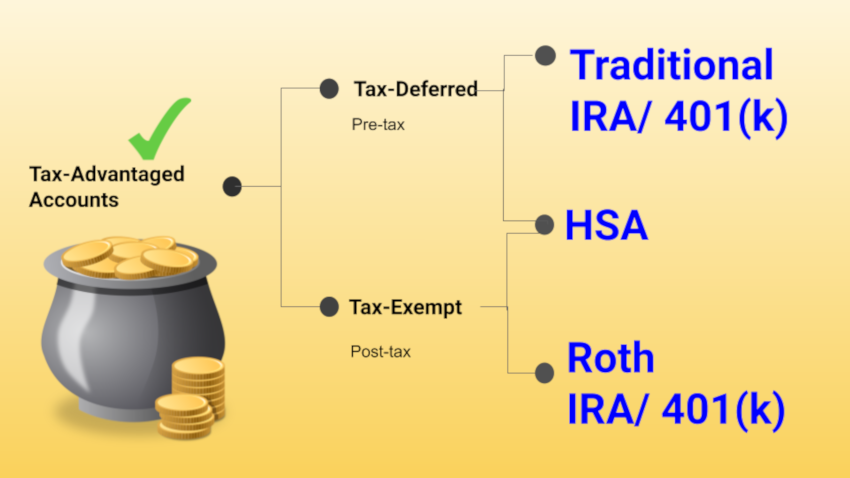

Being debt free, including the mortgage, before you retire has the following additional advantages:

- Lower taxable income in retirement as you don’t need to tap tax-deferred accounts for mortgage payments.

- The psychological boost of not owing anyone money.

UPDATE (4/13/2019): I’m actually paying $1,500 additional towards the principal— payoff date should be EOY 2020 !!!

Here’s a projection of when our 15-year mortgage will be paid off if I keep paying an additional $300 towards the principal:

On May 1, 2024, the outstanding balance will be zero. The year that Maddie goes to college, our mortgage will be paid off.

Her little brother goes to college four years later. So there should be no overlap of college expenses on our part:

Should they decide to attend private school, which I will strongly discourage, it wouldn’t be a problem. We’ve already saved up more than $90K in their 529 accounts, and we have no mortgage to worry about by then.

How we spend, save and invest our money within the next 400 weeks is critical. It’s a huge step towards our lifelong dream to become truly financially independent.

But that’s only half of the 800-week journey. We’ll both be 60 after the next 400 weeks (of the first 400 weeks). I’m confident that by then, we’ll be more than ready to retire completely from being self-employed. If the past 12 years can be used as an indicator, my guess is that our net worth would be somewhere between 10 to 15 million dollars.

That, folks, is an example of how you do your long-term planning!

No Comments