This Sheet Tells You When to Get Out of the Shithole

One of my favorite movies of all-time is American Beauty. The 1999 award-winning film stars Kevin Spacey who played Lester Burnham, a 40-something guy who hated his job and was on the brink of a mid-life crisis. The inflection point was when he saw his daughter’s gorgeous 16-year-old cheerleader friend, Angela Hayes (Mena Suvari), perform during a half-time dance routine at a high school basketball game.

Lester becomes so infatuated with Angela that he began having sexual fantasies with her. He becomes obsessed with youth that he started to live his life like he just graduated from high school. And when he was told that he was about to get laid off, he instead blackmailed his boss for $60,000. He then quits work anyway choosing to work as a crew in a fast-food chain instead– the position with, in his own words, the least amount of responsibility.

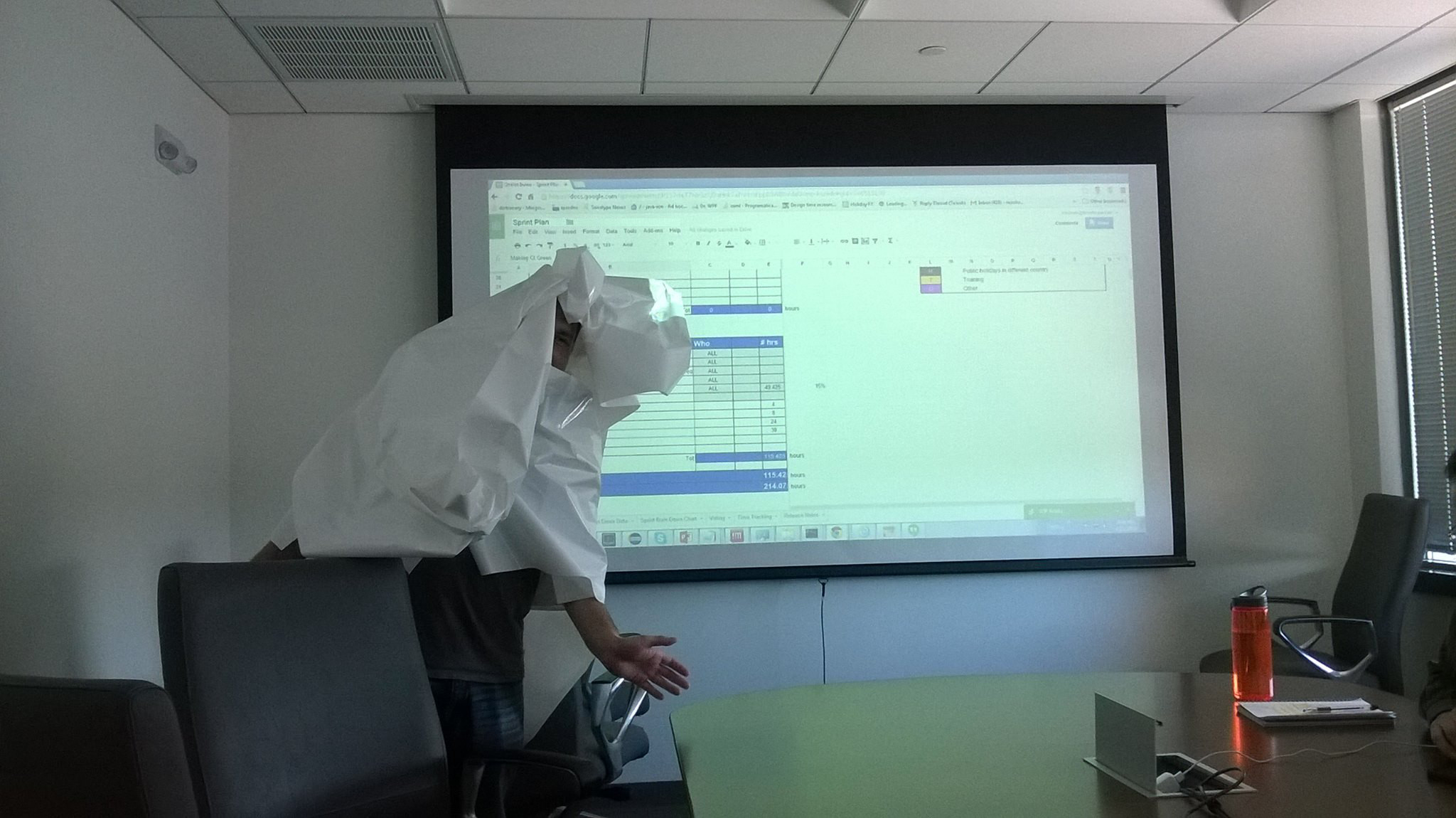

But what really caught my attention is the scene where Lester Burnham wonders in his cubicle while seeing a reflection of his image on the monitor, which resembles a guy trapped in a jail cell. With the numbers on the spreadsheet forming the jail bars in his mind, it’s pretty obvious that he felt imprisoned by his job and wanted an escape. A feeling that many people can sympathize.

12 Jaw-Dropping Stats About Retirement

Below is a guest post from Archana Singh, a finance blogger from the Mystic Land of India. Archana works for one of the leading insurance and web aggregator in the country. Even if you don’t live there, you’ll quickly learn that retirement challenges are fundamentally the same; circumstances could devour …

9 Signs You Probably Won’t Need a Retirement Nest Egg

It’s a fact, people in developed countries are living longer. For instance, life expectancy for women is predicted to surpass 90 years in South Korea by 2030, according to the study published in The Lancet, one of the world’s oldest and most respected medical journals. Of course, the study assumes …

Recent Posts

Recent Comments

- on The VIX Index: How to Get a Little Richer by “Timing the Market”

- on From Diapers to Diplomas: Tips on How to Fully Fund College Using 529s

- on From Diapers to Diplomas: Tips on How to Fully Fund College Using 529s

- on Why I’m Saving More in a Taxable Brokerage Account, Maybe You Should Too

- on Why I’m Saving More in a Taxable Brokerage Account, Maybe You Should Too

Categories

- About me3

- American dream10

- Asset allocation1

- Blogging4

- Books8

- Budgeting2

- Career6

- Credit4

- Financial Planning25

- Fitness1

- Fraud2

- Giving1

- Guest Post2

- Happiness3

- Health2

- Income2

- Insurance4

- Investing32

- Lifestyle21

- Motivation7

- Relationships20

- Retirement16

- Romance2

- Saving for college5

- Saving ideas11

- Side Hustle3

- Speculation4

- Spending11

- Taxes3

- Vacation3