Why You Absolutely Don’t Want to Miss the Best Days

- By : Menard

- Category : Investing

- Tags: Stock market

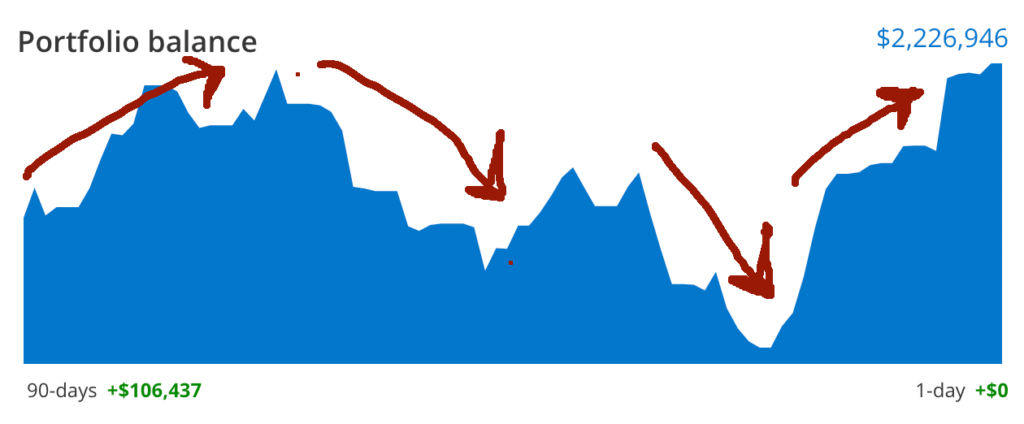

The past 90 days were particularly exciting if you’re a stock market investor. It reminds me of the Hershey Park roller coaster I was compelled to ride to accompany my 10-year-old nephew. It was a terrifying experience, but not for my nephew, who was having a blast the entire time, haha.

Luckily, I was smart enough to stay the course. Jumping out in the middle of the ride would have dire (or fatal) consequences.

Best and worst days in the market

The same is true with regard to my investments. In a matter of days, my portfolio “lost” over $200K after the three major indices Dow, S&P 500, and NASDAQ plummeted due to higher interest rates before recovering sharply in November to where it was. Stocks have enjoyed their best month of 2023 after the Fed hinted they’re done with the rate hikes.

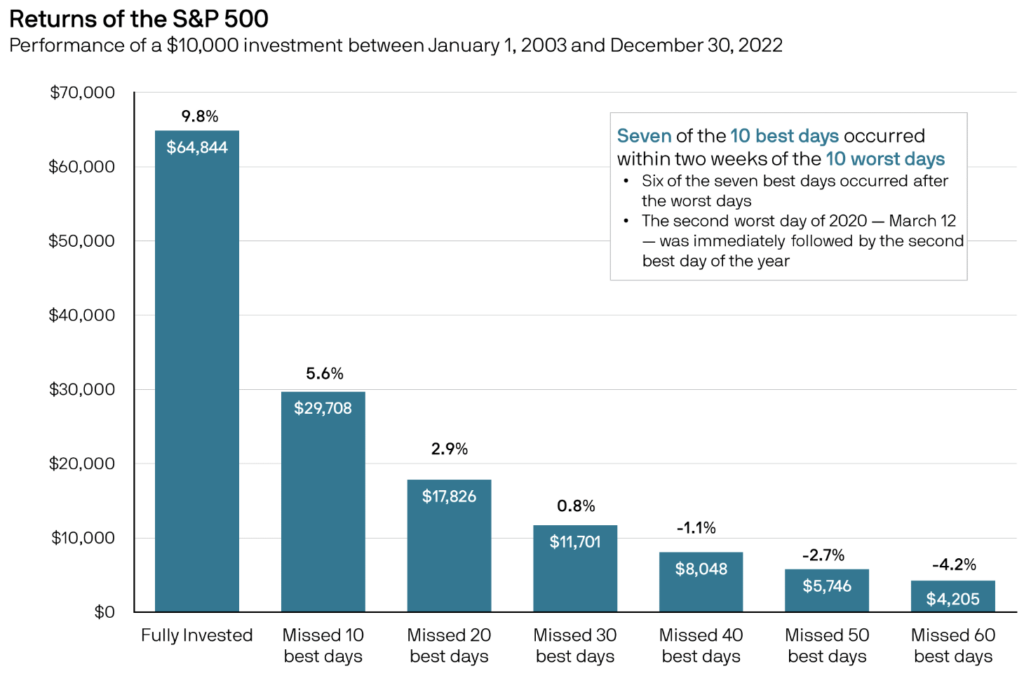

This is actually not surprising. Between January 1, 2002, and December 31, 2022, seven of the S&P 500’s best days occurred within just two weeks of the index’s 10 worst days, according to J.P. Morgan Asset Management’s 2023 “Guide to Retirement” report.

This is especially apparent in a chart that I generated back in 2018:

Had I panicked, I would have locked my losses by selling and praying the market would continue to go down so I could buy it all back at bargain prices. But guess what? The odds were against me because the best days were likely to come. If you look at the chart above, historically, the best days (green) happened in a matter of days after the worst days (red).

The cost of staying on the sidelines

Sadly, many younger investors have sold after being enticed by “risk-free” money market yields of up to 5%. Alas, the best days in stocks can pay 4% to 5% in one day. For instance, the Russell 2000— an index that tracks small caps— returned almost 6% last Tuesday. That’s the same yield a money market fund will pay in a year! Except that it won’t because short-term rates are coming down.

Here’s another chart from the same J.P. Morgan report:

If you invested $10,000 in the S&P 500 at the start of 2003, you would have more than $64,844 at the end of 2022 if you held all your investments, versus just $29,708 if you missed the market’s 10 best days.

Of course, a lot of things can still happen towards the rest of 2023. But It only goes to show that timing the market is a losing proposition.

So let’s stay the course.

No Comments