Russia has invaded Ukraine, another black swan event to wreak havoc in the stock market just when the world has barely recovered from the effects of COVID-19. Putin must have lost his mind— a scary proposition considering that Russia has the most nukes in its arsenal.

What’s next? The Chinese invasion of Taiwan and the start of World War 3?

Instead of working together to solve climate change, we end up emitting immeasurable carbon footprints trying to kill each other. You don’t need a full-blown war against Russia or China to initiate the end of the human race.

The day Pearl Harbor was attacked, Japan invaded the Philippines, which was an American territory. Manila was heavily bombed, and countless women were raped. 16 million Filipinos— U.S. nationals who saluted to the stars and stripes— fell under a foreign power. Yet, then President Roosevelt barely mentioned the country in his “Day of Infamy” speech.

We can’t ignore the human toll and suffering in Ukraine. Millions will be displaced and separated from their families. Here’s a list of vetted nonprofit organizations if you want to help.

How past conflicts affected the stock market

Historically speaking, there are always scary things. No matter how frightening they are, the best response for the long-term investor has always been to ignore the noise.

Take a quick look at the chart below, and you’ll see that even in times of conflict, the stock market went down only a few times, on a six-month and one-year basis. In many instances, it was up by a significant margin!

Of course, past performance is no indication of future results. Nobody can predict how the market will behave in the short and intermediate term.

But if you stay the course, you’ll likely win.

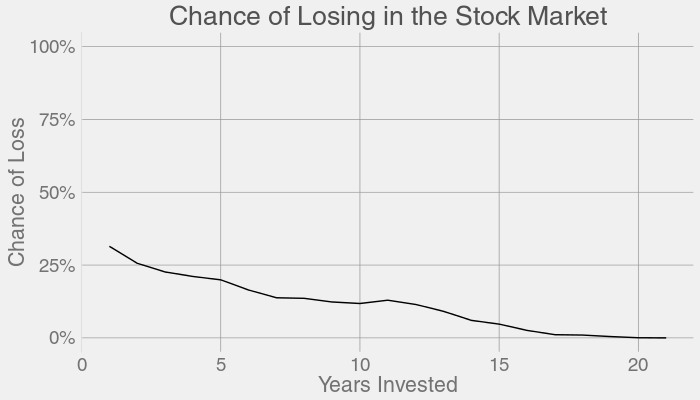

The chart below is from a GitHub user who ran a simulation to determine your chances of losing. The data includes returns throughout the Great Depression, 70’s Oil Embargo, Black Monday, Dot-Com Crash, and the 2008 Financial Crisis.

If you invest a lump sum for two years, the odds are one out of four. But if you stayed the course for 20 years, like when you’re saving for retirement, your chances of losing drop to zero. The longer you stayed invested, the better your chances to win.

The above assumes you’re invested in a fund that tracks a broad-based market index like the Vanguard S&P 500 ETF (Ticker Symbol: VOO).

Panic is not a strategy

Moving your money to cash out of panic has disastrous consequences:

- You risk paying early redemption fees and deferred sales charges (check your mutual fund prospectus).

- Missing the best days can significantly impact your returns.

According to a study made by J.P. Morgan, if you invested $10,000 on January 3, 2000, and remained invested until December 31, 2019, that amount would have grown to $32,421. Missing the ten best days would have cut your returns in half to only $16,180.

And since the best days usually follow the worst days, like what’s shown below, you’ll likely regret selling!

No Comments