I’m not going to lie to you. The past couple of months have been nerve-wracking for us mere mortals who depend on our 401Ks to break free from the nine-to-five grind. Multiply that anxiety tenfold for someone on the brink of retirement next year like I do.

It quickly became clear to me that I had three choices:

- Cut my losses and get out of the market—absorbing a painful but manageable hit now rather than risking deeper volatility ahead.

- Stay the course and ride out the storm—trusting that long-term market trends would eventually smooth out the turbulence, though with no guarantees of how much worse things might get first.

- Buy more when the market bottoms out—leveraging volatility indicators to time strategic adjustments and hedging against downturns while capitalizing on potential recovery opportunities.

Historically, I’ve always recommended #2. Jumping out in the middle of a roller coaster ride would have fatal consequences. History has taught us that knee-jerk reactions often lead to regret. Time and time again, markets recover, and no clowns in the White House can derail that long-term trend. In times of uncertainty, staying the course was the smartest choice then and the smartest choice now.

But I’m not judging you if you pick one of the other options because I also did #3. I bought more when the market bottomed out on April 8th!

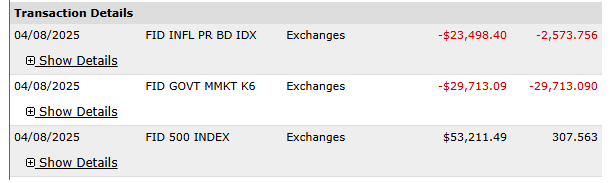

More specifically, I rebalanced my 401K, effectively selling a portion of my cash and bonds in favor of Fidelity’s S&P 500 fund. I also bought a small number of shares of Palantir (PLTR) and Berkshire Hathaway (BRK-B) after the great Warren Buffett announced his retirement.

Nobody said the options have to be mutually exclusive. Now that the market seems to have recovered, my only regret is not buying more stocks!

This begs the question: How can you time the market??

Sorry to disappoint you. Nobody can perfectly time the market– I just got lucky. But history has shown that big opportunities often come wrapped in fear and uncertainty. Sure, you want to hold onto your investments, trusting long-term trends. But also seizing discounted assets others were offloading in panic.

However, by leveraging volatility indicators like the VIX, you can time strategic adjustments. And potentially hedging against downturns while capitalizing on potential recovery opportunities.

What is the VIX?

The CBOE Volatility Index aka “The Fear Index” measures expected market volatility over the next 30 days based on S&P 500 option prices. A high VIX suggests increased uncertainty and potential market declines, while a low VIX indicates stability and optimism.

When the VIX spikes above 30, widespread panic may indicate undervalued stocks, presenting a buying opportunity. Conversely, a VIX below 15 signals low volatility and excessive optimism, suggesting markets may be overheated and ripe for profit-taking.

During periods of rising uncertainty, investors can hedge their portfolios through options, inverse ETFs, or cash reserves. Additionally, the VIX tends to revert to its mean, meaning extreme highs or lows rarely persist, often leading to a reversal in market conditions.

Not saying you need to do all these. For starters, you probably don’t want to trade options. But understanding these patterns can help investors make smarter, more strategic decisions.

Final Thoughts

It wasn’t easy watching the market dip further, but I reminded myself that fear isn’t a strategy—smart investing is. To quote Warren Buffett, “Be fearful when others are greedy and be greedy only when others are fearful.“

While market timing is risky, the VIX index can help you gauge sentiment and tilt the odds slightly in your favor. By understanding volatility trends and leaning into fear rather than running from it, you can position yourself for smarter investment decisions—and maybe even get a little richer.

No Comments