This was a fascinating post! I always swear by SWPPX myself. But now I see I may have been shortchanging myself by not investing in VTSAX instead. Now I see why all those FI and FIRE people recommend VTSAX. To be honest, I don’t know yet that I’ll change my ways. But maybe I will! Thank you for posting this.

I’m not going to lie to you. Financially, it has been an excellent year for us as a couple. With no mortgage to think about and the kids’ college savings almost funded, our cash reserves have been piling up faster than we can invest.

If Trump’s win, four years ago, made us millionaires, the stock market rally following his loss made us “entry-level” multi-millionaires:

Related: How to Survive and Thrive from the Coronavirus Market Crash

If you’re wondering how our portfolio continued its upward momentum in the 4th quarter, it’s due to diversification away from big tech companies: Apple, Microsoft, Amazon, Facebook, and Google.

These five behemoths represent over 20% of the S&P 500’s market capitalization and have been dragging the returns of the index to the positive territory since March.

As the market’s tenor changed in early September because of the economic optimism brought by positive vaccine news, our stock investments in smaller companies started to pick up steam.

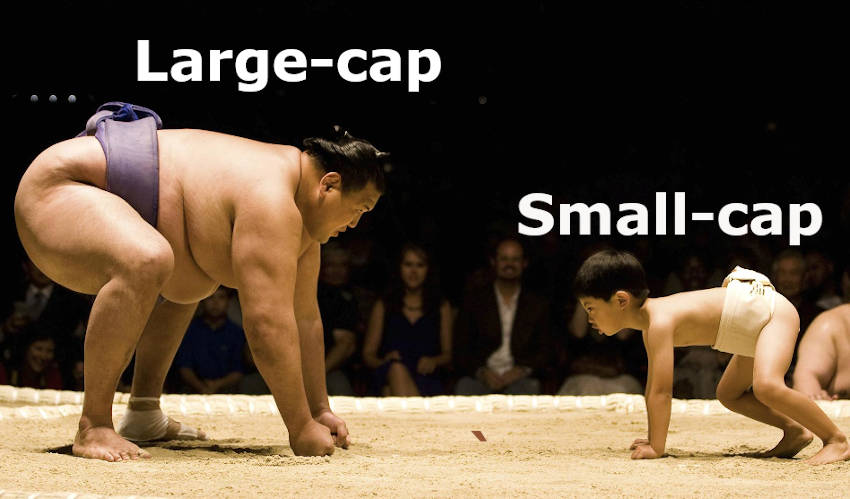

Thanks in part to our 401(k) investments in small and mid-sized companies:

If there’s an investing lesson to be learned towards the end of 2020, it is the following:

Don’t miss out on smaller companies. The S&P 500 is not the stock market.

Of course, nothing wrong with investing 100% of your stash in the S&P 500. You’re essentially buying 500 of the largest, most stable, “blue-chip” U.S. companies.

In fact, in 2008, Warren Buffett issued a $1 million bet against the hedge fund industry— known for charging exorbitant fees— that they won’t beat the index. He won big-time.

But guess what? You would have beaten both Warren Buffett and those greedy hedge fund guys had you placed your bet on a broader-based index fund that doesn’t discriminate against smaller companies.

One of such funds is the Vanguard Total Stock Market Admiral Shares (VTSAX), which holds 3,586 companies!

Note that approximately 75% of VTSAX market capitalization is invested in the S&P 500. If you want more control over the small/ mid cap allocation, I would invest in multiple funds.

Final thoughts

- Investing across different market capitalization funds provides extra diversification. You know you’re spreading your risk because you’re not investing in the same companies.

- Smaller companies are riskier but have better growth potential than larger counterparts. After all, a company like Tesla (TSLA), which recently joined the S&P 500, was once a small capitalization company. But I wouldn’t allocate more than 30% of my portfolio to small caps.

- The stocks of large companies get the most attention when the market is making big moves. This creates buying opportunities for smaller companies.