As I’m writing this, the novel coronavirus known as COVID-19 wreaks havoc across the globe, causing the U.S. stock market to plunge more than 20% in a few weeks. The rush to safety accelerated to unseen levels since the Black Monday of 1987. Thanks to the uncertainty.

As if that’s not bad enough, the surprise petroleum price war between the Russians and the Saudis sent oil prices to plummet more than 30% with the U.S., being the world’s largest oil producer, taking the brunt of the pain.

Adding fuel to the burning fire is Trump’s announcement suspending travel from Europe to America for thirty freaking long days.

To those of us, brave souls, whose nest eggs are heavily invested in stocks, these three unfortunate “Black Swan” events are the Giant Tsunami, Godzilla, and King Kong of our 401(k) balances.

As a couple, we’ve “lost” over $200,000 in less than a month:

If the stock market carnage continues, pretty soon, I will be renaming this site, “Thousandaire Before 50.”

“Holy cow. You must be really scared now?” You might ask.

Of course, not. It’s only a temporary decline.

Paper losses are just that: you didn’t lose anything until you sell. It’s called unrealized losses for a reason— it’s a temporary decline.

Admittedly, it’s much worst than I’ve anticipated. But I’m no stranger to “Zombie Apocalypse” events. I’ve been through a few: Y2K scare and Dot-Com bust of 2000, 9-11 Terrorist Attack, and the Great Financial Crisis of 2008.

You’ll feel like the world is ending as you get what seems to be an endless stream of big losses, day after day. But the American economy has always been resilient to weather the storm. People and companies adapt to the changes, and soon enough, the stock market recovers after confidence get restored in the marketplace.

People didn’t stop flying after suicidal terrorists awaiting 72 virgins flew an airplane into the World Trade Center in 2001.

Many investors sold at the bottom of the bear market in March of 2009, turning temporary paper losses into real, permanent, wealth-crushing losses.

But I stayed the course, bought more, and was handsomely rewarded for my patience.

That’s what I’m doing and will continue to do. It pays to be patient.

As Warren Buffett famously stated, “The stock market is a device for transferring wealth from the impatient to the patient.”

Panic is not a strategy.

Maintaining a level head during scary market conditions keeps your emotions from controlling your investment decisions. If you can’t stomach the downturn, you should rethink your asset allocation. You probably shouldn’t invest in stocks.

Remember the Y2K hysteria? People were rushing to buy boxes and boxes of toilet paper, bottled water, and other indispensable items, like what’s happening now. But when the clock struck 12 midnight that December 31st of 1999, NOTHING HAPPENED.

In times like this, the best way to alleviate your fear is knowledge.

Here are some facts:

- Bear markets generally occur every 4 or 5 years.

- Every bear market is followed by a bull market.

- The worst thing that you can do is stay in cash (read this Charles Schwab study).

Related: Have No Fear, Market Crashes Will Always Be Here

That said, it’s time to prepare for a recession. You’ll need at least six months’ worth of expenses if you work in one of the industries affected. Beefing up your emergency fund helps keep your stress level down. Being prepared gives you the confidence that you need to tackle any of life’s unexpected events like a job loss.

Stay the course and you win.

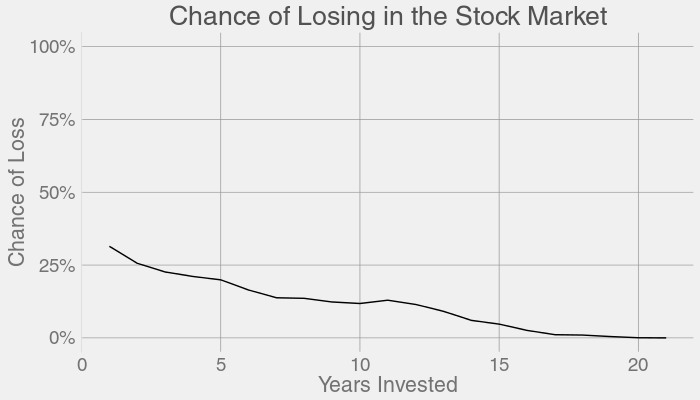

The chart below is from a GitHub user who ran a simulation to determine your chances of losing. The data includes returns throughout the Great Depression, 70’s Oil Embargo, Black Monday, Dot-Com Crash, and the 2008 Financial Crisis.

If you invest a lump sum for two years, the odds are one out of four. But if you stayed the course for 20 years, like when you’re saving for retirement, your chances of losing drop to zero. The longer you stayed invested, the better your chances to win.

Moving your money to cash out of panic has disastrous consequences:

- You risk paying early redemption fees and deferred sales charges (check your mutual fund prospectus).

- Missing the best days can significantly impact your returns.

A chance to leapfrog to where you want to be!

If your investment horizon is six years or more, you shouldn’t be worried about the virus affecting the economy in the long term. Now is a terrific buying opportunity for you.

When the market drops 20%, 30%, or 50%, then you’d be buying shares at a discount. Think of it this way, if bear markets were iPhones, you’d be rushing to the nearest Apple store!

I’d suggest buying low-cost, broad-based index funds like VTSAX or VSTMX, but only with discipline. Perhaps, you are already dollar-cost-averaging. Any extra cash that you won’t need in the short term, I’d invest in these funds.

If you have a propensity to buying individual stocks or sector funds, however, I wouldn’t rush buying in unfavorable industries. I’d buy “stay-at-home” technology companies that can thrive in a post-coronavirus crisis world.

Travel and leisure, hotels, restaurants, and airline stocks may seem undervalued, but you don’t want to catch a falling knife. Buy them only when there are signs of recovery.

No Comments