My Worst Black Friday Experience

One source of amusement that my wife and I both enjoy is watching early shoppers wait in line outside the Best Buy store near our house on Black Friday eve. The store used to open around midnight to enable eager consumers to get their hands on the latest high-tech gadgets at substantially marked down prices.

Back then she worked night shifts, so right after picking her up, we would spend the time to drive around the store’s parking lot to check out the shoppers camping outside, sometimes for days at a time. We can’t help but be amazed by what people will attempt to do just to save a couple of hundred bucks.

Now that my wife is doing day shifts, I found myself on the other side of the coin. On my way back after driving her to work, it suddenly crossed my mind to stop by the store. Best Buy now conveniently reopens at 8 am. I figured I wanted to experience the euphoria over the shopping deals myself so I can write about it on this blog.

This post highlights my suffering spending at my favorite brick and mortar store. Yes, I still buy stuff from the store that issued me the card that ruined my credit in the late 90s.

9 Signs You Probably Won’t Need a Retirement Nest Egg

It’s a fact, people in developed countries are living longer. For instance, life expectancy for women is predicted to surpass 90 years in South Korea by 2030, according to the study published in The Lancet, one of the world’s oldest and most respected medical journals. Of course, the study assumes …

What Rihanna Can Teach You About Liability Insurance

There’s no denying that Rihanna is one of the hottest artists today. No offense to JayZ, but when it comes to overall talent, I honestly think Rihanna will give Beyonce a run for her money. Not only can she sing better, her moves are smoother, more spicy and hypnotic, enough …

How Effective Copywriting Sold my “Unsellable” Typewriter

One of the must-have skills on your road to Financial Independence is selling. Even if you don’t work in a marketing or sales position, we often find ourselves in situations where we have to sell, or loosely speaking, persuade people to act in our favor, may it be applying for …

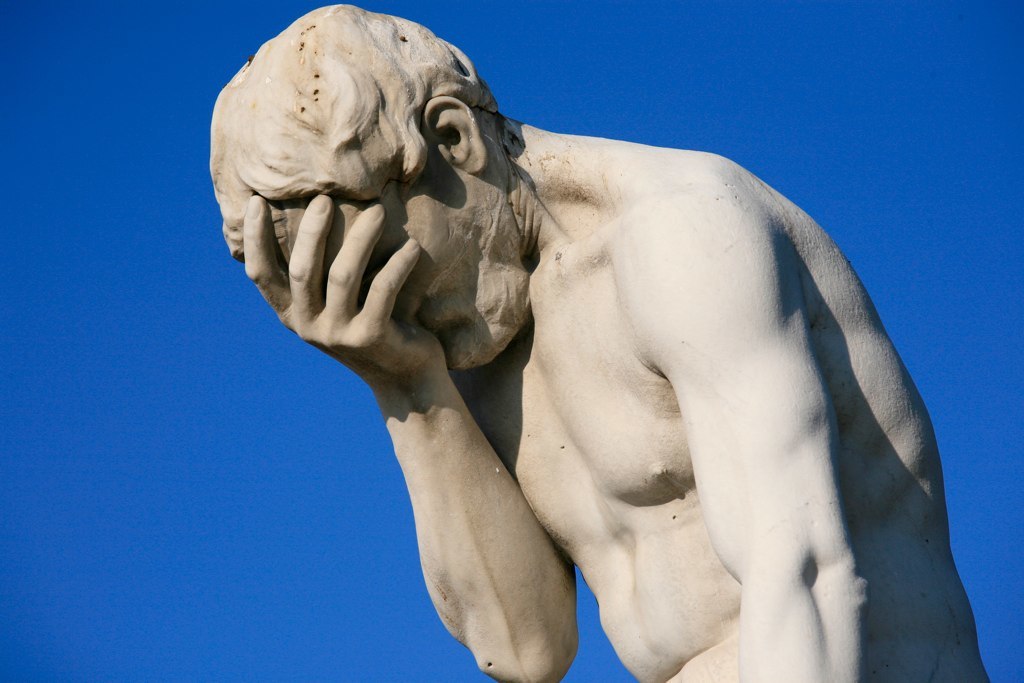

The Opportunity Cost of Claiming $2,500 Worth of Property

Sometimes I wonder if I deserve to blog about personal finance. I’ve made too many embarrassing money mistakes in my life– I would suffocate if I had to re-enact the number of times I have face-palmed myself. Here I was, declaring myself to be on a mission to educate broke …

5 Mistakes Millennials Make with Money

Millennials get something of a bad reputation. They’re considered to be the ficklest generation, spoiled from being told that they were the most special people in the world while they were growing up. However, the truth is that millennials are just like anyone else. They have ambitions and worries to …

Net Worth Update: One Year Later

It’s Labor Day in the U.S., isn’t it ironic that I don’t get to work? I don’t see a lot of pregnant women hanging around the emergency room when I drove my R.N. wife to the hospital this morning either. Kidding aside, the holiday meant I have extra time to …

Millionaire Before 50 Turns One Year Old!

August 21st marks my first year anniversary of blogging at MB-50. I’m so proud that I’ve managed to consistently produce two blog posts per month in spite of having a full-time career outside of blogging– I write code not blog posts for a living. Unbeknownst to many people, this shy, …

California Vacation: Being Frugal Can Cost You More

We recently just came back from a trip to the west coast. It was a week-long vacation with lots of driving between different cities within the state of California. I had to be careful not to overspend. I may be a millionaire, but keep in mind that it’s 2017– a million …

FIRE, FART, or Neither, the Choice is Yours

When it comes to your finances, there are two extremes to model yourself on, FIRE or FART (acronyms below) — that is if you want to be an extremist. The third option is neither, and that’s completely fine. The choice to quit the rat race at either 35 or 95 is completely your own …

Recent Posts

Recent Comments

- on The VIX Index: How to Get a Little Richer by “Timing the Market”

- on From Diapers to Diplomas: Tips on How to Fully Fund College Using 529s

- on From Diapers to Diplomas: Tips on How to Fully Fund College Using 529s

- on Why I’m Saving More in a Taxable Brokerage Account, Maybe You Should Too

- on Why I’m Saving More in a Taxable Brokerage Account, Maybe You Should Too

Categories

- About me3

- American dream10

- Asset allocation1

- Blogging4

- Books8

- Budgeting2

- Career6

- Credit4

- Financial Planning25

- Fitness1

- Fraud2

- Giving1

- Guest Post2

- Happiness3

- Health2

- Income2

- Insurance4

- Investing32

- Lifestyle21

- Motivation7

- Relationships20

- Retirement16

- Romance2

- Saving for college5

- Saving ideas11

- Side Hustle3

- Speculation4

- Spending11

- Taxes3

- Vacation3