Congratulations!!! I think it’s brilliant to do the tracking around Labour Day.

Net Worth Update: Nine Years Later

- By : Menard

- Category : Financial Planning, Retirement

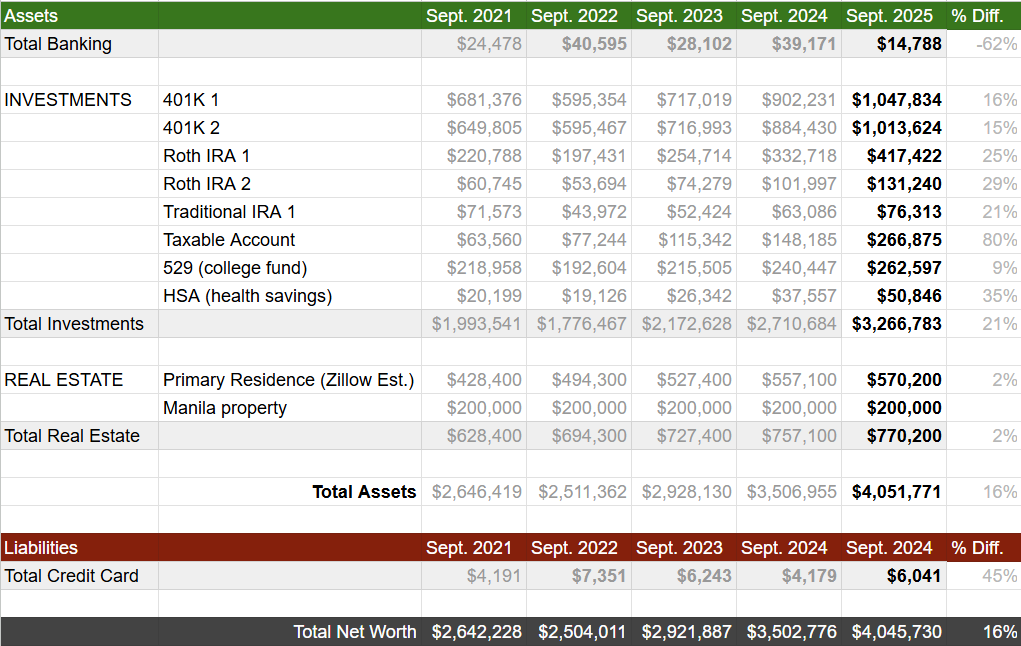

Every September 1st, I take a moment to reflect on our financial journey. What started as a simple spreadsheet in 2017 has evolved into a powerful story of discipline, strategy, and compounding returns.

This year, we hit a major milestone:

Net worth surpassed $4 million

What fueled the climb?

- U.S. Stocks: Hovering near all-time highs, driven by strong earnings and AI optimism.

- Consistent Investing: Staying the course through market dips and rallies.

- Real Estate Holdings: Appreciation and rental income added steady value.

- Frugal Living: We prioritized value over vanity, and it paid off.

Staying debt-free—even the mortgage—has been our financial superpower. No monthly payments, no interest headaches (credit cards paid in full), just more fuel for the net worth rocket. Turns out, compounding works a lot better when you’re not busy paying someone else first.

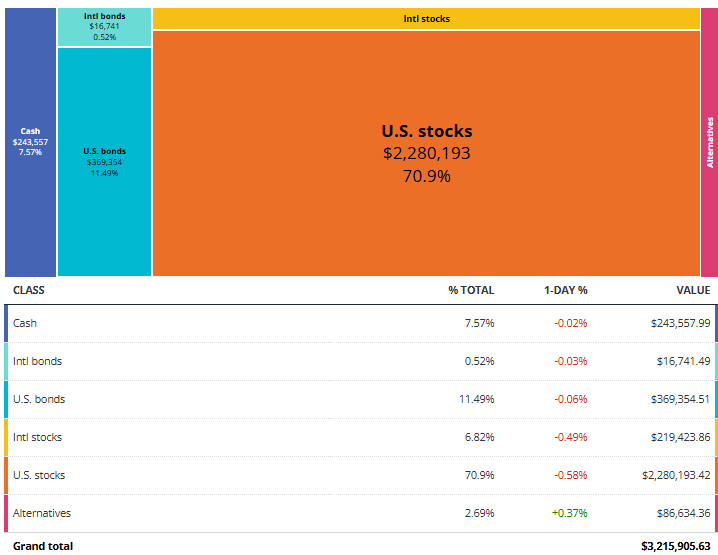

The shift to a decumulation portfolio

With early retirement on the horizon next year, we’ve begun gradually reallocating our ~$3 million portfolio into a more balanced mix—70% stocks, 20% bonds, and 10% cash. The goal is to preserve growth potential while dialing down risk, ensuring our nest egg can support us through the decades ahead.

This also meant reassessing our allocation to international stocks, which I had exited a year before the tariff turmoil. That experience underscored a lasting truth: while the S&P 500 offers some global exposure through multinational companies, it’s still heavily concentrated in U.S. markets, currency, and policy risk. True global diversification requires stepping beyond domestic borders. I’m focused on building a portfolio resilient enough to weather decades of market cycles and geopolitical shifts.

We’re also gradually shifting our contributions away from tax-deferred accounts and into our taxable brokerage. By building up all three buckets—tax-deferred, taxable, and tax-free—we’re setting ourselves up for maximum flexibility in retirement. This approach gives us precise control over our income, which is key to qualifying for ACA subsidies. Combined with the strong rebound in equity markets, this strategy has contributed to an impressive 80% surge in the value of our taxable brokerage account.

Thanks for following along on this nine-year flex—because nothing says “humble” like posting your net worth on the internet every Labor Day. Wishing you all steady growth, fewer financial faceplants, and just enough spreadsheet drama to keep things interesting. Stay curious, stay consistent, and may your assets always outpace your liabilities.