From Toilet to Tax Code: Retiring Early via IRS Rule of 55

- By : Menard

- Category : Retirement

Let me tell you about the moment I decided to retire—not after a huge bonus, not during some dramatic life event, and definitely not while meditating on a mountaintop. No, it happened in the most unglamorous, brutally honest place imaginable: my bathroom.

I was mid-scroll on my phone, resting atop the porcelain throne, when the battery gave out. Just like that—no more Facebook, no more Reddit, no more emails, no more distractions. Silence. Stillness. And me, stuck with nothing but my thoughts and the cold tiles beneath my feet.

So I started counting them.

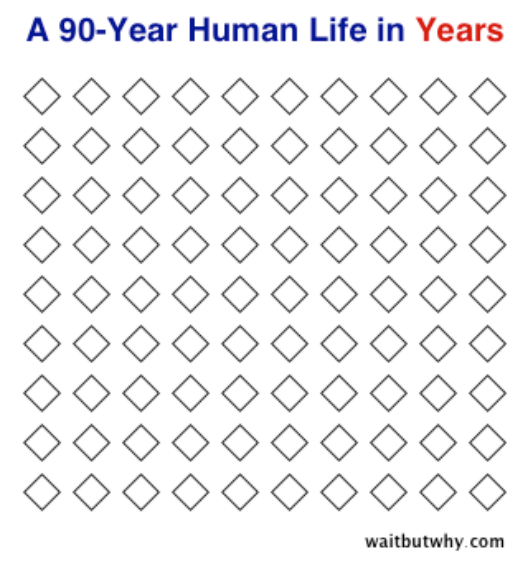

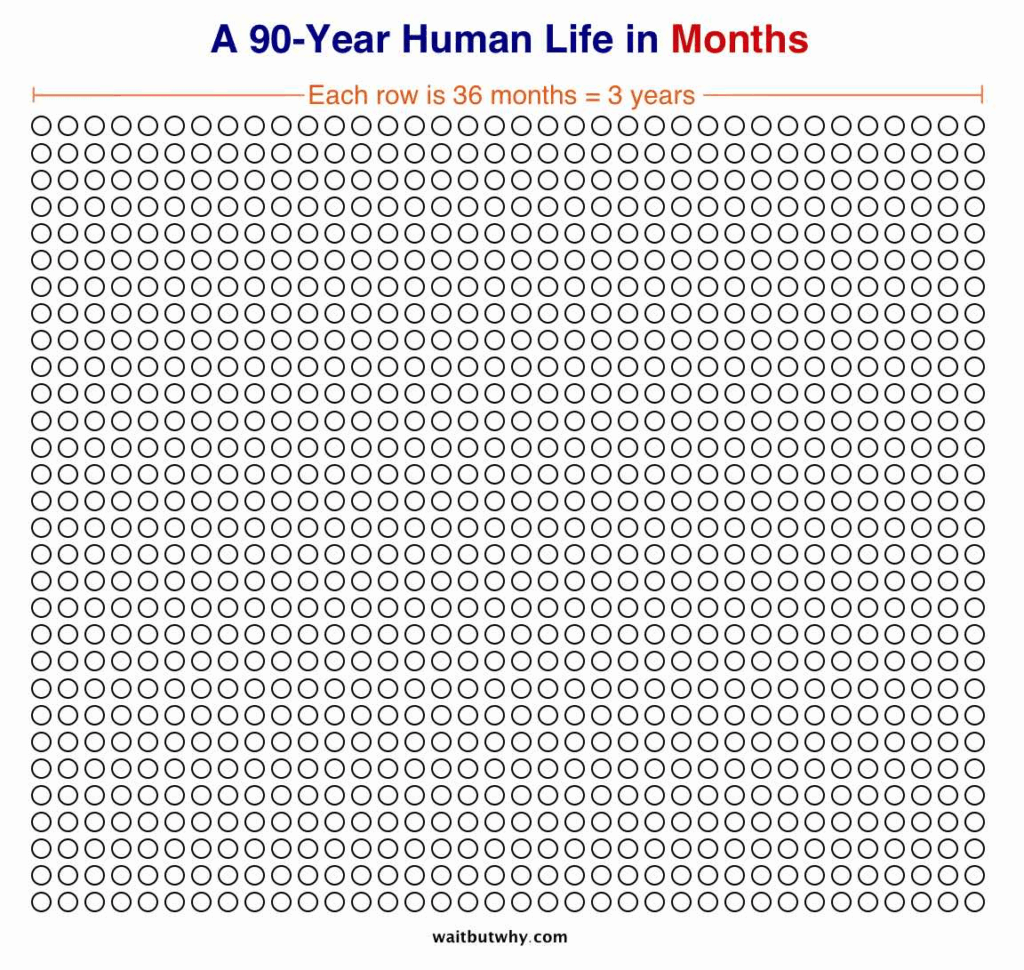

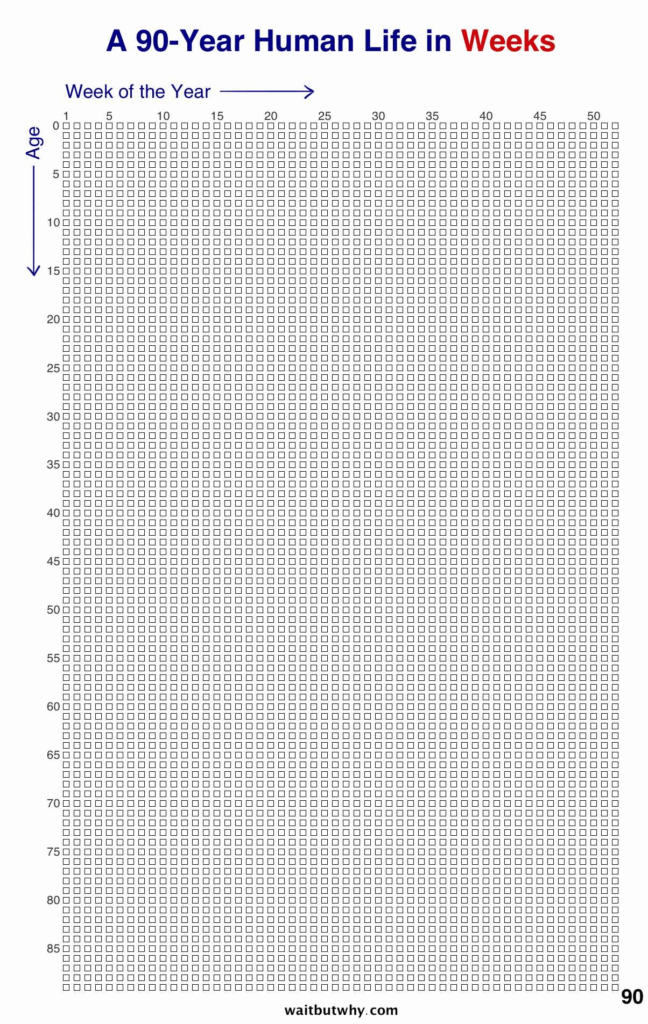

One tile. Two tiles. Ten. Twenty. Thirty. I kept going. Somewhere around tile number 55, it hit me: each tile could represent a year of my life. I had already lived through 54 of them. And if I’m lucky—really lucky—I might live until 90. That’s less than 50 summers left. Less than 50 chances to feel the sun on my face, to take spontaneous road trips with my wife, to laugh until we cry, to be fully present together.

Sure, grandma died at 96, pops at 94, but I’ve got only half of their genes. Mom, the other half, died at 77. If you average that, I probably get to live until 85, right? Not too fast. My big sister, who wrote a book about longevity, died earlier this year at a relatively young age of 69!

That realization may sound morbid—but it’s actually liberating.

My wife and I spent decades working hard, saving diligently, and investing wisely. Together we’ve built up a nest egg of $3 million. And you know what? That’s enough. Enough to stop trading time for money. Enough to start planning the life we’ve been deferring for decades. Enough to say, “We’ve lived wisely, and now we want to live freely.” Hence, she’s retiring with me.

And as it turns out, the IRS agrees. Thanks to the Rule of 55, I can start withdrawing from my 401(K) without the usual 10% early withdrawal penalty—so long as I leave my job in or after the year I turn 55. It’s a little-known provision that gives people like me a bridge between full-time work and full retirement, without having to tap into IRAs or wait until 59½. It’s not a loophole—it’s a lifeline.

Knowing that I can access my retirement funds penalty-free the year I turn 55 gave me the confidence to make the decision. It’s not just about having enough money—it’s about having enough options. Enough flexibility to design a life that’s intentional, joyful, and unhurried.

So yes, I’ve decided to retire next year before I turn 55. Not because I’m running away from work, but because I’m running toward something better: time. Time to travel with my wife. Time to read, reflect, and reconnect. Time to sit on a porch together, sip coffee, and watch the world go by without alarm clocks and obligations tugging at our sleeves.

If you’re reading this and feeling the tug of your own “someday,” maybe it’s time to count your tiles. You might be closer to freedom than you think.

Life is too short to spend another day working for a future that’s already within reach.

No Comments