Interesting perspective. I just still don’t know how realistic of a number that is for millennials. A new graduate, age 22, making $50K out of college would have $100K with this rule. I just think that’s unrealistic.

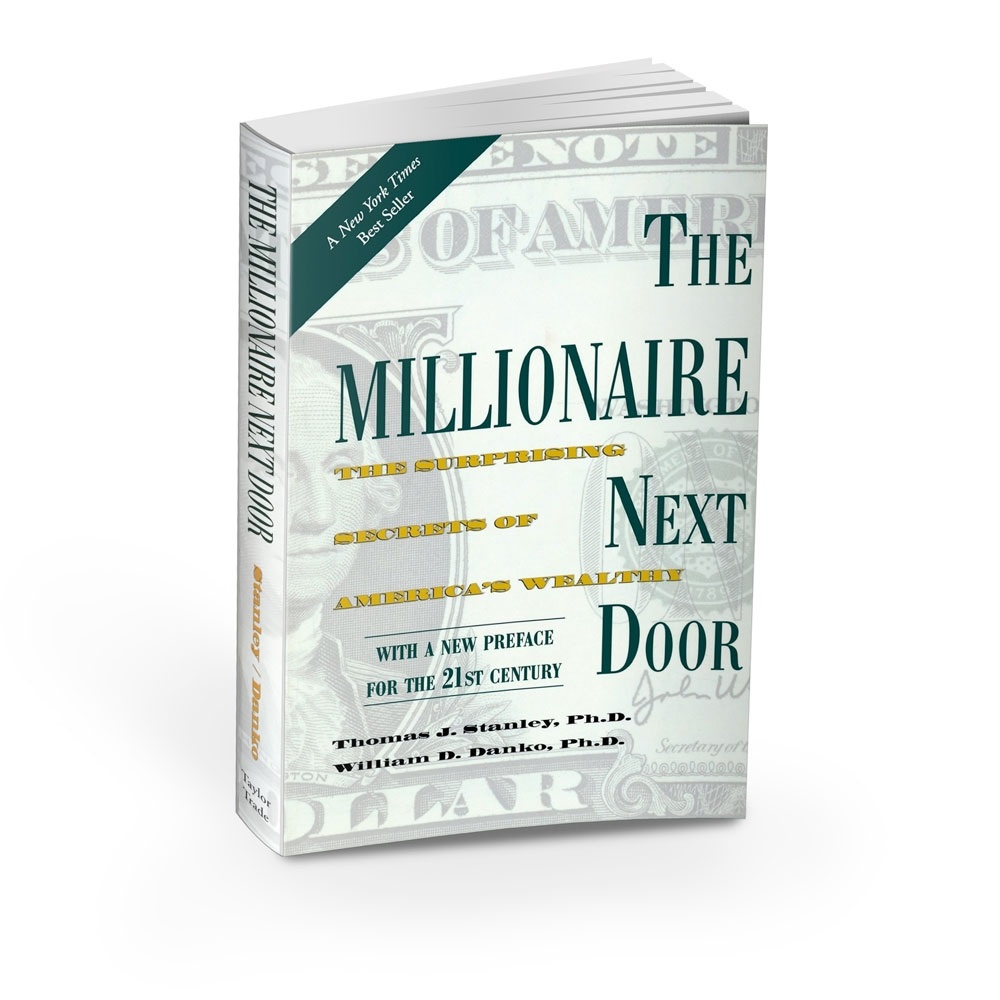

One of my favorite personal finance books of all time is the one that was written by the late Thomas J. Stanley, The Millionaire Next Door (published in 1996).

The bestselling book identifies common traits that show up again and again among those who have accumulated wealth. The surprising finding is that most millionaires in America don’t really live in mansions, drive luxury cars, or wear expensive watches.

Most millionaires never earn $500,000 in one year. Most never become millionaires until they are fifty years of age or older. Most are frugal– only a few could have ever supported a high-consumption lifestyle.

The book also offers a simple rule of thumb to determine if you are wealthy…

“Multiply your age times your realized pretax annual household income from all sources except inheritances. Divide by ten. This, less any inherited wealth, is what your net worth should be.”

The problem with the rule of thumb

As a 31-year-old who had just started getting serious about my finances, I remember being outright discouraged by this calculation. I was a UAW, or under accumulator of wealth, according to Dr. Stanley’s rule of thumb.

What I didn’t realize back then is that I haven’t saved long enough to benefit from any compounding of interest whatsoever. So this rule of thumb is not very useful to someone who just started getting the ball rolling, so to speak.

Another issue that I have is that the calculation uses your current realized pre-tax income instead of the average throughout your working years. It doesn’t take into account that you’ve been earning peanuts for many years before you got that big promotion, for example.

Lastly, the calculation does not take into account that I’m Filipino– I’ve got multiple families to support, lmao. Well, seriously I really think that the calculation should take into consideration the number of your dependents. The more dependents you have in the household, the more challenging it will be to accumulate wealth for obvious reasons.

Using Dr. Stanley’s rule of thumb, I’m only a little above the averagely wealthy or an AAW– I’m just an average accumulator of wealth:

| (age) | (gross income) | (net-worth) | ||

| 46 | x | 200,000 | = | 920,000 |

| 10 |

But who wants to be average? Certainly not me. I’d rather be a PAW, or prodigious accumulator of wealth, which is by definition double the recommended net worth of an AAW.

I understand that it’s just a rule of thumb. One with a broad application and is not intended to be strictly accurate or reliable for every situation. But there’s probably a better calculation that is more suitable for you and me.

|

|

The ruler of thumb |

A better rule of thumb

Ladies and Gentlemen, may I present to you, the Millionaire Before 50 rule of thumb for evaluating your net worth.

Without further ado (** drum roll **):

“Multiply your age times your average realized pretax annual household income from all sources except inheritances. Divide by ten plus the number of your dependents. This, less any inherited wealth, is what your net worth should be.”

Let’s recalculate, but this time using our average income throughout our working years as a couple and 5 dependents (my eldest son actually moved out of the house, 2 years ago):

| (age) | (average income) | (net-worth) | ||

| 46 | x | 150,000 | = | 460,000 |

| 15 | ||||

| (10 + 5 dependents) |

Using the above formula, I’m a PAW because my net worth is easily more than twice as much as the above number.

I know this sounds self-serving. But at least my rule of thumb doesn’t discourage people from having kids.