Have No Fear, Market Crashes Will Always Be Here!

While I don’t believe that a bear market is coming, one big lesson from the last two recessions is that it can’t hurt to be prepared. Crashes will always come and go. Whether it’s six months or six years from now, nobody knows. The prospect of me becoming a thousandaire …

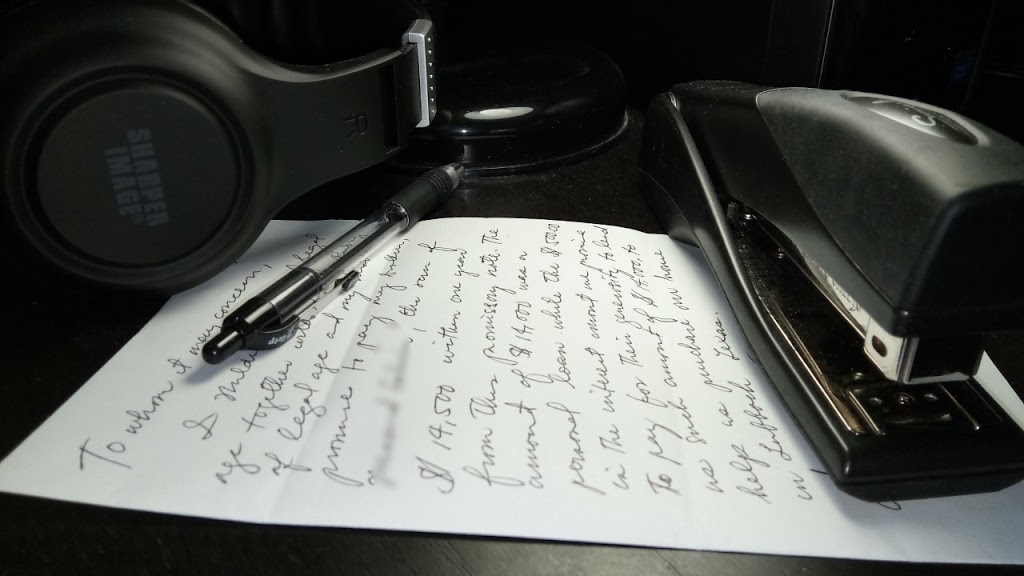

When the Lender is a Slave to the Borrower

You’ve probably heard Dave Ramsey say this many times before, “The borrower is a slave to the lender.” The quote was taken from the scriptures. That’s exactly what I had in mind when I decided to lend my sister $14,000 last summer. Finally, I can ‘enslave’ my annoying sister, who …

Recent Posts

Recent Comments

- on The VIX Index: How to Get a Little Richer by “Timing the Market”

- on From Diapers to Diplomas: Tips on How to Fully Fund College Using 529s

- on From Diapers to Diplomas: Tips on How to Fully Fund College Using 529s

- on Why I’m Saving More in a Taxable Brokerage Account, Maybe You Should Too

- on Why I’m Saving More in a Taxable Brokerage Account, Maybe You Should Too

Categories

- About me3

- American dream10

- Asset allocation1

- Blogging4

- Books8

- Budgeting2

- Career6

- Credit4

- Financial Planning25

- Fitness1

- Fraud2

- Giving1

- Guest Post2

- Happiness3

- Health2

- Income2

- Insurance4

- Investing32

- Lifestyle21

- Motivation7

- Relationships20

- Retirement16

- Romance2

- Saving for college5

- Saving ideas11

- Side Hustle3

- Speculation4

- Spending11

- Taxes3

- Vacation3